Nebraska Quitclaim Deed from Individual to LLC Form

Understanding the Nebraska Quitclaim Deed from Individual to LLC

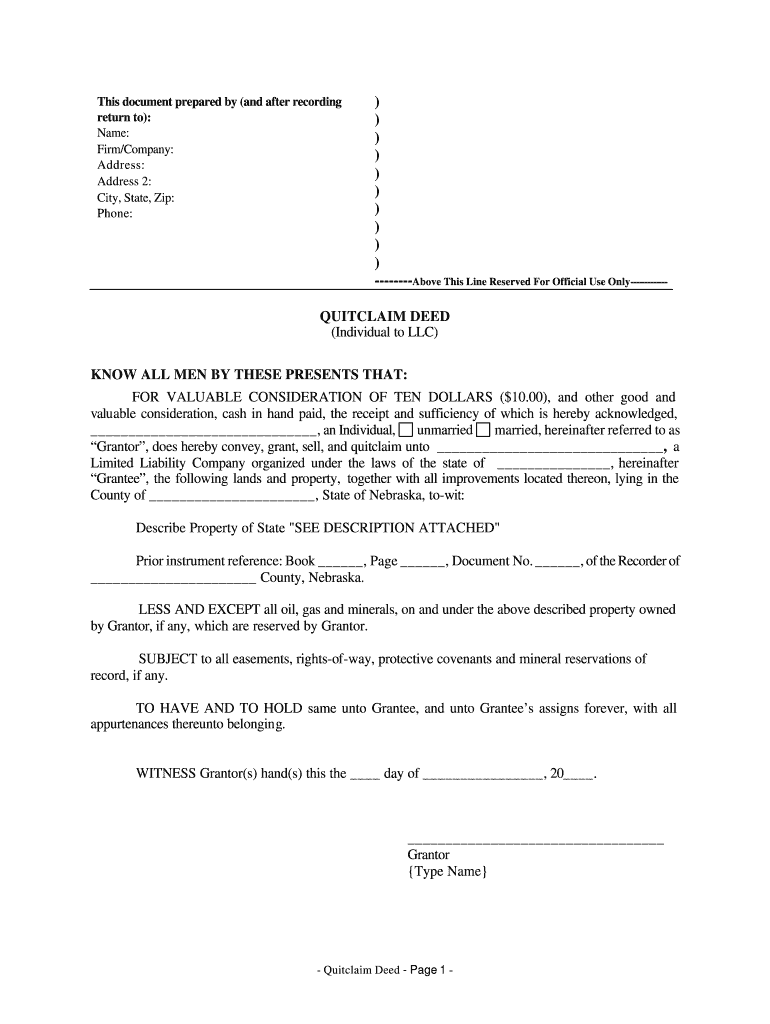

A quitclaim deed is a legal instrument used to transfer ownership of real estate from one party to another without any warranties. In Nebraska, this type of deed is often utilized when an individual wishes to transfer property to a Limited Liability Company (LLC). This process is straightforward but requires careful attention to detail to ensure that the transfer is valid and legally binding.

The quitclaim deed from an individual to an LLC typically includes essential information such as the names of the grantor (the individual transferring the property) and the grantee (the LLC receiving the property), a description of the property, and the date of transfer. Understanding the implications of this transfer is crucial, as it can affect ownership rights, tax responsibilities, and liability issues.

Steps to Complete the Nebraska Quitclaim Deed from Individual to LLC

Completing a quitclaim deed in Nebraska involves several key steps to ensure that the document is valid and enforceable. Here is a simplified process:

- Gather necessary information about the property, including the legal description and current ownership details.

- Obtain the quitclaim deed form, which can be found through legal resources or state websites.

- Fill out the form accurately, ensuring that all names, addresses, and property descriptions are correct.

- Have the document signed by the grantor in the presence of a notary public to ensure its legal validity.

- File the completed quitclaim deed with the appropriate county office to make the transfer official.

Legal Use of the Nebraska Quitclaim Deed from Individual to LLC

The quitclaim deed is legally recognized in Nebraska as a valid means of transferring property. However, it is essential to understand that this type of deed does not guarantee that the grantor holds clear title to the property. Instead, it merely transfers whatever interest the grantor has at the time of the transfer.

Using a quitclaim deed to transfer property to an LLC can provide benefits such as limited liability protection for the individual. However, it is advisable to consult with a legal professional to ensure compliance with state laws and to understand any potential tax implications associated with the transfer.

Key Elements of the Nebraska Quitclaim Deed from Individual to LLC

When preparing a quitclaim deed in Nebraska, certain key elements must be included to ensure its validity:

- Grantor and Grantee Information: Full names and addresses of both the individual and the LLC.

- Property Description: A clear and accurate legal description of the property being transferred.

- Consideration: The value exchanged for the property, which may be nominal in many cases.

- Signatures: The grantor must sign the deed in front of a notary public.

- Filing Information: Instructions for where to file the deed after completion.

State-Specific Rules for the Nebraska Quitclaim Deed from Individual to LLC

Nebraska has specific regulations governing the execution and filing of quitclaim deeds. It is important to adhere to these rules to ensure the transfer is legally binding:

- The deed must be notarized to be valid.

- It should be filed with the county clerk’s office in the county where the property is located.

- Any applicable fees for filing must be paid at the time of submission.

Examples of Using the Nebraska Quitclaim Deed from Individual to LLC

There are various scenarios in which an individual might use a quitclaim deed to transfer property to an LLC:

- An individual who owns rental properties may transfer ownership to an LLC to limit personal liability.

- A property owner may wish to consolidate multiple properties under one LLC for easier management.

- Transferring property to an LLC can also facilitate estate planning and asset protection strategies.

Quick guide on how to complete nebraska quitclaim deed from individual to llc

Complete Nebraska Quitclaim Deed From Individual To LLC seamlessly on any gadget

Web-based document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the proper form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Nebraska Quitclaim Deed From Individual To LLC on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Nebraska Quitclaim Deed From Individual To LLC effortlessly

- Find Nebraska Quitclaim Deed From Individual To LLC and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Review the details and then click the Done button to store your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Nebraska Quitclaim Deed From Individual To LLC and guarantee effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

-

What do you need from your partners in order to fill out a k1-form? We all used LLC's to split our partnership up, so do I just need thier EINs or do I need their personal SSN as well?

Assuming each LLC is a single member disregarded entity, then you need the individual's SSN not the EIN of the LLC. You also put the individual's name on the K1 not the name of the LLC. If the LLC's are any other type of entity, then use the EIN and name of the LLC.You also need each partner's address and capital, loss and profit percentage.

Create this form in 5 minutes!

How to create an eSignature for the nebraska quitclaim deed from individual to llc

How to generate an eSignature for your Nebraska Quitclaim Deed From Individual To Llc in the online mode

How to generate an eSignature for your Nebraska Quitclaim Deed From Individual To Llc in Google Chrome

How to make an eSignature for signing the Nebraska Quitclaim Deed From Individual To Llc in Gmail

How to create an eSignature for the Nebraska Quitclaim Deed From Individual To Llc from your smartphone

How to create an eSignature for the Nebraska Quitclaim Deed From Individual To Llc on iOS

How to make an electronic signature for the Nebraska Quitclaim Deed From Individual To Llc on Android

People also ask

-

What is a Nebraska quit claim deed?

A Nebraska quit claim deed is a legal document that allows a property owner to transfer their interest in real estate to another party without making any guarantees about the title. It is often used in situations where the parties know each other, such as between family members. Utilizing airSlate SignNow can simplify the process of creating and signing a Nebraska quit claim deed.

-

How do I fill out a Nebraska quit claim deed using airSlate SignNow?

Filling out a Nebraska quit claim deed using airSlate SignNow is user-friendly. You can start by selecting a template, inputting the necessary information, and then customize it as required. The platform ensures that your Nebraska quit claim deed meets local legal standards for effectiveness.

-

What are the benefits of using airSlate SignNow for a Nebraska quit claim deed?

Using airSlate SignNow for a Nebraska quit claim deed offers several benefits, such as ease of use, efficient eSigning, and secure document storage. This platform enables you to streamline the transaction, saving time and effort while ensuring legal compliance. Additionally, the digital format allows for easy sharing with all involved parties.

-

Is there a cost associated with creating a Nebraska quit claim deed on airSlate SignNow?

Yes, there is a cost for using airSlate SignNow, but it is known for being an affordable option compared to traditional methods. The pricing models are designed to accommodate businesses of all sizes, making it a cost-effective solution for creating a Nebraska quit claim deed. You can review various subscription plans to find one that best suits your needs.

-

Can I integrate airSlate SignNow with other tools for handling a Nebraska quit claim deed?

Absolutely! airSlate SignNow offers integrations with various applications, allowing seamless collaboration and document management. By connecting with other tools, you can enhance the process of managing a Nebraska quit claim deed, ensuring all related tasks are efficiently handled.

-

What if I need assistance while creating a Nebraska quit claim deed?

If you encounter any challenges while creating a Nebraska quit claim deed, airSlate SignNow offers excellent customer support to assist you. Their team can guide you through the document creation process and provide resources tailored to your specific questions. Accessing support is quick and easy through their help center.

-

Can I edit a Nebraska quit claim deed after it's been signed?

Once a Nebraska quit claim deed has been signed, it becomes a legal document, and editing it may not be advisable. However, if changes are necessary, you can create a new document using airSlate SignNow to reflect those updates. Always consult legal advice to ensure compliance with state regulations regarding property transfers.

Get more for Nebraska Quitclaim Deed From Individual To LLC

Find out other Nebraska Quitclaim Deed From Individual To LLC

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now