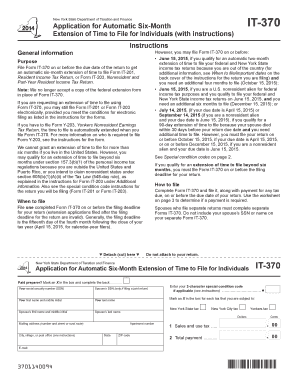

it 370 Form 2014

What is the It 370 Form

The It 370 Form is a tax form used by residents of New Jersey to apply for a tax refund or to claim a credit for taxes paid. This form is particularly relevant for individuals who have overpaid their taxes or are eligible for certain tax credits. Understanding the purpose of the It 370 Form is essential for ensuring compliance with state tax regulations and for maximizing potential refunds.

How to use the It 370 Form

Using the It 370 Form involves several steps. First, gather all necessary documentation, such as W-2 forms, 1099 forms, and any other relevant financial records. Next, accurately fill out the form by entering personal information, income details, and any deductions or credits you wish to claim. Ensure that all information is complete and correct to avoid delays in processing. Once completed, submit the form either electronically or via mail, depending on your preference and the guidelines provided by the New Jersey Division of Taxation.

Steps to complete the It 370 Form

Completing the It 370 Form requires careful attention to detail. Follow these steps:

- Obtain the latest version of the It 370 Form from the New Jersey Division of Taxation website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income as indicated on your tax documents.

- Claim any eligible deductions or credits by following the instructions provided.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, ensuring you keep a copy for your records.

Legal use of the It 370 Form

The It 370 Form is legally recognized by the New Jersey Division of Taxation as a valid means for taxpayers to request refunds or credits. To ensure compliance, it is important to follow all instructions carefully and to submit the form within the designated filing deadlines. Using the form correctly helps avoid penalties and ensures that taxpayers receive any refunds or credits they are entitled to.

Filing Deadlines / Important Dates

Filing deadlines for the It 370 Form are crucial for taxpayers to observe. Typically, the form must be submitted by April 15 of the year following the tax year in question. However, if April 15 falls on a weekend or holiday, the deadline may be extended. It is essential to stay informed about any changes to filing dates or extensions that may be announced by the New Jersey Division of Taxation.

Form Submission Methods (Online / Mail / In-Person)

The It 370 Form can be submitted through various methods to accommodate different preferences. Taxpayers can file online using the New Jersey Division of Taxation's e-filing system, which offers a quick and secure way to submit forms. Alternatively, the form can be mailed to the appropriate tax office, or in some cases, submitted in person. Choosing the right submission method can help ensure timely processing of your tax return.

Quick guide on how to complete 2014 it 370 form

Your assistance manual on how to prepare your It 370 Form

If you wish to learn how to create and submit your It 370 Form, here are some brief guidelines on how to simplify the tax submission process.

To begin, you just need to register your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an extremely intuitive and powerful document solution that allows you to modify, generate, and finalize your tax forms effortlessly. Utilizing its editor, you can transition between text, checkboxes, and electronic signatures and revert to make changes as necessary. Streamline your tax administration with enhanced PDF editing, eSigning, and convenient sharing.

Follow the instructions below to complete your It 370 Form within a few minutes:

- Create your account and start working on PDFs within moments.

- Use our directory to find any IRS tax form; browse through variations and schedules.

- Click Get form to open your It 370 Form in our editor.

- Fill in the necessary fields with your details (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding electronic signature (if necessary).

- Examine your document and rectify any errors.

- Save your changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting on paper can lead to return errors and delays in refunds. Certainly, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2014 it 370 form

FAQs

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

Create this form in 5 minutes!

How to create an eSignature for the 2014 it 370 form

How to generate an electronic signature for your 2014 It 370 Form in the online mode

How to generate an electronic signature for your 2014 It 370 Form in Chrome

How to create an eSignature for putting it on the 2014 It 370 Form in Gmail

How to create an electronic signature for the 2014 It 370 Form straight from your mobile device

How to generate an eSignature for the 2014 It 370 Form on iOS

How to make an eSignature for the 2014 It 370 Form on Android devices

People also ask

-

What is the IT 370 Form and why is it important?

The IT 370 Form is a New York State tax form used for filing personal income taxes. It allows taxpayers to report their income, deductions, and credits accurately. Understanding the IT 370 Form is crucial for ensuring compliance with tax regulations and maximizing potential refunds.

-

How does airSlate SignNow simplify the IT 370 Form signing process?

airSlate SignNow streamlines the signing process for the IT 370 Form by providing an intuitive interface that allows users to send and eSign documents quickly. With features like templates and automated reminders, businesses can manage their document workflow efficiently, ensuring timely submissions.

-

Is there a cost associated with using airSlate SignNow for the IT 370 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for sending and eSigning the IT 370 Form. The plans are designed to be cost-effective, ensuring that you only pay for the features you need, making it an affordable choice for businesses.

-

What features does airSlate SignNow offer for managing the IT 370 Form?

airSlate SignNow provides several features for managing the IT 370 Form, including customizable templates, real-time tracking of document status, and secure cloud storage. These features help businesses streamline their processes and ensure that all necessary signatures are collected efficiently.

-

Can I integrate airSlate SignNow with other software for the IT 370 Form?

Yes, airSlate SignNow offers seamless integrations with various popular software tools, allowing you to manage the IT 370 Form alongside your existing systems. This integration capability enhances productivity by enabling data transfer and workflow automation between platforms.

-

What are the benefits of using airSlate SignNow for the IT 370 Form?

Using airSlate SignNow for the IT 370 Form offers numerous benefits, including enhanced efficiency, improved accuracy, and reduced turnaround times for document processing. Additionally, the electronic signing feature helps eliminate the hassle of printing and mailing, saving businesses time and resources.

-

Is airSlate SignNow secure for handling the IT 370 Form?

Absolutely! airSlate SignNow prioritizes security and compliance, employing advanced encryption and secure access protocols to protect sensitive information associated with the IT 370 Form. You can trust that your data is safe while using our platform.

Get more for It 370 Form

- Utilities account transfer formpdflaw of agencyfee

- Form i 212 application for permission to reapply for admission into

- Fillable online rsk application double agreements iceland form

- Fillable online l 0759 fax email print pdffiller form

- Dual barber shop and cosmetology salon license application form

- Documents submitted with you application will not be returned form

- Form 4 508

- Cosmetologydepartment of state ny gov form

Find out other It 370 Form

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast