it 370 Form 2017

What is the It 370 Form

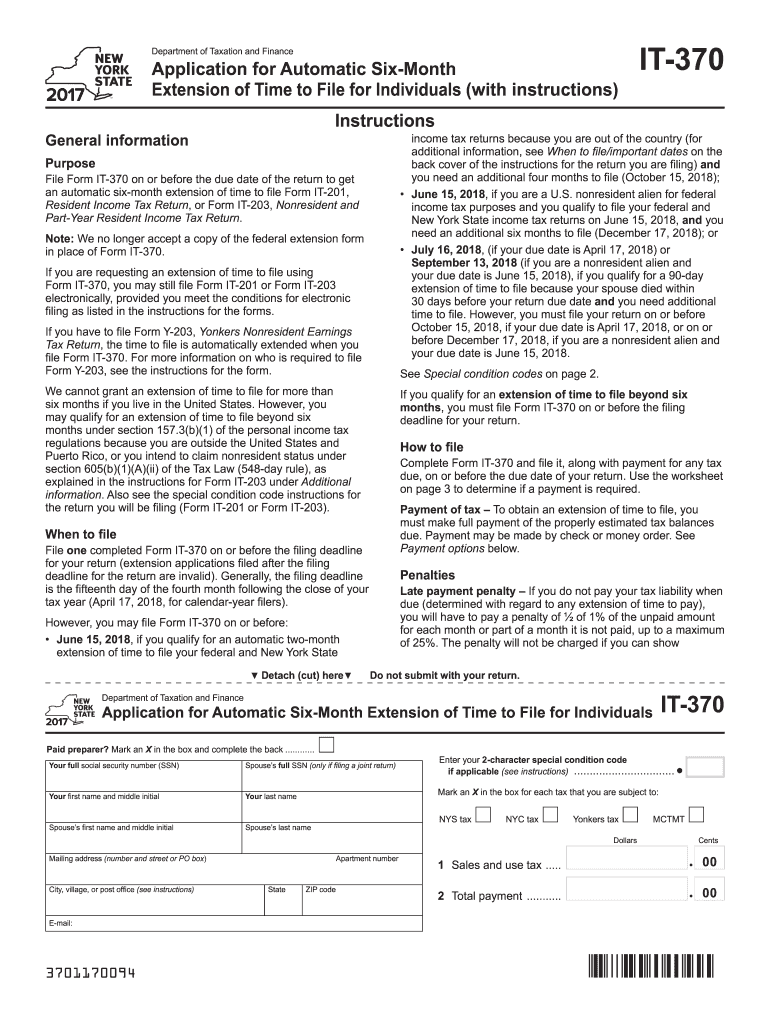

The It 370 Form is a tax form used in the United States for individuals to report their income and calculate their tax liabilities. This form is essential for taxpayers who need to provide detailed information regarding their earnings, deductions, and credits. It is specifically designed to meet federal requirements and IRS specifications, ensuring that all necessary information is captured accurately. Understanding the purpose of the It 370 Form is crucial for proper tax filing and compliance with tax laws.

How to use the It 370 Form

Using the It 370 Form involves several steps to ensure accurate completion and submission. First, gather all necessary documentation, including income statements, previous tax returns, and any relevant financial records. Next, carefully fill out the form by entering your personal information, income details, and applicable deductions. It is important to follow the instructions provided with the form to avoid errors. Once completed, review the form for accuracy before signing and submitting it either online or by mail, adhering to the specified filing deadlines.

Steps to complete the It 370 Form

Completing the It 370 Form requires a systematic approach to ensure all information is accurately reported. The following steps outline the process:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductions.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income by entering amounts from your income statements.

- Claim any deductions and credits you are eligible for, ensuring you have supporting documentation.

- Review all entries for accuracy and completeness.

- Sign the form to validate your submission.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the It 370 Form

The It 370 Form is legally recognized by the IRS and must be completed in compliance with federal tax laws. To ensure its legal validity, taxpayers must provide accurate information and adhere to the guidelines set forth by the IRS. Using this form correctly helps prevent issues related to audits or penalties for non-compliance. Additionally, eSignatures are accepted for this form, allowing for a more efficient and secure submission process.

Filing Deadlines / Important Dates

Filing deadlines for the It 370 Form are critical for taxpayers to adhere to in order to avoid penalties. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April 15th of each year. However, it is important to verify specific dates each tax year, as they may vary due to weekends or holidays. Taxpayers should also be aware of any extensions that may apply and ensure they file within the extended timeframe if needed.

Form Submission Methods (Online / Mail / In-Person)

The It 370 Form can be submitted through various methods, providing flexibility for taxpayers. The primary submission methods include:

- Online: Taxpayers can complete and submit the form electronically through approved e-filing platforms, ensuring quick processing.

- Mail: The form can be printed, signed, and mailed to the appropriate IRS address, as indicated in the form instructions.

- In-Person: Some taxpayers may choose to file in person at designated IRS offices, although appointments may be required.

Quick guide on how to complete it 370 2017 form

Your assistance manual on how to prepare your It 370 Form

If you’re wondering how to generate and submit your It 370 Form, here are some straightforward guidelines for simplifying the tax declaration process.

To get started, all you need to do is create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is a user-friendly and powerful document solution that enables you to modify, generate, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and electronic signatures, and revisit to adjust entries as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow the instructions below to complete your It 370 Form in just a few minutes:

- Set up your account and start editing PDFs in no time.

- Access our directory to find any IRS tax document; browse through variants and schedules.

- Click Get form to open your It 370 Form in our editor.

- Complete the essential fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to affix your legally-binding electronic signature (if necessary).

- Review your document and correct any errors.

- Save your edits, print a copy, submit it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper filing can lead to more mistakes and delays in refunds. Before e-filing your taxes, ensure you check the IRS website for submission guidelines applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct it 370 2017 form

FAQs

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

The Mh CET 2017 application forms were released yesterday. Is it better to fill out the form now or later?

No hard and fast rule for that!It would be better if you fill it early as possible.Because later the traffic will go on increasing and these Government websites are more likely to crash when the traffic is high.fill the forms in initial days if you can..

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

Create this form in 5 minutes!

How to create an eSignature for the it 370 2017 form

How to create an eSignature for the It 370 2017 Form in the online mode

How to make an electronic signature for the It 370 2017 Form in Google Chrome

How to create an eSignature for putting it on the It 370 2017 Form in Gmail

How to create an electronic signature for the It 370 2017 Form right from your mobile device

How to generate an eSignature for the It 370 2017 Form on iOS

How to create an eSignature for the It 370 2017 Form on Android OS

People also ask

-

What is the IT 370 Form and how is it used?

The IT 370 Form is a tax form used by individuals to request an extension of time to file their New York State income tax return. By submitting the IT 370 Form, taxpayers can ensure they have additional time to gather necessary documentation and prepare their returns without incurring penalties.

-

How can airSlate SignNow help with filing the IT 370 Form?

airSlate SignNow streamlines the process of completing and submitting the IT 370 Form by allowing users to easily eSign documents online. This saves time and reduces the hassle of printing and mailing forms, ensuring your extension request is submitted quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the IT 370 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to essential features for managing documents, including eSigning the IT 370 Form, making it a cost-effective solution for businesses looking to simplify their tax processes.

-

What features does airSlate SignNow offer for managing the IT 370 Form?

airSlate SignNow provides features such as customizable templates, secure storage, and real-time tracking when handling the IT 370 Form. These features enhance efficiency and ensure that all necessary documents are completed and submitted accurately.

-

Can I integrate airSlate SignNow with other software for the IT 370 Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including CRM systems and cloud storage services. This allows users to manage the IT 370 Form alongside their existing workflows efficiently.

-

What are the benefits of using airSlate SignNow for the IT 370 Form?

Using airSlate SignNow for the IT 370 Form offers several benefits, including improved efficiency, reduced turnaround times, and enhanced security for sensitive information. Additionally, the user-friendly interface makes it easy for anyone to navigate the signing process.

-

Is airSlate SignNow secure for submitting the IT 370 Form?

Yes, airSlate SignNow employs advanced security measures to protect your information while submitting the IT 370 Form. With encryption and secure cloud storage, you can rest assured that your documents are safe and compliant with industry standards.

Get more for It 370 Form

- This license application is for a corporation seeking to obtain an arizona contractors license form

- Islamic development bank isdb form

- Authorization for release of case status information state of indiana state in

- My depression action plan mdwise inc mdwise form

- Contractconsulting agreement form

- Kinkaid upper school cheerleading tryouts kinkaid form

- Pharr san juan alamo high school webpsjaisdus web psjaisd form

Find out other It 370 Form

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile