About Form 4419, Application for Filing Information Returns 2020-2026

Understanding Form 4419: Application for Filing Information Returns

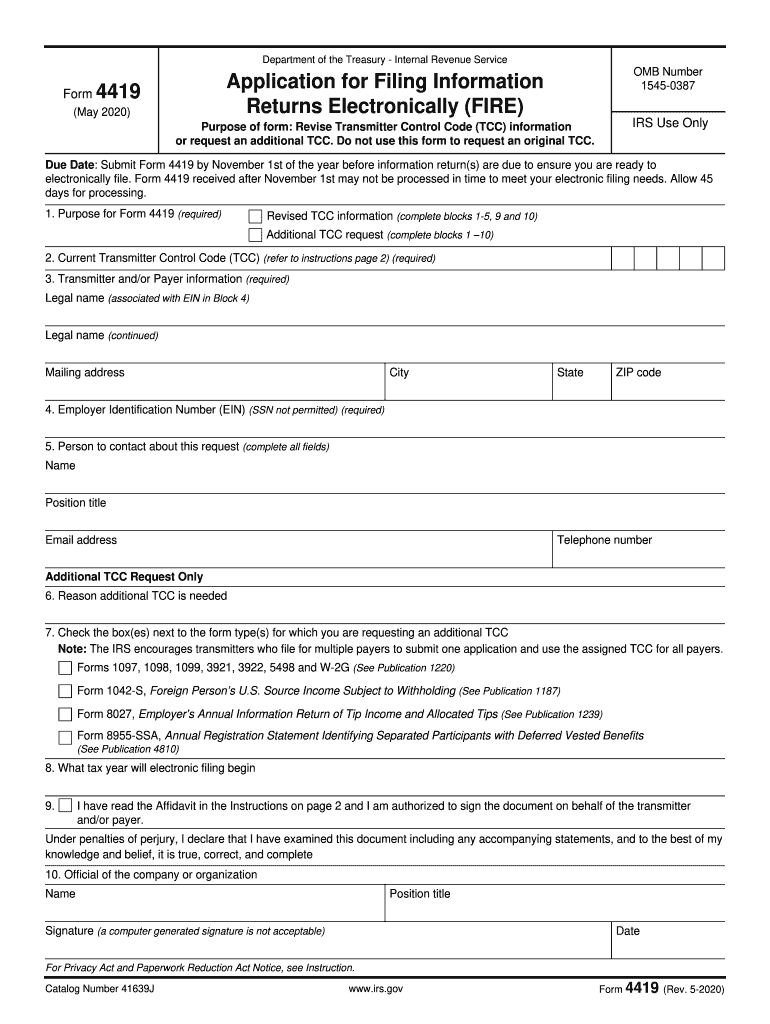

Form 4419 is a crucial document used by businesses and organizations to apply for filing information returns electronically with the Internal Revenue Service (IRS). This form enables filers to request a Transmitter Control Code (TCC), which is essential for submitting various forms electronically, such as Forms 1099 and W-2. Understanding the purpose of Form 4419 is vital for any entity looking to comply with IRS requirements and streamline their filing processes.

Steps to Complete Form 4419

Completing Form 4419 involves several important steps to ensure accurate submission. First, gather all necessary information, including the name of the business, Employer Identification Number (EIN), and contact details. Next, fill out the form accurately, ensuring that all fields are completed. Pay special attention to the section requesting the type of returns you plan to file electronically. Once completed, review the form for any errors before submission. Finally, submit the form to the IRS either electronically or via mail, depending on your preference.

Filing Deadlines for Form 4419

It is essential to be aware of the filing deadlines associated with Form 4419 to avoid penalties. Generally, Form 4419 should be submitted at least 45 days before the due date of the information returns you plan to file. This timeline allows the IRS adequate time to process your application and issue a TCC. Keep in mind that if you miss this deadline, you may have to file your returns on paper instead of electronically, which can be less efficient.

Legal Use of Form 4419

Form 4419 serves a legal purpose as it establishes the authority for businesses to file information returns electronically. By obtaining a TCC through this form, filers can ensure compliance with IRS regulations, which can help avoid potential legal issues related to improper filing. Additionally, electronic submissions are generally considered more secure and efficient, further supporting the legal validity of using Form 4419.

Required Documents for Form 4419 Submission

When preparing to submit Form 4419, certain documents and information are required. These include the business's legal name, Employer Identification Number (EIN), and the contact information of the person responsible for filing. It may also be helpful to have details about the types of returns you intend to file electronically. Having this information ready will facilitate a smoother application process.

Penalties for Non-Compliance with Form 4419 Requirements

Failure to comply with the requirements associated with Form 4419 can result in significant penalties. If a business does not obtain a TCC before filing information returns electronically, the IRS may impose fines. Additionally, submitting incorrect or incomplete information can lead to delays in processing and further complications. It is crucial for filers to adhere to all guidelines and deadlines to avoid these potential penalties.

Quick guide on how to complete about form 4419 application for filing information returns

Effortlessly Prepare About Form 4419, Application For Filing Information Returns on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without delays. Handle About Form 4419, Application For Filing Information Returns on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Effortless Ways to Edit and Electronically Sign About Form 4419, Application For Filing Information Returns

- Find About Form 4419, Application For Filing Information Returns and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the document or redact sensitive information using tools specifically offered by airSlate SignNow.

- Create your electronic signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors necessitating new copies. airSlate SignNow efficiently addresses your document management needs in just a few clicks from any device of your preference. Edit and electronically sign About Form 4419, Application For Filing Information Returns while ensuring exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 4419 application for filing information returns

Create this form in 5 minutes!

How to create an eSignature for the about form 4419 application for filing information returns

How to make an electronic signature for your PDF file online

How to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an eSignature for a PDF on Android devices

People also ask

-

What is Form 4419, Application For Filing Information Returns?

Form 4419, Application For Filing Information Returns, is a request submitted to the IRS for approval to file information returns electronically. This form is essential for businesses looking to comply with IRS regulations while ensuring accurate and efficient reporting of various information returns.

-

How does airSlate SignNow assist with Form 4419 applications?

airSlate SignNow simplifies the process of submitting Form 4419, Application For Filing Information Returns, by providing a user-friendly platform for eSigning and managing documents. Our solution allows users to create, send, and track their applications with ease, ensuring compliance with IRS requirements.

-

What are the benefits of filing Form 4419 electronically with airSlate SignNow?

Filing Form 4419, Application For Filing Information Returns, electronically through airSlate SignNow offers several benefits, including faster processing times and reduced risks of errors. Additionally, our platform provides a secure environment for document handling, enhancing your business's efficiency and accuracy in reporting.

-

Are there any costs associated with using airSlate SignNow for Form 4419?

Yes, while airSlate SignNow offers a cost-effective solution for eSigning and document management, there may be associated fees depending on your subscription plan. We recommend reviewing our pricing options to find the best fit for your needs when filing Form 4419, Application For Filing Information Returns.

-

Can I integrate airSlate SignNow with other software for filing Form 4419?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and business applications, enhancing your workflow when preparing and submitting Form 4419, Application For Filing Information Returns. This integration allows for streamlined data transfer and improved accuracy in your filings.

-

What features does airSlate SignNow offer for managing Form 4419 submissions?

airSlate SignNow includes features such as templates for Form 4419, Application For Filing Information Returns, customized workflows, and real-time tracking. These tools help ensure that your submissions are completed correctly and on time, minimizing the chances of delays or rejections.

-

How can I ensure compliance when using airSlate SignNow for Form 4419?

To ensure compliance with IRS regulations while using airSlate SignNow for Form 4419, Application For Filing Information Returns, it’s important to stay updated on the latest requirements. Our platform provides guidance and resources to help you avoid common pitfalls and adhere to necessary filing protocols.

Get more for About Form 4419, Application For Filing Information Returns

- Ae form 190 16a 2009 2019

- Form st 10010 i1215quarterly schedule fr instructions sales and use tax on quailifed motor fuel and diesel motor fuel st10010i

- Illinois llc 5025 2015 2019 form

- 2018 i 016a schedule h ampamp h ez instructions wisconsin homestead credit schedule h ampamp h ez instructions form

- What is a business partner number florida 2018 2019 form

- Rt 8a information sheet

- Ds 1812 form

- Cbt 100s form 2017 s corporation business tax return cbt 100s form 2017 s corporation business tax return 448096543

Find out other About Form 4419, Application For Filing Information Returns

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF