Three Executors to Three Trustees Form

Understanding the deed executors form

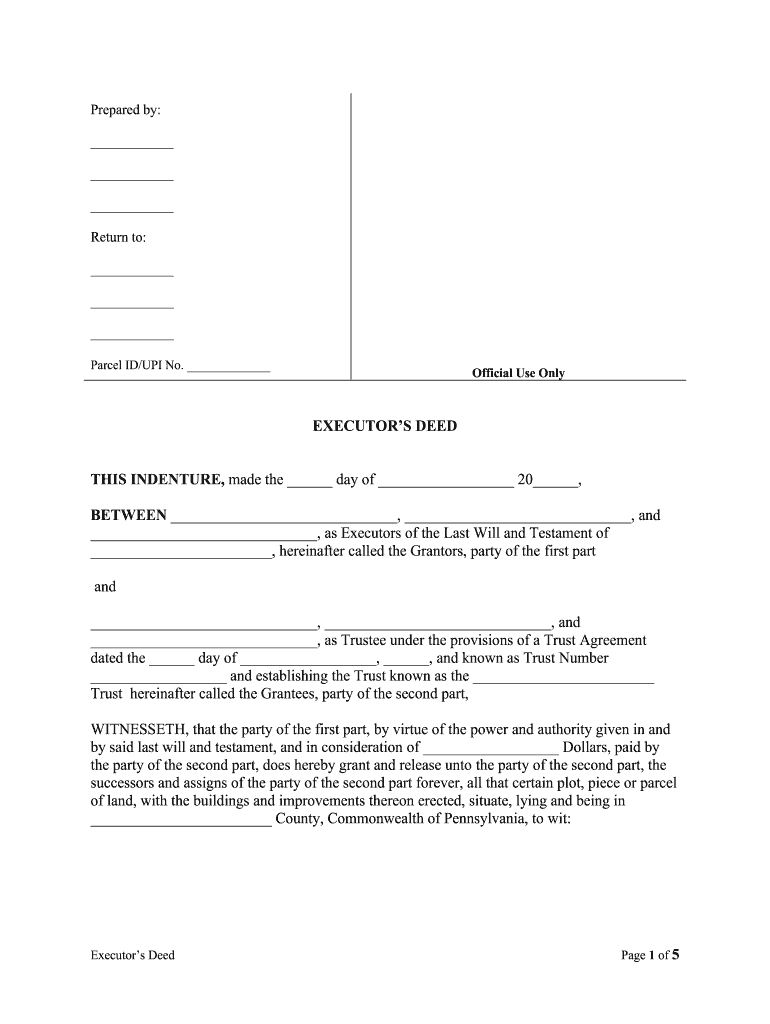

The deed executors form is a legal document that designates individuals responsible for managing and distributing the estate of a deceased person. This form is crucial in ensuring that the wishes of the deceased are honored and that the estate is settled according to applicable laws. Executors have the authority to handle various tasks, including paying debts, filing taxes, and distributing assets to beneficiaries. In the context of Pennsylvania, the executor's duties are governed by state laws, which outline the responsibilities and powers granted to them.

Steps to complete the deed executors form

Completing the deed executors form involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary information about the deceased, including their full name, date of death, and details of the estate. Next, identify the appointed executors and ensure they are willing to accept the role. Fill out the form with accurate information, paying close attention to the details regarding the estate's assets and liabilities. After completing the form, it must be signed by the designated executors and may require notarization depending on state regulations. Finally, submit the form to the appropriate court or agency as specified by local laws.

Legal use of the deed executors form

The legal use of the deed executors form is essential in the probate process, which is the legal procedure for settling an estate after someone passes away. This form serves as official documentation that validates the authority of the executors to act on behalf of the deceased. It is important to ensure that the form complies with state-specific laws, as improper use can lead to legal challenges or delays in the probate process. Executors must understand their legal obligations and the implications of their actions when managing the estate.

Required documents for the deed executors form

When preparing to submit the deed executors form, it is necessary to gather several supporting documents. These may include the deceased's will, death certificate, and any prior court orders related to the estate. Additionally, executors may need to provide identification and proof of their relationship to the deceased. Collecting these documents ahead of time can streamline the process and help avoid complications during the submission and probate phases.

State-specific rules for the deed executors form

Each state has its own rules and regulations governing the use of the deed executors form. In Pennsylvania, for instance, the form must adhere to specific guidelines set forth by the Pennsylvania Orphans' Court. This includes requirements for notarization, filing deadlines, and the manner in which the form is submitted. Understanding these state-specific rules is crucial for executors to ensure compliance and to facilitate a smooth probate process.

Examples of using the deed executors form

Real-world examples of using the deed executors form can provide valuable insights into its practical application. For instance, if a parent passes away and has designated two executors in their will, these individuals will need to complete the deed executors form to manage the estate. They may need to address various assets, such as real estate or bank accounts, and ensure that all debts are settled before distributing the remaining assets to beneficiaries. These examples illustrate the importance of the form in executing the wishes of the deceased effectively.

Quick guide on how to complete three executors to three trustees

Effortlessly Prepare Three Executors To Three Trustees on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage Three Executors To Three Trustees on any device using airSlate SignNow's Android or iOS applications and streamline your document procedures today.

How to Edit and eSign Three Executors To Three Trustees with Ease

- Obtain Three Executors To Three Trustees and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize relevant portions of the documents or obscure sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere moments and has the same legal standing as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Three Executors To Three Trustees to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the three executors to three trustees

How to create an electronic signature for the Three Executors To Three Trustees online

How to generate an electronic signature for your Three Executors To Three Trustees in Chrome

How to make an eSignature for signing the Three Executors To Three Trustees in Gmail

How to create an eSignature for the Three Executors To Three Trustees from your smartphone

How to create an electronic signature for the Three Executors To Three Trustees on iOS

How to make an eSignature for the Three Executors To Three Trustees on Android devices

People also ask

-

What is a deed executors form and why do I need it?

A deed executors form is a legal document that outlines the authority of an executor to manage the estate of a deceased individual. Using a deed executors form ensures that all actions taken in the course of estate management are legally recognized and binding. This form is crucial for executing the wishes of the deceased efficiently.

-

How does airSlate SignNow simplify the process of filling out a deed executors form?

airSlate SignNow provides an intuitive platform that allows users to easily complete a deed executors form online. With templates and guided workflows, users can ensure that all necessary fields are filled accurately and efficiently. Users can focus more on the content rather than the complexity of the document.

-

Is there a cost associated with using airSlate SignNow for a deed executors form?

Yes, airSlate SignNow offers various pricing plans based on your needs, starting from affordable options for individuals to comprehensive solutions for businesses. Each plan includes access to features that allow for effective management of documents like a deed executors form. You can choose a plan that best fits your budget and requirements.

-

Can I integrate airSlate SignNow with other applications for handling a deed executors form?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to manage your deed executors form alongside your existing workflows. Whether you use CRMs, cloud storage, or project management tools, integration helps streamline your processes without losing track of your documents.

-

What features does airSlate SignNow offer for managing a deed executors form?

airSlate SignNow includes features such as eSigning, document sharing, and tracking for your deed executors form. These tools ensure that your documents are not only signed but also secured and easily accessible at any time. You can also collaborate with other stakeholders directly within the platform.

-

How secure is my information when using airSlate SignNow for a deed executors form?

Security is a priority at airSlate SignNow. When handling your deed executors form, your data is protected through advanced encryption protocols. This means that all information is safeguarded from unauthorized access, ensuring confidentiality throughout the signing process.

-

Can I track the status of my deed executors form once it's sent out?

Yes, airSlate SignNow allows you to track the status of your deed executors form in real-time. You'll receive notifications when the document is viewed, signed, or completed, making it easy to stay updated on the progress of your important legal paperwork. This transparency ensures that you never lose track of your documents.

Get more for Three Executors To Three Trustees

Find out other Three Executors To Three Trustees

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe