Llc 1 Online Fillaqble Forms

Understanding the LLC 1 Form

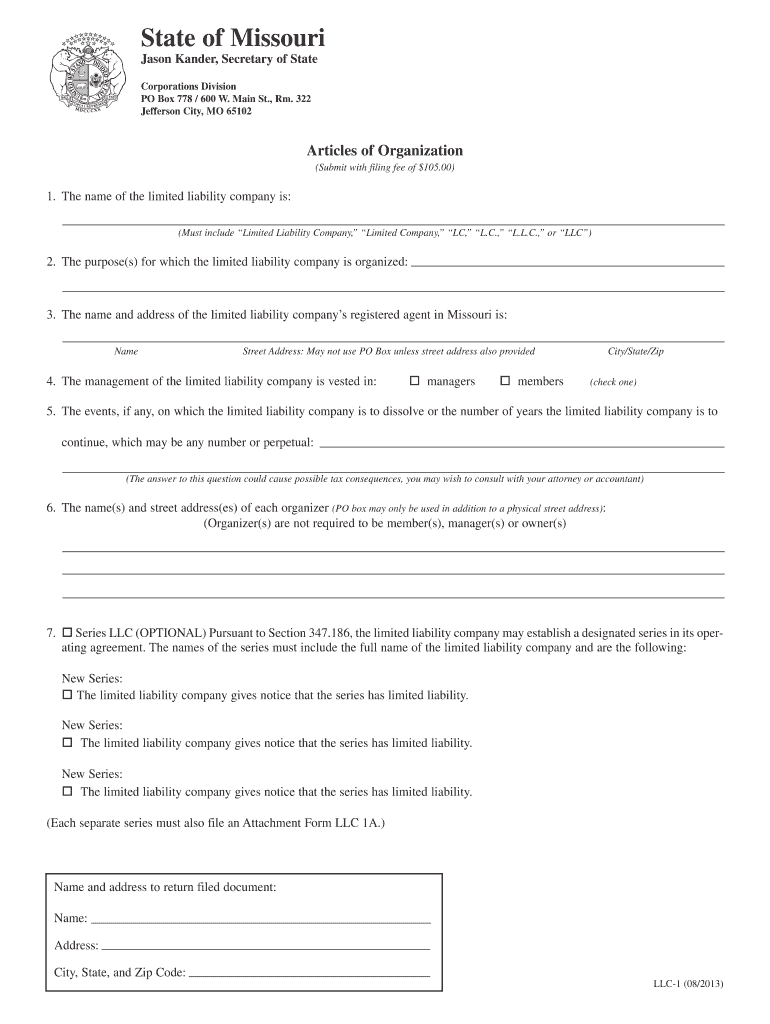

The LLC 1 form is a crucial document for businesses looking to establish a Limited Liability Company (LLC) in the United States. This form serves as the Articles of Organization, which is necessary for formally registering the LLC with the state. It outlines essential information about the business, including its name, address, and the names of its members or managers. Properly completing the LLC 1 form is vital for ensuring legal compliance and protecting the owners' personal assets from business liabilities.

Steps to Complete the LLC 1 Form

Filling out the LLC 1 form requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Gather necessary information: Collect details such as the LLC's name, address, and the names of members or managers.

- Choose a registered agent: Designate a registered agent who will receive legal documents on behalf of the LLC.

- Complete the form: Fill in all required fields accurately, ensuring compliance with state-specific regulations.

- Review the form: Double-check for errors or omissions before submission.

- Submit the form: File the completed LLC 1 form with the appropriate state agency, either online or via mail.

Legal Use of the LLC 1 Form

The LLC 1 form is legally binding once filed with the state. It must meet specific requirements to ensure its validity. This includes adhering to state regulations regarding naming conventions and providing accurate information about the business structure. Failure to comply with these legal standards may result in delays or rejection of the application, which could hinder the establishment of the LLC.

State-Specific Rules for the LLC 1 Form

Each state in the U.S. has its own rules and regulations governing the LLC 1 form. It is essential to familiarize yourself with the specific requirements of the state where the LLC will be registered. This may include variations in filing fees, processing times, and additional documentation that may be required. Understanding these nuances can help streamline the registration process and ensure compliance with local laws.

Form Submission Methods

The LLC 1 form can typically be submitted through various methods, depending on the state. Common submission options include:

- Online submission: Many states offer an online portal for filing the LLC 1 form, which can expedite the process.

- Mail submission: Alternatively, the form can be printed and mailed to the appropriate state agency.

- In-person submission: Some states allow for in-person filing at designated offices, providing immediate confirmation of submission.

Required Documents for LLC 1 Form Submission

When submitting the LLC 1 form, certain documents may be required to accompany the application. These can include:

- Operating Agreement: While not always mandatory, it is advisable to have an operating agreement outlining the management structure and operating procedures of the LLC.

- Identification: Personal identification of the members or managers may be required, especially for online submissions.

- Payment: A filing fee is typically required, which varies by state.

Quick guide on how to complete llc 1 online fillaqble forms

Effortlessly prepare Llc 1 Online Fillaqble Forms on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Llc 1 Online Fillaqble Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to edit and electronically sign Llc 1 Online Fillaqble Forms with ease

- Obtain Llc 1 Online Fillaqble Forms and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then select the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Llc 1 Online Fillaqble Forms to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I correctly fill out a W9 tax form as a single member LLC?

If your SMLLC is a sole proprietorship/disregarded entity, then you put your name in the name box and not the name of the LLC. You check the box for individual/sole proprietor not LLC.If the SMLLC is an S or C corp then check the box for LLC and write in the appropriate classification. In that case you would put the name of the LLC in the name box.

-

What tax form do I need to fill out to convert from single member LLC to multi-member LLC?

When you add a member to your previously single member LLC (which you can do structurally by amending your operating agreement and filing an amended report, if required, with your secretary of state), you cease to be a 'disregarded entity' under the applicable Treasury Regulations.Going forward, you will either be a (a) partnership, by default, and will have to file a partnership income tax return on Form 1065, or (b) a corporation, if you so elect, and will have to file a Form 1120 if you are a C corporation or Form 1120S if you elect to be taxed as an S corporation.There can be other tax issues as well, and these need to be addressed with a business CPA.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

Create this form in 5 minutes!

How to create an eSignature for the llc 1 online fillaqble forms

How to make an eSignature for the Llc 1 Online Fillaqble Forms online

How to make an eSignature for your Llc 1 Online Fillaqble Forms in Chrome

How to make an electronic signature for putting it on the Llc 1 Online Fillaqble Forms in Gmail

How to generate an eSignature for the Llc 1 Online Fillaqble Forms right from your smart phone

How to generate an electronic signature for the Llc 1 Online Fillaqble Forms on iOS devices

How to make an eSignature for the Llc 1 Online Fillaqble Forms on Android

People also ask

-

What is form llc1 and how do I complete it using airSlate SignNow?

Form llc1 is a form used to register a limited liability company (LLC) in certain states. Using airSlate SignNow, you can easily fill out and eSign this document online, ensuring a smooth filing process. Our platform simplifies the completion and submission of form llc1 with user-friendly tools.

-

What are the costs associated with using airSlate SignNow to file form llc1?

airSlate SignNow offers various pricing plans that cater to different business needs. The cost to use the service for filing form llc1 is typically minimal compared to traditional methods. Sign up for a free trial to explore our features and see how cost-effective it can be.

-

Are there any special features available for completing form llc1?

Yes, airSlate SignNow provides several features that enhance the process of completing form llc1, including templates, document sharing, and real-time notifications. Our intuitive interface allows for easy collaboration among team members, ensuring that your form llc1 is accurate and submitted on time.

-

Can airSlate SignNow help me track the status of my filed form llc1?

Absolutely! airSlate SignNow allows you to track the status of your filed form llc1 after submission. You can receive updates and confirmations directly through our platform, providing peace of mind during the registration process.

-

Does airSlate SignNow integrate with other tools I use for business?

Yes, airSlate SignNow seamlessly integrates with various business tools and applications, enhancing your workflow. This compatibility means you can easily incorporate the eSigning process of form llc1 into your existing systems, improving efficiency and saving time.

-

What are the benefits of using airSlate SignNow for form llc1?

Using airSlate SignNow for form llc1 offers signNow benefits such as reduced manual work, increased accuracy, and faster processing times. Our platform helps ensure compliance and security, making the process hassle-free. You can also eSign documents from anywhere, streamlining your operations.

-

Is airSlate SignNow secure for filing sensitive documents like form llc1?

Yes, airSlate SignNow prioritizes the security of your documents, including sensitive files like form llc1. We use advanced encryption and secure storage practices to protect your data, ensuring that your LLC registration information remains confidential.

Get more for Llc 1 Online Fillaqble Forms

- Application and contract state and local 2018 final 2docx form

- Download application camp lohikan form

- Job tag name form

- Dealership name checks will be payable to the above form

- Kullakutse viisakutse form

- Lifeamp39s events narfe form

- Absentee ballot 2018 2019 form

- Lindsey wilson college football ticket form 2017

Find out other Llc 1 Online Fillaqble Forms

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free