Investment Only Retirement Accounts for Small Business 2020-2026

What is the investment only retirement account for small business?

An investment only retirement account is designed specifically for small business owners who want to offer retirement benefits without the complexities of traditional plans. This type of account allows employers to provide employees with a platform to invest their retirement savings in a variety of investment options, such as mutual funds or stocks, without managing the plan themselves. The primary goal is to simplify the retirement savings process while still adhering to legal requirements and providing employees with the ability to grow their investments over time.

Eligibility criteria for investment only retirement accounts

To qualify for an investment only retirement account, small business owners must meet specific criteria. Typically, these accounts are available to businesses with a certain number of employees, often ranging from one to a limited number, depending on the provider. Additionally, business owners must ensure that they comply with IRS regulations regarding contributions and withdrawals. Employees may also need to meet age and service requirements to participate in the plan.

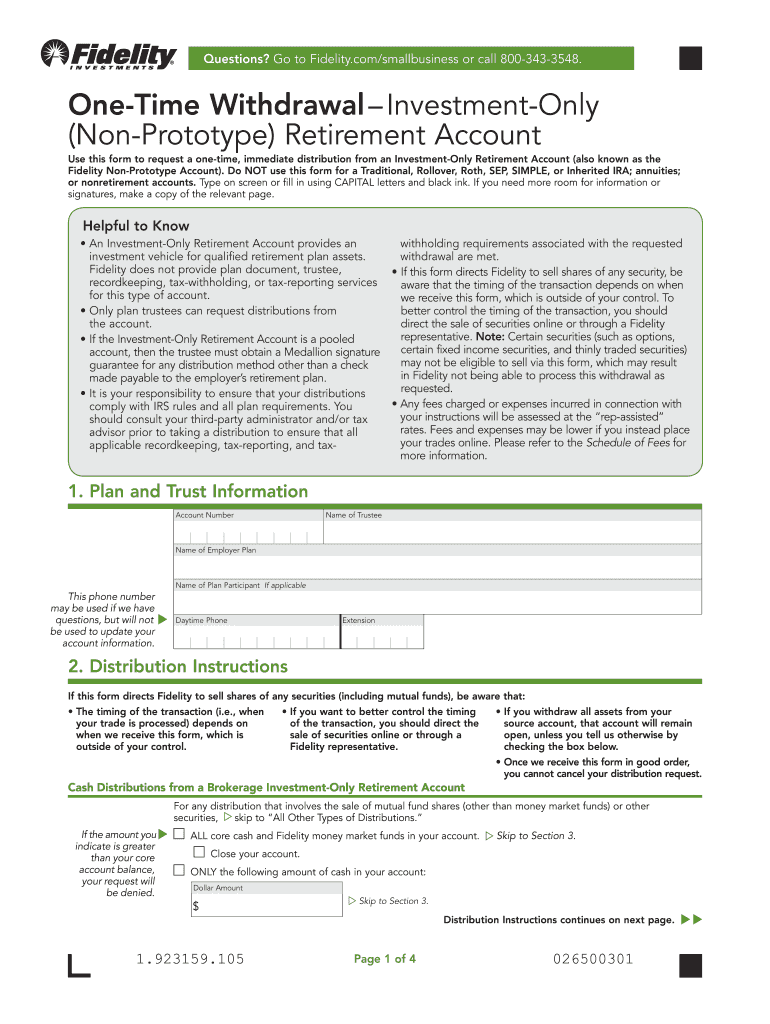

Steps to complete the investment only retirement account application

Completing the application for an investment only retirement account involves several key steps:

- Gather necessary documentation, including business identification and employee details.

- Choose an investment platform or provider that offers investment only retirement accounts.

- Fill out the application form provided by the chosen platform, ensuring all information is accurate.

- Submit the application either online or by mail, depending on the provider's requirements.

- Await confirmation of the account setup and any additional instructions for funding the account.

Required documents for investment only retirement accounts

When applying for an investment only retirement account, several documents are typically required:

- Employer identification number (EIN) for the business.

- Personal identification for the business owner, such as a driver's license or passport.

- Employee information, including names, social security numbers, and employment start dates.

- Any existing retirement plan documents, if applicable.

IRS guidelines for investment only retirement accounts

The IRS has established guidelines that govern the operation of investment only retirement accounts. These guidelines include contribution limits, withdrawal rules, and reporting requirements. Business owners must adhere to these regulations to ensure the account remains compliant and to avoid potential penalties. It is essential to stay informed about any changes in IRS regulations that may affect the account.

Form submission methods for investment only retirement accounts

Submitting the application for an investment only retirement account can typically be done through various methods:

- Online submission via the provider's website, which often allows for quicker processing.

- Mailing the completed application form to the provider's designated address.

- In-person submission at a local branch, if the provider has physical locations.

Quick guide on how to complete investment only retirement accounts for small business

Complete Investment Only Retirement Accounts For Small Business effortlessly on any device

Online document management has surged in popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly and without delays. Manage Investment Only Retirement Accounts For Small Business on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to adjust and eSign Investment Only Retirement Accounts For Small Business effortlessly

- Obtain Investment Only Retirement Accounts For Small Business and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important parts of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to missing or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you select. Edit and eSign Investment Only Retirement Accounts For Small Business and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct investment only retirement accounts for small business

Create this form in 5 minutes!

How to create an eSignature for the investment only retirement accounts for small business

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is a non prototype account in airSlate SignNow?

A non prototype account in airSlate SignNow is a standard user account that provides full access to our document signing and management features. Unlike prototype accounts, which are typically used for testing, non prototype accounts are meant for ongoing business purposes, ensuring seamless workflow and collaboration.

-

How much does a non prototype account cost?

The pricing for a non prototype account in airSlate SignNow varies based on the chosen plan. We offer several options tailored to different business needs, with competitive rates designed to deliver excellent value while supporting your document signing and workflow requirements.

-

What features are included with a non prototype account?

Non prototype accounts in airSlate SignNow come equipped with a variety of essential features such as document templates, eSignature capabilities, and real-time collaboration tools. These features are designed to streamline your processes and improve productivity without any complexity.

-

What are the benefits of using a non prototype account?

Using a non prototype account allows businesses to leverage advanced eSignature solutions, enhancing efficiency and reducing turnaround time for document approvals. It also provides a secure environment for managing sensitive information, making it an excellent choice for businesses of all sizes.

-

Can I integrate a non prototype account with other applications?

Yes, a non prototype account in airSlate SignNow supports integration with various third-party applications including CRM systems, cloud storage, and project management tools. This flexibility helps streamline workflows and enhances overall productivity by connecting your tools seamlessly.

-

Is there a free trial available for a non prototype account?

Yes, airSlate SignNow offers a free trial for users interested in exploring the features of a non prototype account. This allows prospective customers to test the platform's functionalities and understand how it can meet their document signing needs before committing to a subscription.

-

How does a non prototype account enhance document security?

A non prototype account in airSlate SignNow includes advanced security features such as encryption and multi-factor authentication to protect your documents. This ensures that sensitive information remains secure while allowing authorized users to access and sign documents with ease.

Get more for Investment Only Retirement Accounts For Small Business

- Florida neighborhood revitalization program florida department form

- Florida sales and use tax bapplicationb for release or refund of bb form

- Dr 600013 request for verification that customers are authorized to purchase for resale r0608 form

- This bapplicationb is for dealers who sell boats motor vehicles or bb form

- 411033 2009 form

- New dtf 95 2011 form

- Poa 1pdffillercom 2010 form

- Formupack tn sales and use tax return 2015

Find out other Investment Only Retirement Accounts For Small Business

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form