Form 886 H Eic 2018

What is the Form 886 H Eic

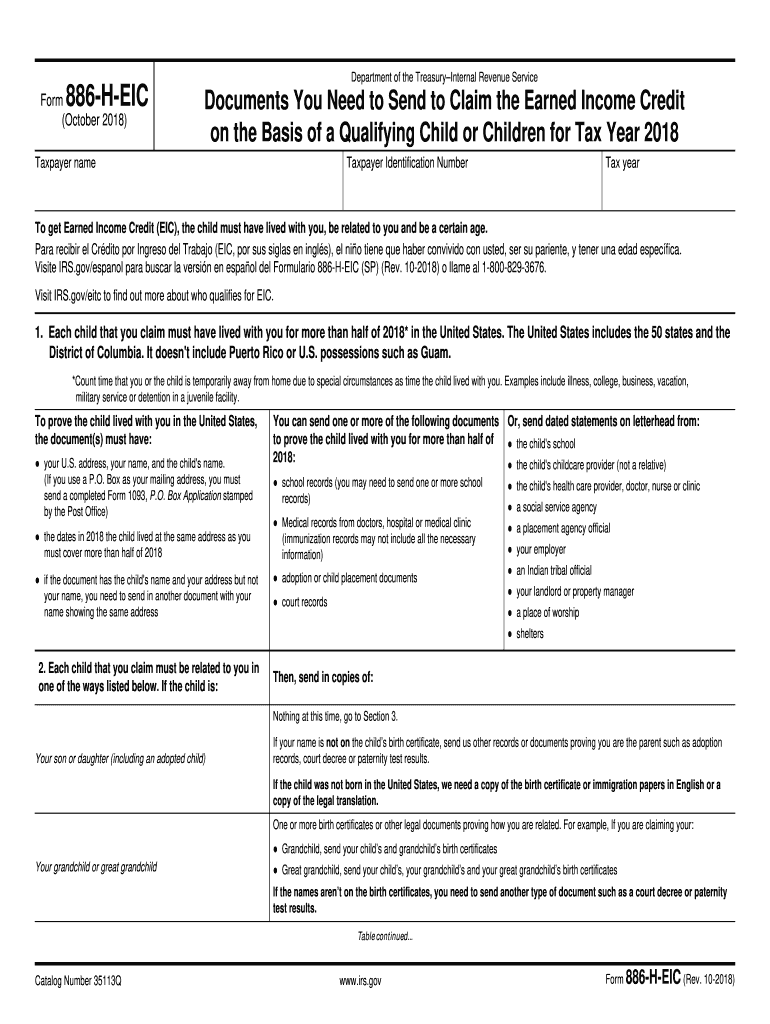

The Form 886 H EIC, officially known as the federal form 886 H EIC 2018, is a document used by taxpayers in the United States to claim the Earned Income Tax Credit (EITC). This form is specifically designed for those who are eligible for the credit, which is aimed at reducing the tax burden on low to moderate-income working individuals and families. The 886 H EIC form helps the Internal Revenue Service (IRS) verify eligibility for the EITC by providing necessary information about the taxpayer's income, filing status, and qualifying children.

How to use the Form 886 H Eic

Using the Form 886 H EIC involves several steps to ensure accurate completion and submission. First, gather all required documentation, including proof of income and information about qualifying children. Next, fill out the form carefully, ensuring all information is accurate and complete. After completing the form, review it for any errors before submission. The form can be submitted electronically or via mail, depending on the taxpayer's preference and filing method. It is essential to keep a copy of the completed form for personal records.

Steps to complete the Form 886 H Eic

Completing the Form 886 H EIC requires attention to detail. Follow these steps:

- Gather necessary documents, including W-2s and 1099s.

- Provide personal information, including your name, Social Security number, and filing status.

- List qualifying children, including their names, Social Security numbers, and relationship to you.

- Report your earned income and any other income sources.

- Double-check all entries for accuracy before submission.

Eligibility Criteria

To qualify for the Earned Income Tax Credit using the Form 886 H EIC, taxpayers must meet specific eligibility criteria. These criteria include having earned income from employment or self-employment, meeting income limits based on filing status, and having a valid Social Security number. Additionally, taxpayers must have qualifying children who meet age and residency requirements or must file without children to claim the credit. Understanding these criteria is crucial for successfully claiming the EITC.

Required Documents

When completing the Form 886 H EIC, certain documents are necessary to support your claim. These documents typically include:

- W-2 forms from employers showing earned income.

- 1099 forms for any self-employment income.

- Proof of residency for qualifying children, such as school records or medical documents.

- Social Security cards for all individuals listed on the form.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 886 H EIC. It is essential to follow these guidelines to ensure compliance and avoid potential issues. Taxpayers should refer to the IRS instructions for the form, which detail how to fill it out correctly, what documentation is needed, and the deadlines for submission. Staying informed about these guidelines can help streamline the filing process and ensure that taxpayers receive the credits they are entitled to.

Quick guide on how to complete form 886 h eic 2018

Complete Form 886 H Eic effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Form 886 H Eic on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Form 886 H Eic without any hassle

- Locate Form 886 H Eic and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to submit your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 886 H Eic and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 886 h eic 2018

Create this form in 5 minutes!

How to create an eSignature for the form 886 h eic 2018

How to generate an eSignature for the Form 886 H Eic 2018 in the online mode

How to generate an electronic signature for your Form 886 H Eic 2018 in Chrome

How to create an eSignature for signing the Form 886 H Eic 2018 in Gmail

How to generate an electronic signature for the Form 886 H Eic 2018 from your smartphone

How to generate an eSignature for the Form 886 H Eic 2018 on iOS

How to create an electronic signature for the Form 886 H Eic 2018 on Android OS

People also ask

-

What is Form 886 H Eic and why is it important?

Form 886 H Eic is a crucial IRS document used to verify eligibility for the Earned Income Credit (EIC). This form helps taxpayers provide necessary information and documentation to claim the EIC, ensuring they receive the correct refund. Using tools like airSlate SignNow can streamline this process by allowing you to eSign and send Form 886 H Eic quickly and securely.

-

How can airSlate SignNow help with Form 886 H Eic submissions?

airSlate SignNow simplifies the submission process for Form 886 H Eic by allowing users to easily fill out, eSign, and send the form electronically. With its user-friendly interface, you can manage all your document needs in one place, ensuring that your Form 886 H Eic is processed efficiently. This not only saves time but also enhances the accuracy of your submissions.

-

What are the pricing options for using airSlate SignNow for Form 886 H Eic?

airSlate SignNow offers flexible pricing plans designed to fit various budgets and needs. Whether you're a small business or a large organization, you can choose a plan that allows you to manage Form 886 H Eic and other documents effectively. Visit our pricing page to review the options and find the best fit for your requirements.

-

Can I integrate airSlate SignNow with other software for managing Form 886 H Eic?

Yes, airSlate SignNow seamlessly integrates with various applications, making it easy to manage Form 886 H Eic alongside your existing workflows. You can connect with popular software like CRM systems and document management tools, enhancing your productivity and eliminating manual processes. This integration ensures all your documentation is organized and accessible.

-

What features does airSlate SignNow offer for managing Form 886 H Eic?

airSlate SignNow provides a range of features tailored for managing Form 886 H Eic, including customizable templates, eSignature capabilities, and secure document storage. These features empower users to create, modify, and send forms effortlessly while ensuring compliance with legal standards. The platform’s intuitive design makes it easy for anyone to navigate.

-

Is airSlate SignNow secure for handling sensitive documents like Form 886 H Eic?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and authentication methods to protect sensitive documents like Form 886 H Eic. Our platform ensures that your data is secure at all stages of the signing process, giving you peace of mind while managing your important documents.

-

How does airSlate SignNow improve the efficiency of completing Form 886 H Eic?

Using airSlate SignNow signNowly improves the efficiency of completing Form 886 H Eic by streamlining the entire process—from filling out the form to eSigning and sending it. The platform reduces paperwork and eliminates the need for physical signatures, allowing you to complete your submissions faster. This efficiency translates to quicker processing times and faster refunds.

Get more for Form 886 H Eic

- United states general services administration gsa form

- Property transfer authorization gsa form

- 310 fw 6 report of survey and boards of survey fish and form

- Gsa 527 contractors qualifications and financial information

- 15659amp601675721 form

- Identify gfebs master data elements ssi lrc form

- Deposit productsstate bank of india chicago form

- Results driven form

Find out other Form 886 H Eic

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer