Multistate Fixed Rate Note Single Family Fannie Mae Freddie Mac Uniform Instrument 2001-2026

What is the Multistate Fixed Rate Note?

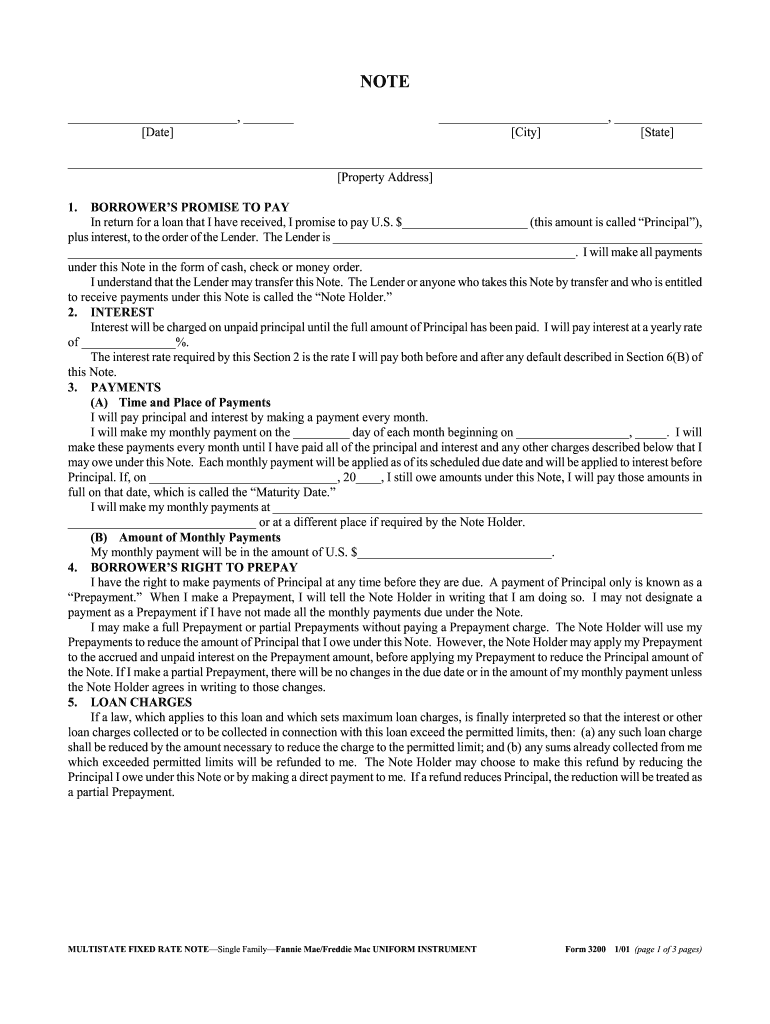

The Multistate Fixed Rate Note, commonly referred to as the Fannie Mae promissory note, is a standardized legal document used in the mortgage lending process. This instrument outlines the terms of a loan, including the borrower's promise to repay the lender under specific conditions. It is widely recognized and utilized across various states in the U.S., ensuring consistency in mortgage agreements. The note serves as a binding contract that details the loan amount, interest rate, payment schedule, and other critical terms necessary for both parties involved.

Key Elements of the Multistate Fixed Rate Note

Understanding the key elements of the Fannie Mae form 3200 is essential for both borrowers and lenders. The document typically includes:

- Loan Amount: The total sum borrowed by the borrower.

- Interest Rate: The fixed rate at which interest will accrue on the borrowed amount.

- Payment Schedule: Details on how often payments are due, including the frequency and amount.

- Late Fees: Information on penalties for late payments.

- Prepayment Penalties: Terms regarding any fees associated with paying off the loan early.

Steps to Complete the Multistate Fixed Rate Note

Completing the Fannie Mae promissory note involves several important steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect personal and financial details, including the loan amount and borrower information.

- Fill Out the Form: Carefully enter the required information into the note, ensuring all fields are completed accurately.

- Review the Document: Double-check all entries for accuracy and completeness to avoid future complications.

- Sign the Document: The borrower must sign the note in the designated areas, ensuring that all signature lines are properly executed.

- Store Securely: Keep a copy of the signed note in a safe place for future reference.

Legal Use of the Multistate Fixed Rate Note

The legal use of the Fannie Mae form 3200 is governed by federal and state laws. This document must meet specific legal standards to be considered valid. Key aspects include:

- Compliance with ESIGN and UETA: The note must adhere to electronic signature laws to ensure its validity in digital formats.

- Proper Execution: All parties must sign the document where indicated, and any witnesses or notarization should be completed as required by state law.

Digital vs. Paper Version of the Multistate Fixed Rate Note

Both digital and paper versions of the Fannie Mae promissory note are legally valid, provided they meet the necessary legal requirements. Digital versions offer advantages such as:

- Convenience: Easier to complete and sign from anywhere.

- Security: Enhanced security features, including encryption and audit trails.

- Storage: Simplified storage and retrieval compared to physical documents.

How to Obtain the Multistate Fixed Rate Note

Obtaining the Fannie Mae form 3200 can be done through various channels. Typically, lenders provide this document as part of the mortgage application process. It can also be accessed through official Fannie Mae resources or legal document services. Ensure that you are using the most current version to comply with any updates or changes in legal requirements.

Quick guide on how to complete multistate fixed rate note single family fannie mae freddie mac uniform instrument

Complete Multistate Fixed Rate Note Single Family Fannie Mae Freddie Mac Uniform Instrument effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb environmentally friendly alternative to traditional printed and signed papers, as you can easily find the desired template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Manage Multistate Fixed Rate Note Single Family Fannie Mae Freddie Mac Uniform Instrument on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest way to adjust and electronically sign Multistate Fixed Rate Note Single Family Fannie Mae Freddie Mac Uniform Instrument with minimal effort

- Find Multistate Fixed Rate Note Single Family Fannie Mae Freddie Mac Uniform Instrument and then click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Alter and electronically sign Multistate Fixed Rate Note Single Family Fannie Mae Freddie Mac Uniform Instrument and guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the multistate fixed rate note single family fannie mae freddie mac uniform instrument

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is a Fannie Mae promissory note?

A Fannie Mae promissory note is a legal document that outlines the borrower's commitment to repay a loan to Fannie Mae. This document details the loan terms, including the principal amount, interest rate, and repayment schedule. Using airSlate SignNow, businesses can easily prepare and manage these documents, ensuring a streamlined process.

-

How can airSlate SignNow help with Fannie Mae promissory notes?

AirSlate SignNow offers a user-friendly platform to create, send, and eSign Fannie Mae promissory notes efficiently. With its robust features, businesses can expedite the document workflow, reducing the time spent on traditional paper processes. This ultimately enhances productivity while ensuring compliance with loan requirements.

-

Is airSlate SignNow cost-effective for managing Fannie Mae promissory notes?

Yes, airSlate SignNow provides a cost-effective solution for managing Fannie Mae promissory notes. With flexible pricing plans, businesses can choose options that fit their budget while gaining access to essential eSigning features. This helps companies save both time and money in their document management.

-

What features does airSlate SignNow offer for Fannie Mae promissory notes?

AirSlate SignNow includes several features essential for handling Fannie Mae promissory notes, such as customizable templates, secure eSigning, and in-app collaboration tools. These features allow teams to work together seamlessly and ensure that all necessary details are captured correctly. Additionally, the platform provides real-time tracking for document status.

-

Can I integrate airSlate SignNow with other tools for processing Fannie Mae promissory notes?

Absolutely! AirSlate SignNow integrates with numerous CRM and project management tools to streamline the process of creating and managing Fannie Mae promissory notes. This integration ensures that your workflows remain efficient and organized, allowing for better tracking and management of related documents.

-

How secure is airSlate SignNow for handling Fannie Mae promissory notes?

AirSlate SignNow prioritizes security, especially when handling sensitive documents like Fannie Mae promissory notes. With industry-standard encryption, secure cloud storage, and compliance with regulations, users can trust that their documents are protected throughout the signing and management process.

-

What are the benefits of using airSlate SignNow for Fannie Mae promissory notes?

Using airSlate SignNow for Fannie Mae promissory notes offers several benefits, including faster turnaround times, reduced paper clutter, and increased efficiency in document handling. The platform's user-friendly interface makes it easy for everyone to create and sign documents, enhancing collaboration and satisfaction among stakeholders.

Get more for Multistate Fixed Rate Note Single Family Fannie Mae Freddie Mac Uniform Instrument

Find out other Multistate Fixed Rate Note Single Family Fannie Mae Freddie Mac Uniform Instrument

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement