Westpac Home and Contents Insurance Claim 2017-2026

What is the Westpac Home and Contents Insurance Claim

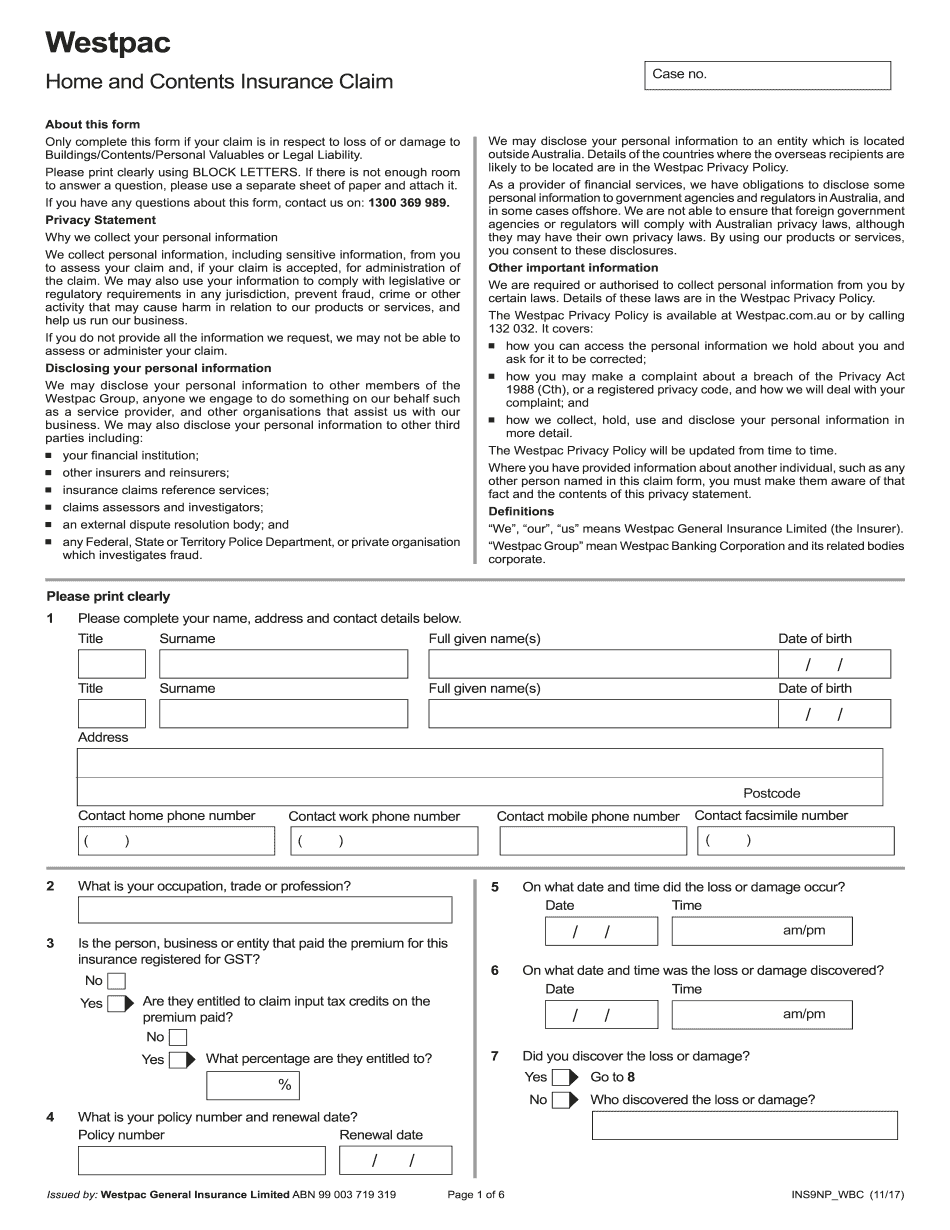

The Westpac home and contents insurance claim is a formal request made by policyholders to receive compensation for damages or losses covered under their insurance policy. This claim process is essential for individuals who have experienced incidents such as theft, fire, or natural disasters affecting their homes or personal belongings. The claim outlines the specifics of the loss, including the items affected and the estimated value of the damages. It is crucial for policyholders to understand the terms of their coverage to ensure they provide all necessary information when filing a claim.

Steps to Complete the Westpac Home and Contents Insurance Claim

Completing the Westpac home and contents insurance claim involves several key steps to ensure a smooth process. First, gather all relevant documentation, including photographs of the damage, receipts for lost or damaged items, and any police reports if applicable. Next, fill out the claim form accurately, detailing the nature of the loss and providing supporting evidence. Once the form is completed, submit it through the designated method, which may include online submission, mailing, or in-person delivery. Finally, keep a copy of the claim and any correspondence for your records.

Required Documents for the Westpac Home and Contents Insurance Claim

When filing a Westpac home and contents insurance claim, several documents are typically required to support the claim. These may include:

- Proof of ownership for lost or damaged items, such as receipts or photographs.

- A detailed list of items affected by the loss.

- Documentation of the incident, such as police reports or fire department reports.

- Any correspondence related to the claim process.

Having these documents ready can expedite the claims process and help ensure that the claim is processed efficiently.

How to Use the Westpac Home and Contents Insurance Claim

Using the Westpac home and contents insurance claim involves understanding the process and effectively communicating your situation. Begin by reviewing your insurance policy to confirm coverage details. Next, gather all necessary documentation and complete the claim form with precise information about the incident and the items affected. It is important to be thorough and honest in your description to avoid any delays in processing. After submission, monitor the status of your claim through the Westpac customer service channels to stay informed about any updates or additional requirements.

Legal Use of the Westpac Home and Contents Insurance Claim

The legal use of the Westpac home and contents insurance claim is governed by the terms outlined in the insurance policy. Policyholders must ensure that they comply with all legal requirements when filing a claim, including providing accurate information and documentation. Misrepresentation or failure to disclose relevant facts can lead to denial of the claim or potential legal consequences. Understanding the legal framework surrounding insurance claims can help policyholders navigate the process more effectively and protect their rights.

Filing Deadlines / Important Dates for the Westpac Home and Contents Insurance Claim

Filing deadlines for the Westpac home and contents insurance claim are critical to ensure that claims are processed in a timely manner. Typically, policyholders must submit their claims within a specified period following the incident, often ranging from a few days to several weeks, depending on the policy terms. It is important to check the specific deadlines outlined in your insurance policy to avoid missing the opportunity to file a claim. Keeping track of these important dates can help ensure that your claim is submitted on time and processed without unnecessary delays.

Quick guide on how to complete westpac home and contents insurance claim

Prepare Westpac Home And Contents Insurance Claim effortlessly on any device

Online document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Westpac Home And Contents Insurance Claim on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Westpac Home And Contents Insurance Claim seamlessly

- Find Westpac Home And Contents Insurance Claim and click Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searches, or errors requiring new document prints. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Westpac Home And Contents Insurance Claim and ensure excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct westpac home and contents insurance claim

Create this form in 5 minutes!

How to create an eSignature for the westpac home and contents insurance claim

The way to create an eSignature for a PDF document in the online mode

The way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is Westpac home insurance?

Westpac home insurance provides comprehensive coverage for your home and belongings against various risks such as theft, fire, and natural disasters. This insurance is designed to protect your investment and offer peace of mind to homeowners.

-

How much does Westpac home insurance cost?

The cost of Westpac home insurance varies based on factors such as the value of the property, location, and chosen coverage levels. To get an accurate quote, it's best to assess your specific needs through Westpac's online tools or consult with an agent.

-

What features are included in Westpac home insurance?

Westpac home insurance includes a range of features such as coverage for building and contents, optional extras like accidental damage, and 24/7 claims assistance. Additionally, policyholders may benefit from flexible payment options and discounts for eligible customers.

-

Are there any benefits to choosing Westpac home insurance?

Choosing Westpac home insurance comes with several benefits, including coverage for a wide range of risks, customizable policies, and support from a reputable financial institution. You can also take advantage of their extensive network and online management tools for easy policy oversight.

-

Can I customize my Westpac home insurance policy?

Yes, Westpac home insurance allows you to customize your policy based on your specific needs. You can choose different coverage levels, add optional extras, and adjust your premium to fit your budget and desired protection.

-

How do I file a claim with Westpac home insurance?

Filing a claim with Westpac home insurance is straightforward. You can submit a claim online through their website or call their claims support team for assistance. Make sure to have your policy details handy to expedite the process.

-

Is there a waiting period for Westpac home insurance coverage?

Generally, there is no waiting period for Westpac home insurance coverage once your policy is active. However, it's always important to review the specific terms and conditions of your policy for any unique stipulations regarding coverage commencement.

Get more for Westpac Home And Contents Insurance Claim

Find out other Westpac Home And Contents Insurance Claim

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease