Earned Income Tax Credit Maryland Department of Human 2022-2026

What is the Earned Income Tax Credit?

The Earned Income Tax Credit (EITC) is a federal tax benefit designed to assist low- to moderate-income working individuals and families. It reduces the amount of tax owed and may result in a refund. The EITC is particularly beneficial for those with qualifying children, but it is also available to individuals without children, provided they meet specific income thresholds. Understanding the EITC can help taxpayers maximize their refund and improve their financial situation.

Eligibility Criteria for the Earned Income Tax Credit

To qualify for the Earned Income Tax Credit, taxpayers must meet several criteria, including:

- Filing status: Taxpayers must file as single, married filing jointly, head of household, or qualifying widow(er).

- Income limits: Income must fall below certain thresholds, which vary based on filing status and the number of qualifying children.

- Qualifying children: If claiming children, they must meet age, relationship, and residency requirements.

- Investment income: Taxpayers must have less than a specified amount of investment income for the year.

Steps to Complete the Earned Income Tax Credit

Completing the form for the Earned Income Tax Credit involves several steps:

- Gather necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Determine eligibility based on income and family size.

- Complete the appropriate tax forms, including the IRS Form 8862 if claiming the credit after a previous disallowance.

- Calculate the credit using the EITC worksheet provided in the tax form instructions.

- File the tax return electronically or by mail, ensuring all required documentation is included.

IRS Guidelines for the Earned Income Tax Credit

The IRS provides specific guidelines for claiming the Earned Income Tax Credit. Taxpayers should refer to the IRS website or the instructions for Form 1040 for detailed information. Key points include:

- Filing deadlines: Tax returns must be filed by the annual deadline, typically April 15.

- Documentation: Proper documentation must be maintained to support claims for the credit.

- Amendments: If errors are discovered after filing, taxpayers may need to amend their returns to correct the information.

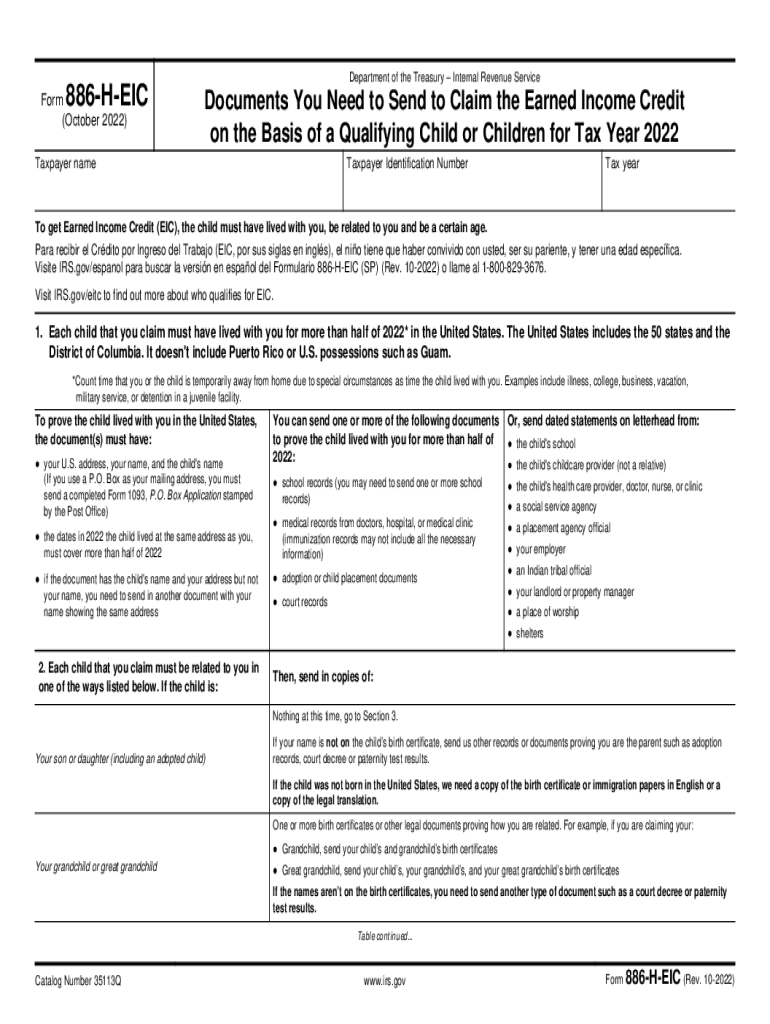

Required Documents for the Earned Income Tax Credit

When applying for the Earned Income Tax Credit, certain documents are necessary to support your claim:

- W-2 forms from employers showing earned income.

- 1099 forms for any freelance or self-employment income.

- Proof of residency for qualifying children, such as school records or medical documents.

- Any other income documentation that may affect eligibility.

Examples of Using the Earned Income Tax Credit

Understanding how the Earned Income Tax Credit works can be illustrated through examples:

- A single mother with two children earning $30,000 may qualify for a significant credit, boosting her tax refund.

- A married couple with one child earning $40,000 could also benefit from the EITC, depending on their specific income and tax situation.

- Individuals without children who earn less than $15,000 may still qualify for a smaller credit, helping to alleviate tax burdens.

Quick guide on how to complete earned income tax credit maryland department of human

Complete Earned Income Tax Credit Maryland Department Of Human effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, allowing you to obtain the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Earned Income Tax Credit Maryland Department Of Human on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

How to edit and eSign Earned Income Tax Credit Maryland Department Of Human with ease

- Obtain Earned Income Tax Credit Maryland Department Of Human and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Earned Income Tax Credit Maryland Department Of Human to ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct earned income tax credit maryland department of human

Create this form in 5 minutes!

How to create an eSignature for the earned income tax credit maryland department of human

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 886 h eic and how does it relate to airSlate SignNow?

The term 886 h eic refers to a specific regulatory code related to electronic signatures. With airSlate SignNow, businesses can ensure compliance with this regulation while efficiently managing the eSigning process.

-

How can airSlate SignNow help my business comply with 886 h eic requirements?

airSlate SignNow offers advanced features that meet the 886 h eic standards, ensuring that all eSigned documents are legally binding and secure. By utilizing secure authentication and audit trails, you can confidently meet regulatory requirements.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow provides various pricing options tailored to suit different business needs. These plans are designed to be cost-effective while ensuring compliance with 886 h eic standards for your eSigning needs.

-

What features does airSlate SignNow offer that support 886 h eic compliance?

airSlate SignNow includes features such as secure document storage, customizable workflows, and user authentication that directly support 886 h eic compliance. These features help streamline your eSigning process while ensuring legal validity.

-

Can I integrate airSlate SignNow with other software applications?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow while adhering to 886 h eic standards. You can connect with CRM systems, document management tools, and more to enhance your business processes.

-

What benefits does airSlate SignNow provide for businesses focused on 886 h eic compliance?

By using airSlate SignNow, businesses can optimize their document management processes while ensuring compliance with 886 h eic regulations. This leads to increased efficiency, reduced turnaround times, and improved legal compliance.

-

How does airSlate SignNow improve the eSigning experience for users?

airSlate SignNow offers a user-friendly interface that simplifies the eSigning experience, even for those unfamiliar with 886 h eic regulations. Users can quickly navigate the platform, ensuring a smooth document signing process.

Get more for Earned Income Tax Credit Maryland Department Of Human

- Maryland dnr form b 108

- Apartment letter leaving form

- Employment verification form 6854315

- Csd loyalty card form

- Constat amiable degat des eaux form

- Sandf group life insurance scheme form

- Code of conduct adults girl scouts diamonds girlscoutsdiamonds form

- Nafta certificate of origin aaa cooper transportation form

Find out other Earned Income Tax Credit Maryland Department Of Human

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement