Money Earning 2007-2026

What is the Money Earning

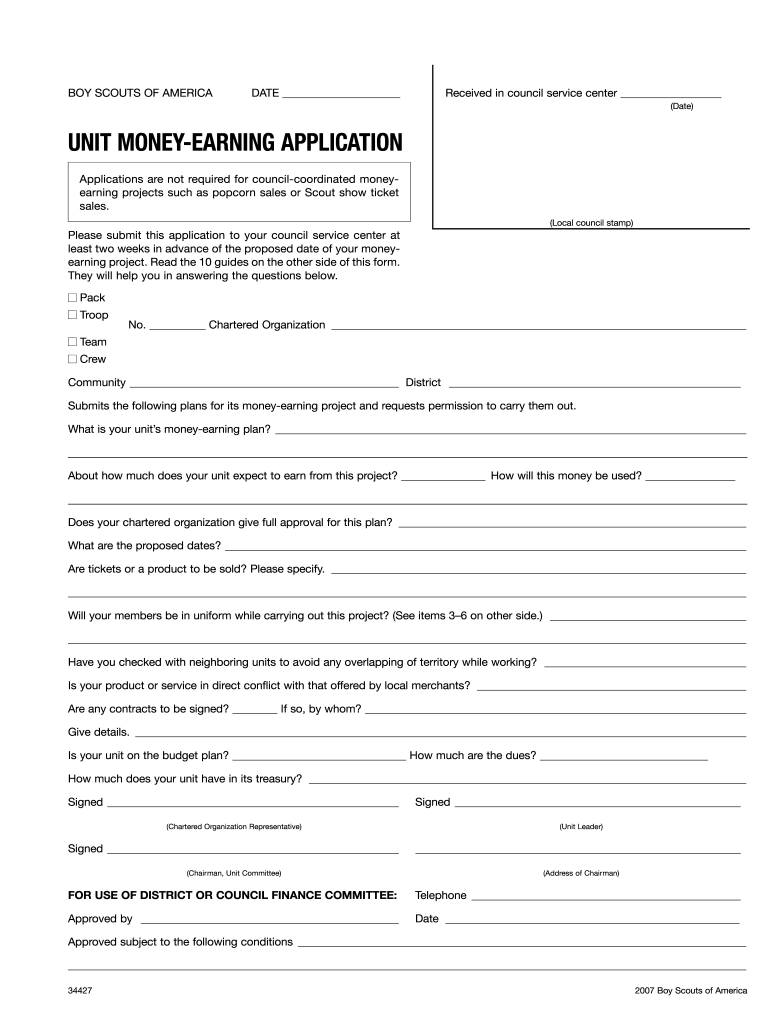

The money earning application is a crucial document used by various organizations, especially in the context of fundraising and financial management. It serves to track and report the funds raised through activities such as events or sales. This application is often utilized by units within organizations like the Boy Scouts of America (BSA) to ensure transparency and accountability in their financial dealings. Completing this form accurately is essential for maintaining compliance with organizational policies and regulations.

How to use the Money Earning

Using the money earning application involves several steps to ensure that all necessary information is captured correctly. First, gather all relevant details about the fundraising activity, including the purpose, expected revenue, and any associated costs. Next, fill out the application form, providing clear and concise information. Once completed, the form should be submitted to the appropriate authority within your organization for approval. Maintaining a copy of the submitted application is advisable for your records.

Steps to complete the Money Earning

Completing the money earning application requires careful attention to detail. Follow these steps for a smooth process:

- Identify the fundraising activity and its objectives.

- Gather necessary documentation, such as budgets and projected earnings.

- Fill out the application form, ensuring all fields are completed accurately.

- Review the form for any errors or missing information.

- Submit the application to the designated authority for approval.

Legal use of the Money Earning

Legal compliance is vital when using the money earning application. Organizations must adhere to relevant regulations, including those set forth by the IRS and state laws. This ensures that all fundraising activities are conducted within the legal framework, protecting both the organization and its members. It is important to familiarize yourself with these regulations to avoid potential penalties or legal issues.

Key elements of the Money Earning

Understanding the key elements of the money earning application is essential for effective use. Important components typically include:

- The purpose of the fundraising activity.

- Projected income and expenses associated with the activity.

- Details about the organization or unit conducting the fundraising.

- Approval signatures from relevant authorities.

Eligibility Criteria

Eligibility to use the money earning application often depends on the specific organization and its guidelines. Generally, members of the organization who are involved in fundraising activities are eligible to complete this form. It is advisable to check with your unit or organization for any specific criteria or requirements that must be met to ensure compliance.

Quick guide on how to complete earning form

Explore how to seamlessly navigate the Money Earning completion with this simple guide

Electronic filing and signNowing of documents are gaining traction and becoming the preferred option for many users. It provides numerous advantages over outdated printed documents, including convenience, efficiency, enhanced accuracy, and security.

With platforms like airSlate SignNow, you can find, modify, sign, enhance, and transmit your Money Earning without the hassle of repetitive printing and scanning. Follow this brief tutorial to initiate and finalize your form.

Utilize these instructions to obtain and complete Money Earning

- Begin by clicking on the Get Form button to access your document in our editor.

- Observe the green indicator on the left that highlights required fields so you don’t overlook them.

- Employ our advanced features to annotate, modify, sign, secure, and improve your document.

- Secure your document or change it into a fillable form using the appropriate tab features.

- Review the document and look for mistakes or inconsistencies.

- Click DONE to complete your edits.

- Rename your form or leave it as is.

- Select the storage service you wish to use for your document, send it via USPS, or click the Download Now button to save your file.

If Money Earning isn’t what you were looking for, you can browse our extensive selection of pre-uploaded forms that you can fill out with ease. Try our service today!

Create this form in 5 minutes or less

FAQs

-

How can I pay taxes on cryptocurrency earnings in India? Which ITR form should be filled out, and how should I do that? If I reinvest the earnings into tax saving funds, will it still be taxable?

The IT department has notified that gains on Bitcoins will be taxable, however, I think that there will be no separate forms to be filled out.It could be taxed under the head “Capital Gains”, and thus be included in the total income.Income and Deductions are two separate things. You can claim deductions on account of investment in tax savings funds, but you can’t change the taxability of gains on Bitcoins.This is what will happen - You will have to add up Gains from Bitcoin to the Head “Capital Gains”. Then show the deduction of tax saving fund from the Total Income.Note - This is not a professional opinion and I cannot be held liable for correctness of such opinion in a court of law.

-

If you work for yourself doing government contracts and American Express asks for you to show them a current pay stub, how would you provide that? Is there a form that has an earnings statement that you can fill out yourself?

It seems to me you should just ask American Express if they have form you can fill out. It seems odd they would want to see an earnings statement, but if you need to show some sort of proof of income, typically in the absence of a pay stub, your most recently-filed tax return should suffice.I'd really ask them first before automatically sending them your tax returns though.

-

What could a 20-year-old do to potentially improve their quality of life?

Take a 10-30 minutes walk every day. Sit in silence for at least 10 minutes each day. Sleep for 7 hours. Live with the 3 E’s — Energy, Enthusiasm, and Empathy. Play more games. Read more books than you did the previous year. Spend time with people over the age of 70 & under the age of 6. Dream more while you are awake. Eat more foods that grow on trees and plants and eat less food that is manufactured in plants. Drink plenty of water. Smile and laugh more. Don’t waste your precious energy or time on gossip. Forget issues of the past. They’ll just ruin your present happiness. Don’t have negative thoughts or things you cannot control. Instead invest your energy in the positive present moment. Realize that life is a school and you are here to learn. Problems are simply part of the curriculum that appear and fade away like algebra class but the lessons you learn will last a lifetime. Eat breakfast like a king, lunch like a prince and dinner like a beggar. Life is too short to waste time hating anyone, so don’t even try. Don’t take yourself so seriously. You don’t have to win every argument. Just agree to disagree. Make peace with your past so it won’t spoil the present. Don’t compare your life to others’. You have no idea what their journey is all about. Don’t compare your partner with others either. What other people think of you is none of your business. No one is in charge of your happiness except you. However good or bad a situation is, it will change. Your job won’t take care of you when you are sick. Your friends will. Stay in touch. Get rid of anything that isn’t useful, beautiful or joyful. Envy is a waste of time. You already have all you need. No matter how you feel, get up, dress up and show up. Call your family often. Your inner most is always happy. So be happy. Each day give something good to others.

-

I've been earning income on Airbnb as a non resident alien on an O1 visa. The site is withholding funds until I fill out a tax information form. Will I be in trouble if I pay tax on this income?

You could be in more trouble if you don't, assuming that you rented the space for at least 15 days in 2012. You are required to report that income on your tax return. Furthermore, AirBnB is required to report it to you and to the IRS (which will then be looking for it on your return) when the amount that they pay you is $600 or more. I strongly recommend that you consult with a tax professional before you file your return. If you personally used the space you rent on AirBnB for more than 14 days or 10% of the number of days you rented it (whichever is greater), you are considered to be renting your personal residence and your ability to take deductions against the income is limited. Furthermore, the method that you use to report the income and expenses depends on whether or not you are renting to make a profit - see Publication 527 (2011), Residential Rental Property for more information.

-

Under which ITR form will the return be filled out if the person getting the pension is earning from renting 2 shops? Will the rental income from both shops be considered as “income from house property”?

you need to choose ITR-2 for Pension income and rental income from two properties.Yes, Rental income from shop’s considered as Income from House Property. And Pension income shown in “Income from salary”.You also see below link for more info regarding ITR-2 form uses.USE OF RETURN FORM ITR-2

-

What are some legal ways to earn money if you cannot legally be employed (i.e. not having to fill out a W-2 form)?

Online work, freelancing (aka independent contractor) and distant work. A lot of graphic design, tech (aka Computer Science) and numbers related work can be done from your own home. You will probably won’t get the benefits of working for a huge corporation, but it sure beats being homeless.The term “Legally allowed to work at X country” is complicated to apply to independent contractors hired over the internet because technically, the internet is not a country.I used to play in a Private Server for the videogame World of Warcraft. They offered developpers who applied for their team a salary between $4,000 and $5,000 USD a month. It’s quite low for a developper job, but the only requirements were having access to Skype to talk with your team mates.There are many legal companies that offer distance jobs.You can be a private accountant for small LLC’s or individuals and work from anywhere in the globe. A graphic artist has many websites availables to freelance and sell their workThe problem is that many freelancers don’t report self-enployment income tax. And some banks in the US (or other countries) do allow foreigners to open bank accounts just by providing your passport, proof of income and an address.Therein lies the problem. You don’t report taxes in the US because you’re not living in the US and are not a resident or citizen. But also, the tax offices (the IRS in the US or the Canadian Revenue Agency in Canada have no jurisdiction over foreing banks, so they don’t know that you’re making money.Freelancing is legal, but reporting taxes is something of a mix between legal income and working-under-the table income.The thing is, when people do that, they are often limited to a single bank account. If you start sending money from your US bank account to your Canadian bank account, the CRA might get suspicious because you’re supposedly unemployed, so they will wonder where you’re getting that money from, and might even ask for proof. Are you selling drugs? Traficking people? Or do you have a proof of self-employment income? Once you give that to them, they will obviously tax you and apply any penalties for tax evasion.

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

Create this form in 5 minutes!

How to create an eSignature for the earning form

How to make an eSignature for your Earning Form online

How to make an electronic signature for the Earning Form in Chrome

How to make an electronic signature for putting it on the Earning Form in Gmail

How to make an electronic signature for the Earning Form right from your smart phone

How to create an eSignature for the Earning Form on iOS devices

How to generate an electronic signature for the Earning Form on Android

People also ask

-

How can airSlate SignNow assist in Money Earning for businesses?

airSlate SignNow streamlines document management, which can signNowly enhance your operational efficiency. By reducing the time spent on paperwork, businesses can focus more on revenue-generating activities, thus boosting their Money Earning potential. Additionally, the ease of eSigning documents accelerates contract turnaround times, further contributing to increased earnings.

-

What pricing plans does airSlate SignNow offer for maximizing Money Earning?

airSlate SignNow provides flexible pricing plans tailored to different business needs, ensuring you find the right fit for your budget. These plans are designed to maximize your Money Earning opportunities by offering features that enhance productivity and streamline workflows. Choose from monthly or annual subscriptions to find the best option for your organization's financial goals.

-

What are the key features of airSlate SignNow that support Money Earning?

Key features of airSlate SignNow include customizable templates, automated workflows, and real-time tracking of document status. These functionalities help businesses save time and reduce errors, directly impacting their Money Earning capabilities. By improving efficiency, companies can process more transactions and close deals faster.

-

Can airSlate SignNow integrate with other tools to enhance Money Earning?

Yes, airSlate SignNow seamlessly integrates with popular business applications like Salesforce, Google Workspace, and Microsoft Office. These integrations enhance your document management processes, which in turn can lead to improved Money Earning. By connecting your existing tools, you can create a more streamlined workflow that maximizes productivity.

-

How does eSigning with airSlate SignNow contribute to Money Earning?

eSigning with airSlate SignNow eliminates the delays associated with traditional signatures, allowing for quicker contract execution. This speed translates to faster deal closures and increased sales, thereby enhancing your Money Earning capabilities. The convenience of eSigning also improves customer satisfaction, fostering repeat business and referrals.

-

What security measures does airSlate SignNow have in place to protect Money Earning documents?

airSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage, to protect your documents. By ensuring the safety of sensitive information, businesses can confidently engage in transactions, knowing their Money Earning potential is safeguarded. This trust is essential for maintaining strong client relationships.

-

How can I use airSlate SignNow to track my Money Earning metrics?

With airSlate SignNow's detailed analytics and reporting features, you can track key metrics related to your document transactions. This data allows you to analyze performance and make informed decisions that enhance your Money Earning strategies. By understanding which processes yield the best results, businesses can optimize their operations for maximum profitability.

Get more for Money Earning

- Permit for use of real property by federal gsa form

- Check if orders issued to other than above form

- General serivces administration form

- Great seal order form

- Record of expenditures form

- Contract 47qtch18d0008 sf33 centuria corporation form

- Pre exit clearance process quick reference guide gsagov form

- Inventory of emergency operating records gsa form

Find out other Money Earning

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement