State of Pennsylvania, Hereinafter Referred to as the Trustor, Whether One or Form

What is the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or

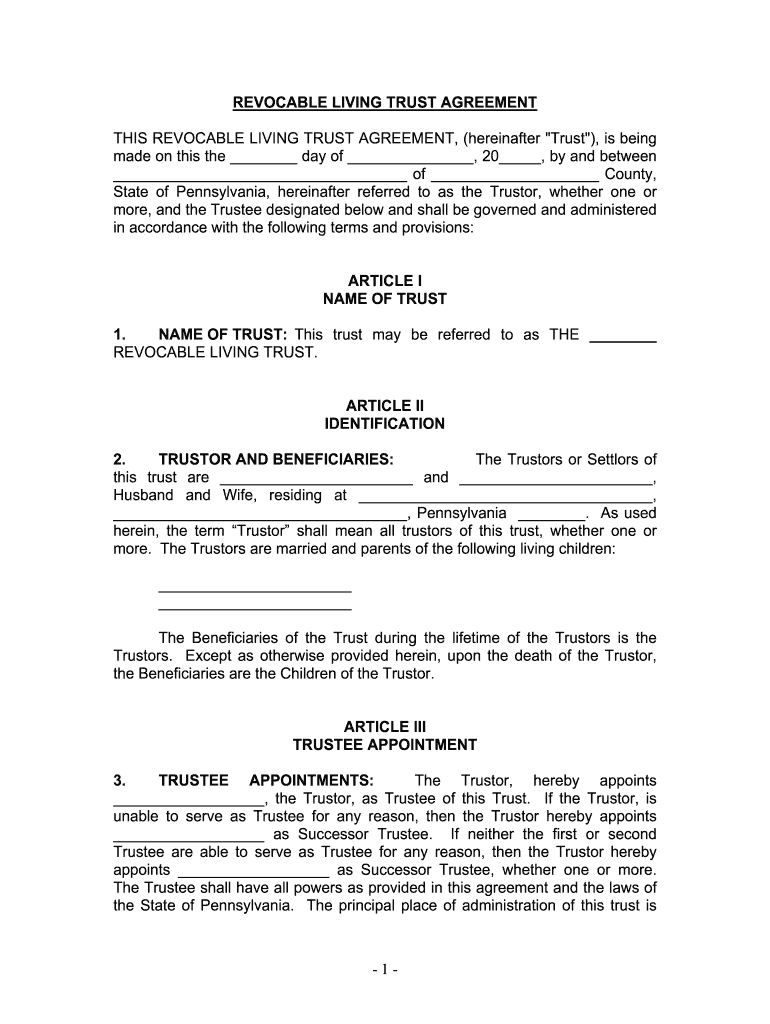

The State of Pennsylvania, hereinafter referred to as the Trustor, whether one or more, is a legal entity that plays a crucial role in trust agreements and fiduciary relationships. This form is typically utilized in the establishment of trusts, where the Trustor designates assets to be managed by a trustee for the benefit of beneficiaries. Understanding the legal implications and responsibilities of the Trustor is essential when creating a trust, as it outlines the terms and conditions under which the trust operates.

How to use the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or

Using the State of Pennsylvania, hereinafter referred to as the Trustor, whether one or more, involves several steps to ensure that the trust is set up correctly. Initially, the Trustor must clearly define the purpose of the trust and identify the assets to be included. Next, the Trustor should select a reliable trustee who will manage the trust according to the specified terms. It is also important for the Trustor to communicate their intentions to the beneficiaries to avoid any misunderstandings in the future. Proper legal advice may be beneficial during this process to ensure compliance with Pennsylvania laws.

Steps to complete the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or

Completing the State of Pennsylvania, hereinafter referred to as the Trustor, whether one or more, involves a systematic approach:

- Define the trust purpose and objectives.

- Identify the assets to be included in the trust.

- Select a trustee who will manage the trust.

- Draft the trust document, detailing the terms and conditions.

- Sign the document in the presence of a notary public.

- Transfer the identified assets into the trust.

- Communicate with beneficiaries about the trust's provisions.

Legal use of the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or

The legal use of the State of Pennsylvania, hereinafter referred to as the Trustor, whether one or more, is governed by state trust laws. This form is legally binding when executed properly, meaning it must adhere to Pennsylvania's legal requirements for trusts. This includes having a clear intention to create a trust, a lawful purpose, and identifiable beneficiaries. Additionally, the Trustor must ensure that the trust document is signed and notarized, which adds a layer of legal validity to the agreement.

Key elements of the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or

Key elements of the State of Pennsylvania, hereinafter referred to as the Trustor, whether one or more, include:

- Trustor's Intent: The Trustor must express a clear intention to create a trust.

- Trustee Selection: The Trustor appoints a trustee responsible for managing the trust.

- Beneficiaries: The Trustor designates beneficiaries who will benefit from the trust.

- Assets: The Trustor specifies the assets to be placed in the trust.

- Trust Document: A formal document outlining the trust's terms is required.

State-specific rules for the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or

State-specific rules for the State of Pennsylvania, hereinafter referred to as the Trustor, whether one or more, include adherence to the Pennsylvania Uniform Trust Act. This act provides guidelines on the creation, administration, and termination of trusts. It is important for the Trustor to be aware of specific provisions, such as the requirements for trust modification and revocation, as well as the fiduciary duties imposed on trustees. Understanding these rules ensures that the trust operates smoothly and in compliance with state regulations.

Quick guide on how to complete state of pennsylvania hereinafter referred to as the trustor whether one or

Prepare State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or effortlessly on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the right form and store it securely online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents promptly without delays. Handle State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or with ease

- Find State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of pennsylvania hereinafter referred to as the trustor whether one or

How to create an eSignature for the State Of Pennsylvania Hereinafter Referred To As The Trustor Whether One Or online

How to create an eSignature for the State Of Pennsylvania Hereinafter Referred To As The Trustor Whether One Or in Google Chrome

How to create an electronic signature for putting it on the State Of Pennsylvania Hereinafter Referred To As The Trustor Whether One Or in Gmail

How to generate an eSignature for the State Of Pennsylvania Hereinafter Referred To As The Trustor Whether One Or right from your mobile device

How to create an electronic signature for the State Of Pennsylvania Hereinafter Referred To As The Trustor Whether One Or on iOS devices

How to make an electronic signature for the State Of Pennsylvania Hereinafter Referred To As The Trustor Whether One Or on Android devices

People also ask

-

What advantages does airSlate SignNow offer for the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or?

airSlate SignNow provides the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or, with a user-friendly platform that simplifies the document signing process. Its features allow for quick eSigning, ensuring that documents are securely signed and managed digitally. This efficiency helps accelerate business transactions and enhances productivity.

-

How much does airSlate SignNow cost for businesses in the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or?

The pricing for airSlate SignNow is quite competitive, making it an ideal solution for the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or. Plans are available to fit various needs and budgets, with options for monthly or annual subscriptions. This allows businesses to choose a plan that aligns with their eSigning needs.

-

What key features does airSlate SignNow provide for the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or?

For the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or, airSlate SignNow offers essential features such as customizable templates, bulk sending, and secure storage. These features enhance the eSigning experience by streamlining document workflows and ensuring compliance with legal standards. Additionally, users can track document status in real-time.

-

Can airSlate SignNow integrate with other tools commonly used in the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or?

Yes, airSlate SignNow seamlessly integrates with numerous applications and platforms valuable to the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or. It connects with CRM systems, productivity tools, and cloud storage services, allowing users to enhance their workflow. This integration capability increases efficiency and reduces manual entry.

-

Is airSlate SignNow secure for document handling in the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or?

Absolutely, airSlate SignNow prioritizes the security of all documents processed by the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or. The platform employs advanced encryption protocols and complies with regulatory standards to ensure data protection. Users can confidently sign and send documents knowing their information is secure.

-

How does airSlate SignNow support mobile users in the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or?

For mobile users in the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or, airSlate SignNow provides a mobile-friendly app that allows for eSigning on-the-go. This flexibility ensures that users can manage document signing anytime, anywhere, enhancing convenience. The app maintains the same robust features as the desktop version.

-

What benefits does eSigning offer to the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or?

eSigning with airSlate SignNow offers signNow benefits to the State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or, including faster turnaround times and reduced paper usage. This digital approach minimizes delays involved in traditional signing and enhances sustainability. Additionally, it improves customer satisfaction through faster service.

Get more for State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or

- Nj form630 application for extension of time to file nj gross income tax return

- Nj form 630 application for extension of time to file nj gross

- 2013 new jersey form

- Jersey form 2017 2019

- Jersey form 2015

- Nj form 630 application for extension of time to file nj gross

- New jersey appeal 2018 2019 form

- Nj form a 1 2014

Find out other State Of Pennsylvania, Hereinafter Referred To As The Trustor, Whether One Or

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure