Independent Contractor Worksheet 2008-2026

What is the Independent Contractor Worksheet

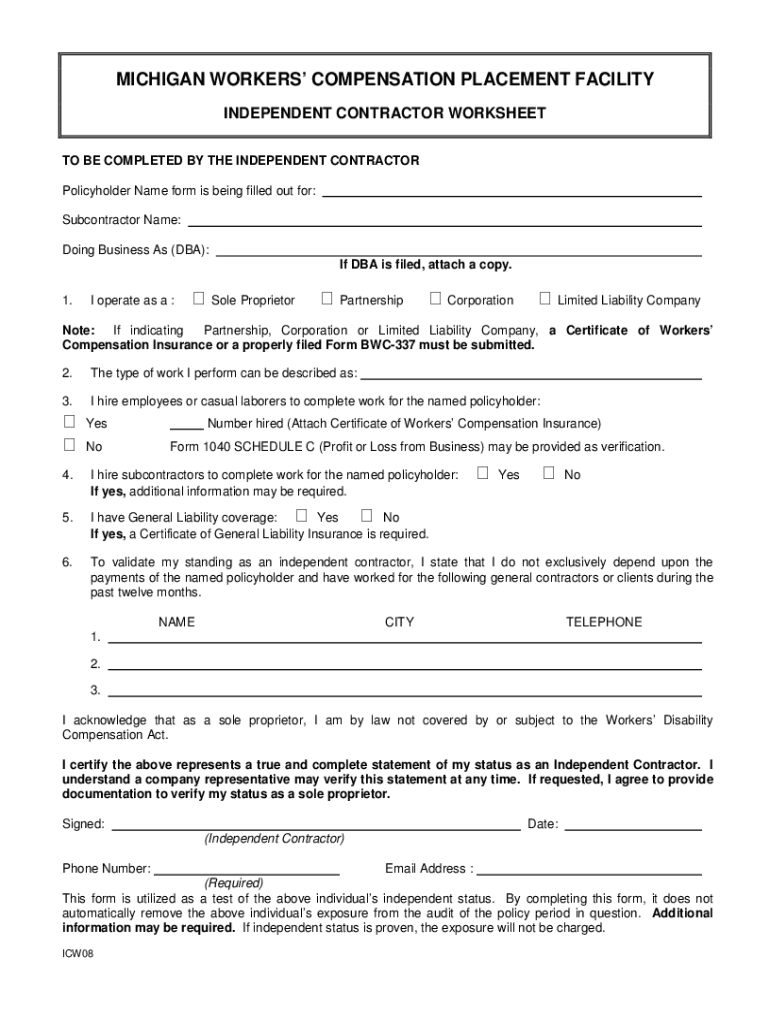

The Independent Contractor Worksheet is a vital document used to gather essential information about individuals or entities providing services as independent contractors. This form helps businesses determine the correct classification of workers, ensuring compliance with tax regulations and labor laws. It typically includes details such as the contractor's name, address, Social Security number or Employer Identification Number (EIN), and the nature of the services performed. Properly completing this worksheet is crucial for accurate tax reporting and avoiding potential penalties.

Steps to Complete the Independent Contractor Worksheet

Completing the Independent Contractor Worksheet involves several straightforward steps to ensure all necessary information is accurately captured. Begin by entering the contractor's personal and business information, including their legal name and contact details. Next, specify the type of services provided and the duration of the contract. It is also essential to include payment terms, such as the rate and frequency of payments. Finally, review the completed worksheet for accuracy before submission to ensure compliance with IRS guidelines.

Legal Use of the Independent Contractor Worksheet

The Independent Contractor Worksheet serves a legal purpose by providing documentation that supports the classification of a worker as an independent contractor rather than an employee. This classification is significant for tax purposes, as it affects withholding obligations and eligibility for benefits. To ensure the worksheet is legally valid, it must be completed accurately and retained for record-keeping. Additionally, businesses should familiarize themselves with relevant state and federal laws governing independent contractor relationships to maintain compliance.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the classification of independent contractors. According to IRS criteria, a worker's status depends on the degree of control the business has over them and the nature of their work relationship. The IRS emphasizes the importance of proper documentation, including the Independent Contractor Worksheet, to substantiate the classification. Businesses should refer to IRS publications, such as Publication 15-A, for detailed information on the tax implications and responsibilities associated with independent contractors.

Required Documents

When completing the Independent Contractor Worksheet, several documents may be required to support the information provided. These typically include the contractor's W-9 form, which verifies their taxpayer identification number, and any contracts or agreements outlining the terms of service. Additionally, businesses may need to gather proof of the contractor's qualifications or certifications relevant to the services being provided. Collecting and organizing these documents ensures compliance and facilitates smooth processing of payments.

Form Submission Methods

The Independent Contractor Worksheet can be submitted through various methods, depending on the preferences of the business and the contractor. Common submission methods include electronic submission via email or secure online platforms, which offer efficiency and convenience. Alternatively, businesses may choose to submit the form by mail or in-person at their offices. Regardless of the method chosen, it is essential to keep a copy of the submitted worksheet for record-keeping and compliance purposes.

State-Specific Rules for the Independent Contractor Worksheet

Different states may have unique regulations governing the classification and treatment of independent contractors. It is important for businesses to be aware of these state-specific rules when using the Independent Contractor Worksheet. For instance, some states may require additional documentation or impose different criteria for classification. Staying informed about local labor laws ensures that businesses maintain compliance and avoid potential legal issues related to worker classification.

Quick guide on how to complete independent contractor worksheet

Complete Independent Contractor Worksheet effortlessly on any gadget

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Handle Independent Contractor Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-based activity today.

The easiest method to modify and eSign Independent Contractor Worksheet without difficulty

- Obtain Independent Contractor Worksheet and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiring form searches, or errors that necessitate reprinting new copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you prefer. Modify and eSign Independent Contractor Worksheet and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the independent contractor worksheet

The best way to create an eSignature for a PDF document online

The best way to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to generate an electronic signature straight from your smart phone

The way to generate an eSignature for a PDF document on iOS

The way to generate an electronic signature for a PDF document on Android OS

People also ask

-

What is an Independent Contractor Worksheet and how can it help my business?

An Independent Contractor Worksheet is a vital tool for businesses that engage independent contractors. It allows you to gather essential information, track payments, and ensure compliance with tax regulations. By using an Independent Contractor Worksheet, you can streamline your contractor management process and maintain organized records.

-

How does airSlate SignNow facilitate filling out an Independent Contractor Worksheet?

With airSlate SignNow, you can easily create, send, and eSign your Independent Contractor Worksheet. Our intuitive platform enables users to fill out forms online, ensuring that all necessary information is captured accurately. This not only saves time but also reduces the risk of errors in the documentation process.

-

What are the pricing options for using airSlate SignNow for Independent Contractor Worksheets?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you're a small startup or a larger organization, our cost-effective solutions allow you to manage your Independent Contractor Worksheets without breaking the bank. Visit our pricing page for detailed information on the plans available.

-

Can I integrate airSlate SignNow with other tools for managing Independent Contractor Worksheets?

Yes, airSlate SignNow seamlessly integrates with various business applications, enhancing your workflow for managing Independent Contractor Worksheets. You can connect it with CRM systems, accounting software, and more to ensure all your contractor data is synchronized and easily accessible.

-

What features does airSlate SignNow offer for Independent Contractor Worksheets?

airSlate SignNow provides a range of features designed to simplify the management of Independent Contractor Worksheets. These include customizable templates, electronic signatures, secure document storage, and automated reminders, ensuring you have a comprehensive solution for contractor management.

-

Is it secure to use airSlate SignNow for Independent Contractor Worksheets?

Absolutely! airSlate SignNow prioritizes the security of your documents, including Independent Contractor Worksheets. We utilize industry-standard encryption and comply with data protection regulations to ensure that your sensitive information remains safe throughout the signing process.

-

How can airSlate SignNow improve the efficiency of processing Independent Contractor Worksheets?

By using airSlate SignNow, you can signNowly improve the efficiency of processing Independent Contractor Worksheets. Our platform automates workflows, reduces manual tasks, and accelerates the signing process, allowing you to focus on what matters most—growing your business.

Get more for Independent Contractor Worksheet

Find out other Independent Contractor Worksheet

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT