Form 886 H EIC Rev 10 Documents You Need to Provide You Can Claim the Earned Income Credit on the Basis of a Qualifying 2019

What is the Form 886 H EIC?

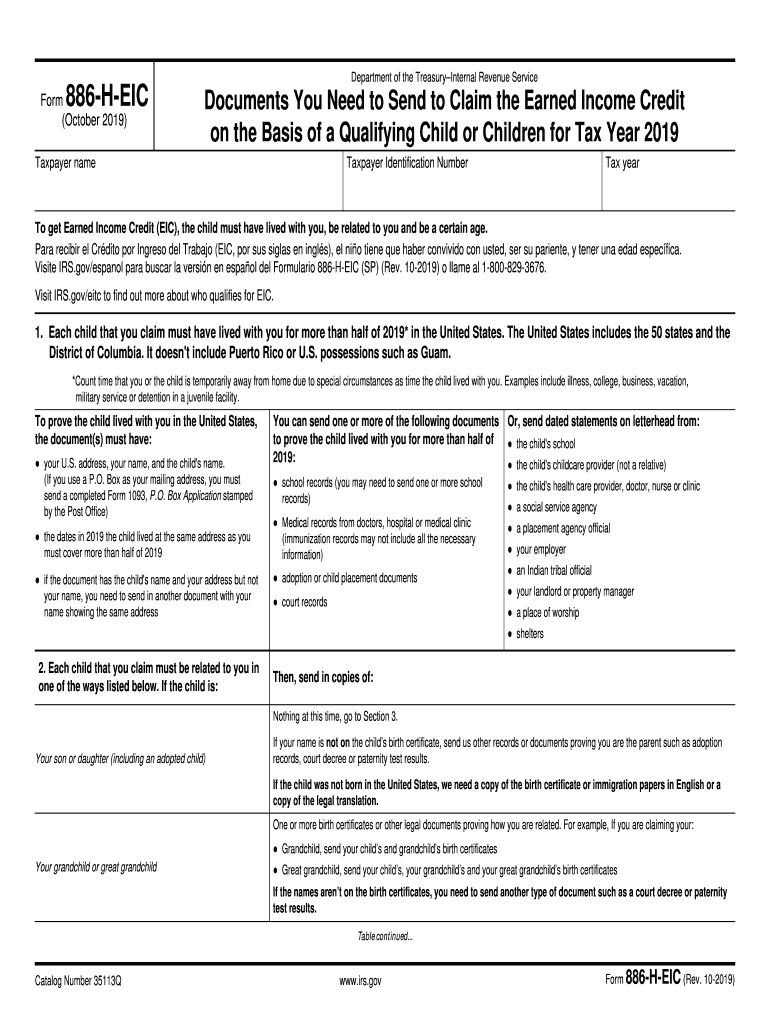

The Form 886 H EIC is a document used by taxpayers in the United States to claim the Earned Income Credit (EIC). This credit is designed to benefit low- to moderate-income working individuals and families, providing them with a financial boost. It is essential for taxpayers to understand the eligibility criteria and necessary documentation required to successfully claim this credit. The form itself serves as a declaration that the filer meets the qualifications set forth by the Internal Revenue Service (IRS) for the EIC, which can significantly impact their tax return.

Steps to Complete the Form 886 H EIC

Completing the Form 886 H EIC involves several key steps to ensure accuracy and compliance with IRS requirements. First, gather all relevant documents, such as proof of income, Social Security numbers for all qualifying children, and any other necessary financial records. Next, carefully fill out the form, ensuring that all information is correct and complete. It is important to double-check the eligibility of dependents, as this can affect the amount of credit received. Finally, submit the form along with your tax return, either electronically or by mail, depending on your filing preference.

Required Documents for Form 886 H EIC

To successfully claim the Earned Income Credit using Form 886 H EIC, certain documents must be provided. These typically include:

- Proof of earned income, such as W-2 forms or 1099 forms.

- Social Security cards for you and any qualifying children.

- Documentation of any other income sources, if applicable.

- Records that support the residency of qualifying children, such as school records or medical documents.

Having these documents ready will facilitate a smoother filing process and help ensure that the claim is processed without delays.

IRS Guidelines for Form 886 H EIC

The IRS provides specific guidelines for completing and submitting the Form 886 H EIC. Taxpayers are encouraged to review these guidelines to ensure compliance. Key points include understanding the income thresholds for eligibility, the definition of qualifying children, and the importance of accurate documentation. Adhering to these guidelines can help prevent issues with claims and ensure that taxpayers receive the credits they are entitled to.

Eligibility Criteria for Form 886 H EIC

To qualify for the Earned Income Credit using Form 886 H EIC, taxpayers must meet certain criteria. These include:

- Having earned income from employment or self-employment.

- Meeting specific income limits based on filing status and number of qualifying children.

- Filing a tax return, even if not required to do so.

- Having a valid Social Security number.

Understanding these eligibility criteria is crucial for taxpayers to determine if they can claim the EIC and to avoid potential penalties for incorrect filings.

Form Submission Methods for Form 886 H EIC

Taxpayers have several options for submitting the Form 886 H EIC. The form can be filed electronically through tax preparation software, which often streamlines the process and reduces the chance of errors. Alternatively, taxpayers may choose to print the form and submit it by mail. In-person submission at designated IRS offices is also an option, although this may require an appointment. Each method has its advantages, and taxpayers should select the one that best fits their needs and circumstances.

Quick guide on how to complete form 886 h eic rev 10 2019 documents you need to provide you can claim the earned income credit on the basis of a qualifying

Complete Form 886 H EIC Rev 10 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying effortlessly on any device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without interruptions. Handle Form 886 H EIC Rev 10 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to edit and eSign Form 886 H EIC Rev 10 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying with ease

- Obtain Form 886 H EIC Rev 10 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device of your choice. Edit and eSign Form 886 H EIC Rev 10 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 886 h eic rev 10 2019 documents you need to provide you can claim the earned income credit on the basis of a qualifying

Create this form in 5 minutes!

How to create an eSignature for the form 886 h eic rev 10 2019 documents you need to provide you can claim the earned income credit on the basis of a qualifying

How to generate an eSignature for your Form 886 H Eic Rev 10 2019 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying in the online mode

How to generate an eSignature for your Form 886 H Eic Rev 10 2019 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying in Chrome

How to create an electronic signature for putting it on the Form 886 H Eic Rev 10 2019 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying in Gmail

How to generate an eSignature for the Form 886 H Eic Rev 10 2019 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying straight from your mobile device

How to create an eSignature for the Form 886 H Eic Rev 10 2019 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying on iOS devices

How to generate an electronic signature for the Form 886 H Eic Rev 10 2019 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying on Android OS

People also ask

-

What is 886 h eic and how does it relate to airSlate SignNow?

The 886 h eic is a critical designation for businesses looking to streamline their signing processes. With airSlate SignNow, businesses can utilize this feature to enhance document management and ensure compliance with various regulations.

-

What are the pricing options for using airSlate SignNow with 886 h eic?

airSlate SignNow offers flexible pricing plans that suit different business needs. By incorporating the 886 h eic feature, customers can choose a plan that provides the necessary tools without breaking their budget.

-

What key features does airSlate SignNow offer for 886 h eic users?

For 886 h eic users, airSlate SignNow provides a comprehensive suite of features including customizable templates, advanced security protocols, and multi-user collaboration capabilities to make document signing efficient and secure.

-

How can I integrate airSlate SignNow with other services using 886 h eic?

Integrating airSlate SignNow with other applications is seamless, particularly for 886 h eic users. The platform supports various integrations, allowing businesses to connect it with CRM systems, cloud storage, and other tools to enhance workflow automation.

-

What benefits does airSlate SignNow offer specifically for businesses handling 886 h eic documents?

Businesses that utilize 886 h eic documents can benefit from greater efficiency and reduced turnaround times with airSlate SignNow. The platform simplifies the eSigning process, making it easier for users to manage important documents with a few simple clicks.

-

Is airSlate SignNow secure for handling sensitive 886 h eic information?

Yes, airSlate SignNow prioritizes security, especially when dealing with sensitive 886 h eic information. With advanced encryption and compliance with relevant regulations, businesses can trust that their documents are safe.

-

Can airSlate SignNow assist in compliance with regulatory requirements for 886 h eic documents?

Absolutely! airSlate SignNow is designed to help businesses comply with regulatory standards associated with 886 h eic documentation. The platform provides audit trails and secure verification processes to ensure all signatures are legally valid.

Get more for Form 886 H EIC Rev 10 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying

- Gsa 2192 request for forms management services gsa

- Transactional data reporting federal register form

- 13212 irs relocation travel guideinternal revenue service form

- Transmittal of shop drawings equipment data material form

- Gsa 2419 certification of progress payments under fixed price construction contracts form

- Contact record general services administration gsa form

- Findings of fact for contract modification gsa form

- Download order form camera check point

Find out other Form 886 H EIC Rev 10 Documents You Need To Provide You Can Claim The Earned Income Credit On The Basis Of A Qualifying

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free