Irs Form 5498 2013-2026

What is the IRS Form 5498?

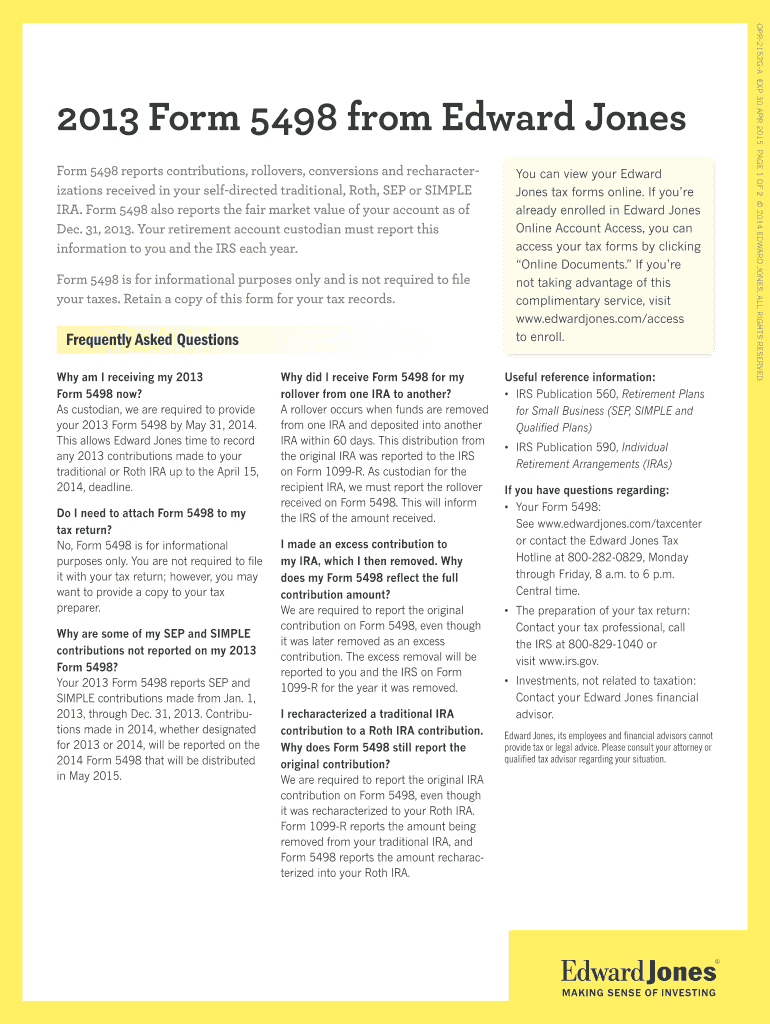

The IRS Form 5498 is an important tax document used to report contributions to individual retirement accounts (IRAs), including traditional IRAs, Roth IRAs, and SEP IRAs. This form is issued by financial institutions, such as Edward Jones, to the IRS and the account holder. It provides crucial information regarding the contributions made during the tax year, the fair market value of the account, and any rollovers or conversions that occurred. Understanding the details on the form is essential for accurate tax reporting and compliance with IRS regulations.

How to Obtain the IRS Form 5498

To obtain the IRS Form 5498, account holders typically receive it from their financial institution, such as Edward Jones. The form is usually mailed to account holders by May 31 of the year following the tax year in which contributions were made. If you do not receive your form, you can contact your financial institution directly to request a copy. Additionally, some institutions may provide electronic access to the form through their online platforms, allowing you to download it directly.

Steps to Complete the IRS Form 5498

Completing the IRS Form 5498 involves several key steps. First, gather all relevant information regarding your IRA contributions for the tax year. This includes details on the amounts contributed, any rollovers, and the fair market value of your account as of December 31. Next, accurately fill in the form, ensuring that all figures are correct and reflect your financial records. Finally, submit the completed form to the IRS, if required, and retain a copy for your records. It is important to review the form for accuracy to avoid potential issues with the IRS.

Legal Use of the IRS Form 5498

The IRS Form 5498 serves a legal purpose by documenting contributions to retirement accounts, which can affect your tax liability. It is essential for ensuring compliance with IRS regulations regarding retirement savings. The form must be completed accurately and submitted in accordance with IRS guidelines. Failure to report contributions correctly can lead to penalties or issues during tax filing. Understanding the legal implications of the form helps account holders maintain compliance and avoid complications.

Key Elements of the IRS Form 5498

Key elements of the IRS Form 5498 include the following:

- Contributions: Total contributions made to the IRA during the tax year.

- Rollover amounts: Any funds transferred from another retirement account.

- Fair market value: The value of the account as of December 31 of the tax year.

- Type of account: Indicates whether the account is a traditional IRA, Roth IRA, or SEP IRA.

- Required minimum distributions (RMDs): Information regarding any distributions that must be taken if applicable.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Form 5498 are crucial for compliance. Financial institutions must provide the form to account holders by May 31 of the year following the tax year. While individual taxpayers do not need to file Form 5498 with their tax returns, they should retain it for their records. It is important to be aware of these dates to ensure that all contributions and rollovers are accurately reported and documented for tax purposes.

Quick guide on how to complete irs form 5498

Complete Irs Form 5498 effortlessly on any device

Digital document management has become popular among organizations and individuals. It offers an ideal eco-friendly replacement for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs Form 5498 on any device using airSlate SignNow Android or iOS applications and simplify any document-focused operation today.

The easiest way to modify and eSign Irs Form 5498 seamlessly

- Locate Irs Form 5498 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, laborious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from a device of your preference. Alter and eSign Irs Form 5498 and guarantee outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 5498

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is IRS Form 5498 and why do I need it?

IRS Form 5498 is an informational tax form used to report contributions to Individual Retirement Accounts (IRAs). You need it to verify contributions and rollovers made to IRAs, which can impact your tax liability. Ensuring you have this form filed correctly is crucial for your financial records.

-

How can airSlate SignNow help me manage IRS Form 5498?

With airSlate SignNow, you can easily create, send, and eSign IRS Form 5498 digitally. Our platform streamlines the documentation process, ensuring that your forms are filled out correctly and submitted on time, making tax season less stressful for you.

-

Is there a cost associated with using airSlate SignNow for IRS Form 5498?

airSlate SignNow offers a range of pricing plans to suit different business needs. While there are costs associated with our services, the investment can save you time and reduce errors when handling IRS Form 5498, ultimately enhancing your efficiency.

-

Can I integrate airSlate SignNow with my accounting software for IRS Form 5498?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, making it easier to manage IRS Form 5498 alongside your other financial documents. This integration helps keep your records organized and accessible.

-

What features does airSlate SignNow offer for eSigning IRS Form 5498?

airSlate SignNow provides a user-friendly interface for eSigning IRS Form 5498, with features like templates, reminders, and secure storage. These tools ensure that you can manage your forms efficiently while maintaining compliance with IRS requirements.

-

How secure is my information when using airSlate SignNow for IRS Form 5498?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your information when preparing and submitting IRS Form 5498, ensuring your sensitive data remains confidential.

-

Can I track the status of my IRS Form 5498 with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your IRS Form 5498 in real-time. You'll receive notifications when your forms are viewed, signed, and completed, giving you peace of mind throughout the process.

Get more for Irs Form 5498

Find out other Irs Form 5498

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure