Non Tax Filer Statement 2019

What is the Non Tax Filer Statement

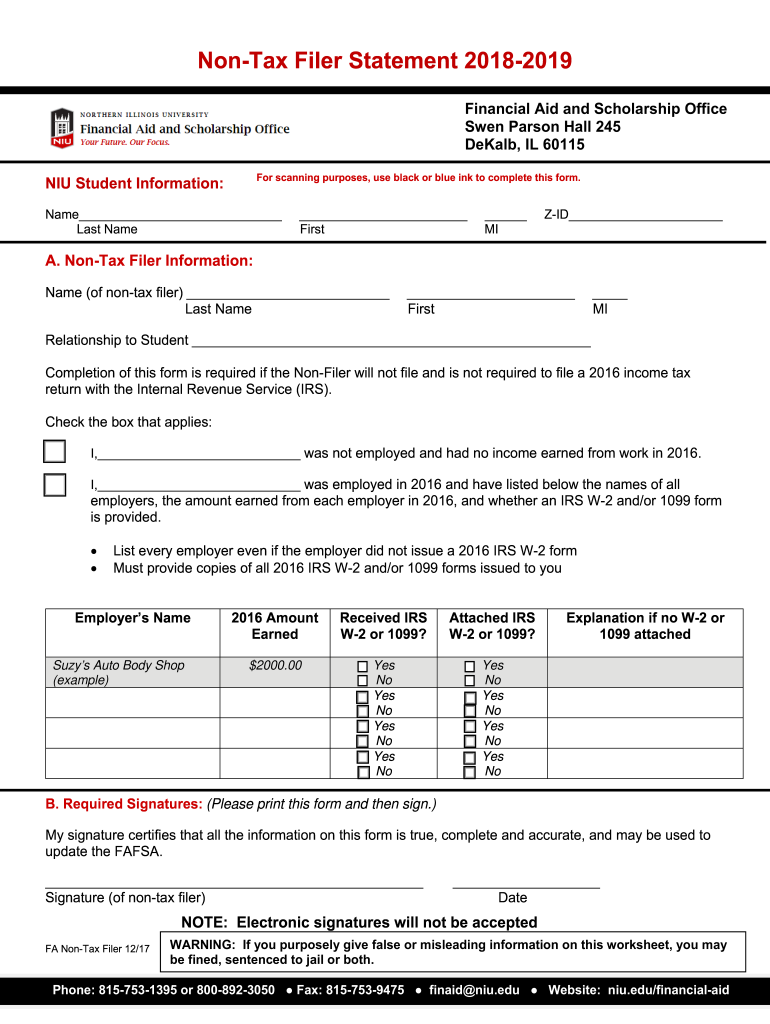

The Non Tax Filer Statement is a formal document used by individuals who do not file a tax return for a specific year. This statement is often required for various purposes, such as applying for financial aid, securing housing assistance, or verifying income for government programs. It serves as an official declaration that the individual did not earn enough income to necessitate filing a tax return, thus providing necessary proof to relevant authorities.

How to Use the Non Tax Filer Statement

The Non Tax Filer Statement can be utilized in several scenarios where proof of non-filing is required. Common uses include:

- Submitting to educational institutions for financial aid applications.

- Providing to housing authorities for rental assistance programs.

- Verifying income for state or federal benefit programs.

When using this statement, ensure that it is filled out accurately and submitted according to the specific requirements of the requesting organization.

Steps to Complete the Non Tax Filer Statement

Completing the Non Tax Filer Statement involves several key steps:

- Obtain the correct form from the relevant authority or organization.

- Fill in your personal information, including your name, address, and Social Security number.

- Clearly indicate the tax year for which you are declaring non-filing.

- Sign and date the statement to validate your declaration.

Review the completed form for accuracy before submission to ensure compliance with any specific guidelines provided by the requesting entity.

Legal Use of the Non Tax Filer Statement

The Non Tax Filer Statement holds legal significance as it serves as an official record of an individual's non-filing status. It must be completed truthfully, as providing false information can lead to legal repercussions, including penalties or loss of eligibility for programs that require this documentation. The statement is often governed by various regulations, ensuring that it meets the necessary legal standards for acceptance by institutions and government agencies.

Required Documents

When preparing to submit a Non Tax Filer Statement, certain documents may be required to support your declaration. These can include:

- A copy of your Social Security card or another form of identification.

- Proof of income, if applicable, such as pay stubs or bank statements.

- Any correspondence from the IRS or tax authority indicating your non-filing status.

Ensure that all supporting documents are current and accurately reflect your financial situation to avoid any issues during the review process.

Eligibility Criteria

To qualify for a Non Tax Filer Statement, individuals typically must meet certain criteria. Generally, these criteria include:

- Having an income below the minimum threshold required to file a tax return.

- Being a dependent or independent individual who is not required to file based on IRS guidelines.

- Providing accurate personal information and documentation as requested by the institution or agency.

Understanding these eligibility requirements can help ensure that you complete the statement correctly and submit it for the intended purpose.

Quick guide on how to complete non tax filer statement 2018 2019

Access Non Tax Filer Statement effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Non Tax Filer Statement on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to modify and electronically sign Non Tax Filer Statement with ease

- Locate Non Tax Filer Statement and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select pertinent sections of the documents or redact confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Non Tax Filer Statement and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct non tax filer statement 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the non tax filer statement 2018 2019

The way to make an electronic signature for a PDF in the online mode

The way to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

The way to generate an eSignature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is a Non Tax Filer Statement?

A Non Tax Filer Statement is a document that certifies an individual has not filed a federal tax return for a specific year. This statement can be required for various purposes, including financial aid applications or verifying income. Utilizing airSlate SignNow can simplify the process of creating and sending a Non Tax Filer Statement securely.

-

How does airSlate SignNow help in creating a Non Tax Filer Statement?

airSlate SignNow provides customizable templates that can be easily tailored to create a Non Tax Filer Statement. With our intuitive platform, users can fill in their information and eSign documents swiftly, making the entire process efficient and user-friendly. This ensures that you can focus more on your needs rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for a Non Tax Filer Statement?

Yes, there is a cost associated with using airSlate SignNow, but it is considered a cost-effective solution for document management. We offer various pricing plans that cater to different business sizes and needs. With our competitive pricing, you'll be able to manage Non Tax Filer Statements without breaking the bank.

-

What are the benefits of using airSlate SignNow for Non Tax Filer Statements?

Using airSlate SignNow for Non Tax Filer Statements offers several benefits including fast document processes, secure eSigning, and the ability to store documents in the cloud. This enhances your workflow and ensures that your Non Tax Filer Statements are easily accessible whenever needed. Additionally, our solution reduces paperwork and helps in maintaining environmental sustainability.

-

Can I integrate airSlate SignNow with other tools for managing Non Tax Filer Statements?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage Non Tax Filer Statements efficiently. Popular integrations include CRM systems, cloud storage services, and accounting software. This streamlines your workflow by connecting processes and enabling data to flow smoothly across platforms.

-

How secure is my data when using airSlate SignNow for Non Tax Filer Statements?

airSlate SignNow prioritizes security and uses advanced encryption protocols to protect your data when creating and signing Non Tax Filer Statements. Our platform complies with industry standards and regulations to ensure your sensitive information is handled securely. You can rest assured knowing that your documents are safe with us.

-

Are there templates available for a Non Tax Filer Statement on airSlate SignNow?

Yes, airSlate SignNow offers several templates specifically designed for creating Non Tax Filer Statements. These templates are customizable and easy to use, allowing you to generate the necessary documentation quickly. This saves you valuable time and ensures that you have compliant and professional statements for any requirement.

Get more for Non Tax Filer Statement

- A critical evaluation of community rail policy core form

- Vehicle suitable for safe use declaration 2015 2019 form

- Important your vehicle must be safe for use on the form

- Acfi answer appraisal pack 2013 2019 form

- Carer adjustment payment australian government department of form

- Request to withdraw a lodged document form

- Strata title body corporate tax return and instructions 2015 ato gov form

- Form 388 certificate of airworthinesschecklist 07 airworthiness directive aircraft

Find out other Non Tax Filer Statement

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter