4564 Information Document Request Form 2006-2026

What is the 4564 Information Document Request Form

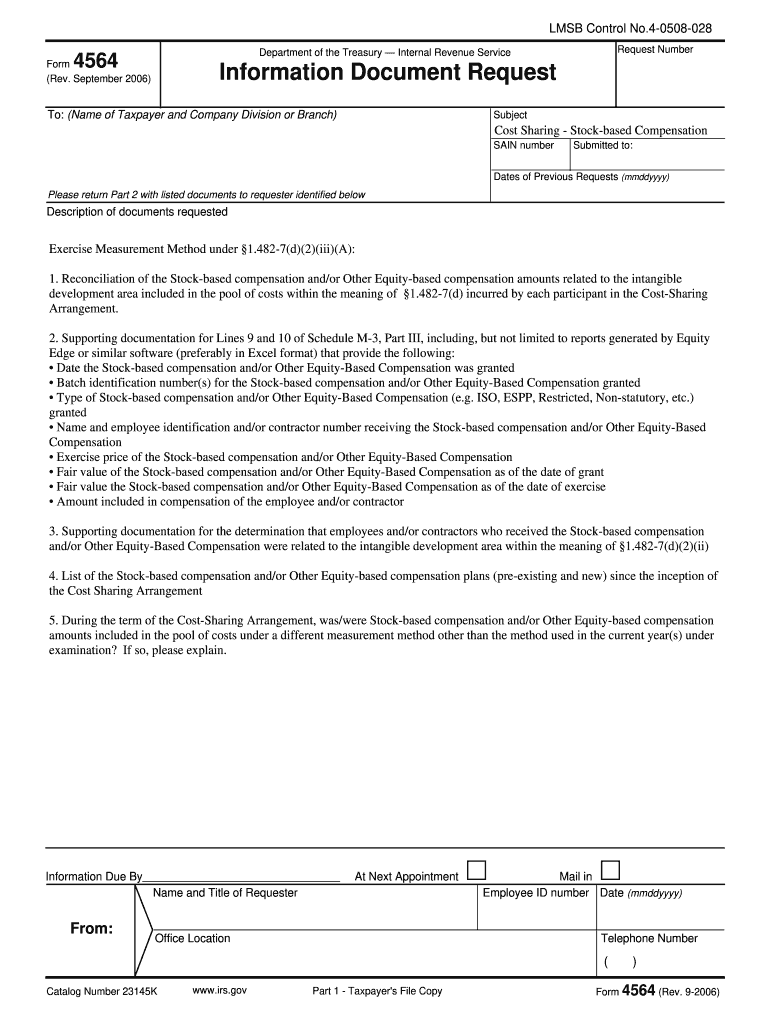

The 4564 Information Document Request Form is an official document used by the Internal Revenue Service (IRS) to request specific information from taxpayers. This form is typically issued during audits or inquiries to gather necessary details regarding a taxpayer's financial situation. Understanding the purpose of this form is crucial for compliance and ensuring that all requested information is provided accurately and promptly.

How to use the 4564 Information Document Request Form

Using the 4564 Information Document Request Form involves several key steps. First, carefully read the request to understand what information is required. Next, gather all relevant documents and data that pertain to the request. Ensure that all information is accurate and complete before submitting. It is also important to respond within the timeframe specified by the IRS to avoid potential penalties.

Steps to complete the 4564 Information Document Request Form

Completing the 4564 Information Document Request Form requires attention to detail. Begin by reviewing the form to identify all required fields. Fill in your personal information accurately, including your name, address, and taxpayer identification number. Next, provide the requested information in the appropriate sections, ensuring that all attachments are included. Double-check for any missing information before submission to prevent delays.

Required Documents

When responding to the 4564 Information Document Request Form, it is essential to include all required documents. This may include tax returns, financial statements, and any other relevant records that support your case. Organizing these documents in a clear and logical manner can facilitate the review process by the IRS.

Form Submission Methods (Online / Mail / In-Person)

The 4564 Information Document Request Form can be submitted through various methods. If the IRS allows electronic submissions, consider using a secure online platform to send your documents. Alternatively, you can mail the completed form and attachments to the address specified in the request. In some cases, in-person submissions may also be an option, depending on the IRS office's guidelines.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 4564 Information Document Request Form. It is important to familiarize yourself with these guidelines to ensure compliance. This includes understanding the deadlines for submission, the types of information that may be requested, and the consequences of failing to respond adequately. Adhering to these guidelines can help protect you from potential penalties.

Quick guide on how to complete 4564 information document request

Discover the most efficient method to complete and sign your 4564 Information Document Request Form

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to complete and sign your 4564 Information Document Request Form and similar forms for public services. Our intelligent eSignature solution provides you with everything necessary to handle documents swiftly and in compliance with formal standards - robust PDF editing, managing, securing, signing, and sharing tools all available in a user-friendly interface.

Only a few steps are required to fill out and sign your 4564 Information Document Request Form:

- Upload the fillable template to the editor using the Get Form button.

- Review the information that you need to include in your 4564 Information Document Request Form.

- Navigate through the fields using the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to enter your details in the blanks.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is essential or Obscure fields that are no longer relevant.

- Click on Sign to create a legally binding eSignature using any option you choose.

- Add the Date beside your signature and finalize your task with the Done button.

Store your completed 4564 Information Document Request Form in the Documents section of your profile, download it, or send it to your chosen cloud storage. Our service also provides versatile form sharing. There’s no need to print your templates when you can submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

FAQs

-

I'm interesting in becoming an Uber driver. How do I fill out an application and give my car and document information by the Internet?

Go to the Uber website. And, download the driver app.You’ll be asked to give your info on line. Name, DOB, DL# etc. You’ll also have to give the make and model of your car with proof of insurance, brake tag and registration. That info can be submitted by taking a picture and uploading it.It’ll take a few days to confirm your info and a basic background check. Then you are good to go. Good luck.

-

How long does it take to get information from RTI after filling a request?

Hi Kishore,I think the link provided below shall answer all your queries pertaining to the question you asked here.How many days will it take to get a reply for an RTI?Have a good day.

-

How do I respond to a request for a restraining order? Do I need to fill out a form?

As asked of me specifically;The others are right, you will likely need a lawyer. But to answer your question, there is a response form to respond to a restraining order or order of protection. Worst case the form is available at the courthouse where your hearing is set to be heard in, typically at the appropriate clerk's window, which may vary, so ask any of the clerk's when you get there.You only have so many days to respond, and it will specify in the paperwork.You will also have to appear in court on the date your hearing is scheduled.Most courts have a department that will help you respond to forms at no cost. I figure you are asking because you can't afford an attorney which is completely understandable.The problem is that if you aren't represented and the other person is successful in getting a temporary restraining order made permanent in the hearing you will not be allowed at any of the places the petitioner goes, without risking arrest.I hope this helps.Not given as legal advice-

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

Create this form in 5 minutes!

How to create an eSignature for the 4564 information document request

How to generate an eSignature for your 4564 Information Document Request online

How to create an eSignature for your 4564 Information Document Request in Chrome

How to make an eSignature for putting it on the 4564 Information Document Request in Gmail

How to make an electronic signature for the 4564 Information Document Request straight from your mobile device

How to generate an electronic signature for the 4564 Information Document Request on iOS devices

How to make an eSignature for the 4564 Information Document Request on Android

People also ask

-

What is the 4564 Information Document Request Form?

The 4564 Information Document Request Form is a crucial tool for businesses needing to request specific information from clients or partners. Utilizing airSlate SignNow, you can easily create, send, and eSign this form, ensuring a streamlined process for document management. This form is designed to enhance communication and organization within your document workflows.

-

How can airSlate SignNow improve my use of the 4564 Information Document Request Form?

airSlate SignNow enhances the use of the 4564 Information Document Request Form by providing a user-friendly platform that simplifies document creation and signing. With features like customizable templates and real-time tracking, you can manage requests more efficiently and maintain better oversight of your document processes. This ultimately leads to improved productivity and faster turnaround times.

-

Is there a cost associated with using the 4564 Information Document Request Form on airSlate SignNow?

Yes, while the 4564 Information Document Request Form can be created and sent at no additional cost, there are pricing plans for using airSlate SignNow based on your business needs. These plans provide access to a range of features that can enhance your document management experience. It's advisable to check the pricing section on our website for detailed information.

-

What features does airSlate SignNow offer for the 4564 Information Document Request Form?

AirSlate SignNow offers a variety of features for the 4564 Information Document Request Form, including customizable templates, eSignature capabilities, and integration with other tools. You can also benefit from document tracking and audit trails, ensuring that you have complete visibility over the request process. These features help streamline your operations and enhance document security.

-

Can I integrate the 4564 Information Document Request Form with other software?

Absolutely! airSlate SignNow allows you to integrate the 4564 Information Document Request Form with various third-party applications such as CRMs and project management tools. This integration capability helps you maintain consistent workflows and ensures that all your documents are accessible within your existing systems. Check our integration options for more details.

-

What are the benefits of using the 4564 Information Document Request Form with airSlate SignNow?

Using the 4564 Information Document Request Form with airSlate SignNow offers numerous benefits, including improved efficiency, enhanced collaboration, and increased accuracy in document handling. The platform's eSignature feature allows for quick approvals, which accelerates your business processes. Additionally, the ease of use can help reduce training time for your team.

-

How secure is the 4564 Information Document Request Form when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The 4564 Information Document Request Form is protected with advanced encryption and secure access protocols, ensuring that your data remains confidential. Additionally, our platform complies with industry standards and regulations, providing peace of mind when handling sensitive information.

Get more for 4564 Information Document Request Form

- Jv 432 six month prepermanency attachment judicial council forms

- Form cr 001 stanislaus 2017 2018

- Mc 010 form 2017 2019

- Please visit our self help portal at httpsselfhelp form

- Jv 435 findings and orders after 12 month permanency hearing welf ampamp inst code36621f judicial council forms

- Wv 120 response to petition for workplace violence restraining orders judicial council forms

- Mgi application form 2014 2019

- Jdf 205 2015 2019 form

Find out other 4564 Information Document Request Form

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF