Residence Homestead Exemption Application Coleman County CAD Form

Understanding the Residence Homestead Exemption Application

The Residence Homestead Exemption Application is a crucial document for homeowners in the United States, particularly in Texas. This application allows eligible homeowners to reduce their property taxes by exempting a portion of their property's value from taxation. The exemption is designed to provide financial relief to those who occupy their homes as their primary residence. Understanding the requirements and benefits of this application can significantly impact your tax obligations.

Steps to Complete the Residence Homestead Exemption Application

Completing the Residence Homestead Exemption Application involves several key steps:

- Gather Required Documents: Collect necessary documents such as proof of identity, ownership, and residency.

- Fill Out the Application: Complete the application form accurately, ensuring all required information is provided.

- Submit the Application: Send the completed application to your local appraisal district by mail, online, or in person.

- Await Confirmation: After submission, wait for confirmation from the appraisal district regarding the status of your application.

Eligibility Criteria for the Residence Homestead Exemption

To qualify for the Residence Homestead Exemption, applicants must meet specific criteria, which typically include:

- The property must be your primary residence.

- You must own the property on January 1 of the tax year.

- You must not claim a homestead exemption on any other property.

These criteria ensure that the exemption is granted to those who genuinely occupy and own their homes.

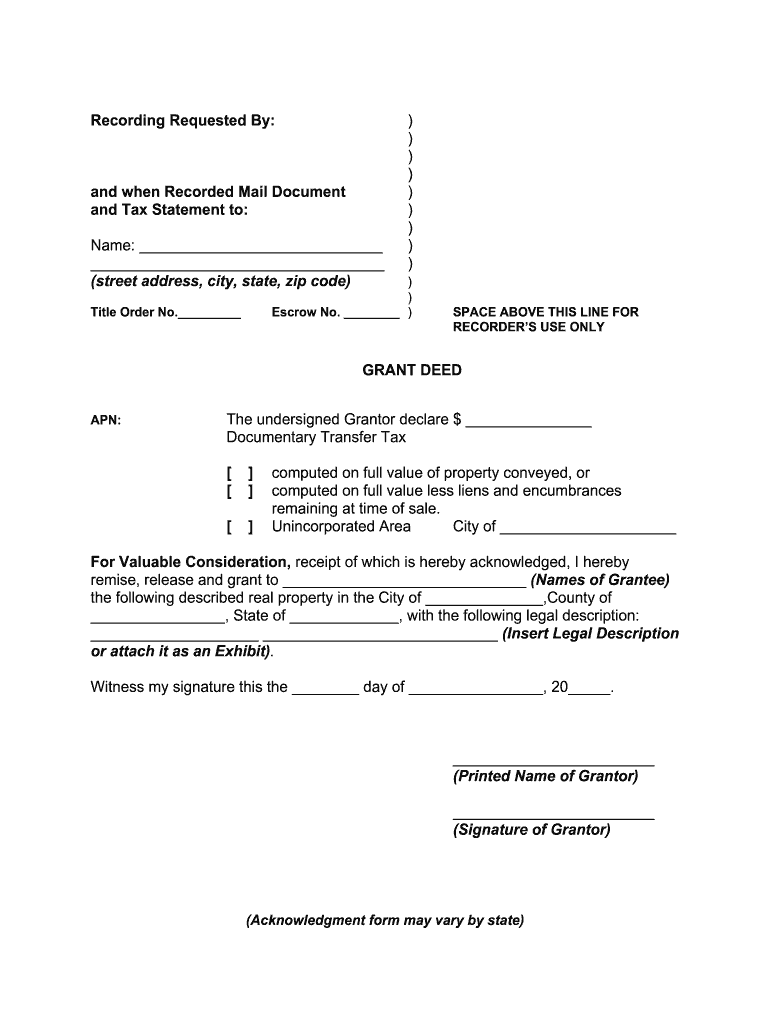

Key Elements of the Residence Homestead Exemption Application

The application includes several key elements that applicants must be aware of:

- Property Description: Information about the property, including its address and legal description.

- Owner Information: Details about the homeowner, including name and contact information.

- Signature: The homeowner must sign the application, affirming the accuracy of the information provided.

Legal Use of the Residence Homestead Exemption Application

The legal use of the Residence Homestead Exemption Application is governed by state laws. In Texas, the application must be filed with the local appraisal district to be considered valid. Failure to comply with the legal requirements can result in denial of the exemption, leading to higher property taxes. It is essential to adhere to the guidelines set forth by the state to ensure the application is processed correctly.

Examples of Using the Residence Homestead Exemption Application

Understanding practical examples can clarify how the Residence Homestead Exemption Application works:

- A homeowner who has lived in their property for over a year applies for the exemption to reduce their tax bill.

- A newly married couple files for the exemption after purchasing their first home, ensuring they qualify for the tax benefits.

These examples illustrate the application’s relevance for various homeowner scenarios.

Quick guide on how to complete residence homestead exemption application coleman county cad

Effortlessly Prepare Residence Homestead Exemption Application Coleman County CAD on Any Device

Managing documents online has gained prevalence among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, as one can easily find the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Residence Homestead Exemption Application Coleman County CAD on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related task today.

The Easiest Method to Modify and Electronically Sign Residence Homestead Exemption Application Coleman County CAD with Ease

- Find Residence Homestead Exemption Application Coleman County CAD and click Get Form to begin.

- Make use of the tools provided to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Design your signature using the Sign tool, which takes only seconds and bears the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Residence Homestead Exemption Application Coleman County CAD to ensure excellent communication throughout the entire document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the residence homestead exemption application coleman county cad

How to generate an eSignature for your Residence Homestead Exemption Application Coleman County Cad in the online mode

How to make an electronic signature for your Residence Homestead Exemption Application Coleman County Cad in Chrome

How to make an electronic signature for signing the Residence Homestead Exemption Application Coleman County Cad in Gmail

How to generate an eSignature for the Residence Homestead Exemption Application Coleman County Cad right from your smart phone

How to generate an electronic signature for the Residence Homestead Exemption Application Coleman County Cad on iOS devices

How to create an electronic signature for the Residence Homestead Exemption Application Coleman County Cad on Android

People also ask

-

What is title authorization meaning in the context of eSigning documents?

Title authorization meaning refers to the process by which a signatory is granted the authority to act on behalf of another party in signing documents. In the realm of eSigning, this ensures that all involved parties understand the legal implications of the authorization, providing clarity and security in contractual agreements.

-

How can airSlate SignNow help me understand title authorization meaning?

airSlate SignNow simplifies the concept of title authorization meaning by providing clear templates and guidance within the platform. This allows users to easily identify who has the authority to sign documents, ensuring compliance and reducing the chances of misinterpretation.

-

Are there any costs associated with using airSlate SignNow for title authorization documentation?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan provides features that facilitate understanding of title authorization meaning, ensuring that you can eSign documents with confidence without breaking the bank.

-

What features does airSlate SignNow offer related to title authorization?

airSlate SignNow includes features such as customizable workflows, secure document storage, and audit trails that clarify title authorization meaning. These tools help streamline the signing process while ensuring that all parties are aware of their roles and responsibilities.

-

What are the benefits of understanding title authorization meaning for business transactions?

Understanding title authorization meaning is crucial for mitigating risks in business transactions. Properly identifying authorized signers reduces the potential for disputes and enhances the legitimacy of signed documents, which is well-supported by airSlate SignNow's user-friendly interface.

-

How can I integrate airSlate SignNow with my existing systems to support title authorization processes?

airSlate SignNow offers robust integrations with various platforms like CRM and ERP systems, enabling you to streamline title authorization processes. This integration ensures that all relevant parties are easily notified and have access to the necessary documents related to title authorization meaning.

-

Is airSlate SignNow compliant with legal standards regarding title authorization?

Yes, airSlate SignNow complies with industry standards such as ESIGN and UETA, which govern electronic signatures and title authorization meaning. This adherence to regulations ensures that all signed documents are legally binding and secure.

Get more for Residence Homestead Exemption Application Coleman County CAD

Find out other Residence Homestead Exemption Application Coleman County CAD

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template