1098t Reasonable Cause Form 2013

What is the 1098-T Reasonable Cause Form

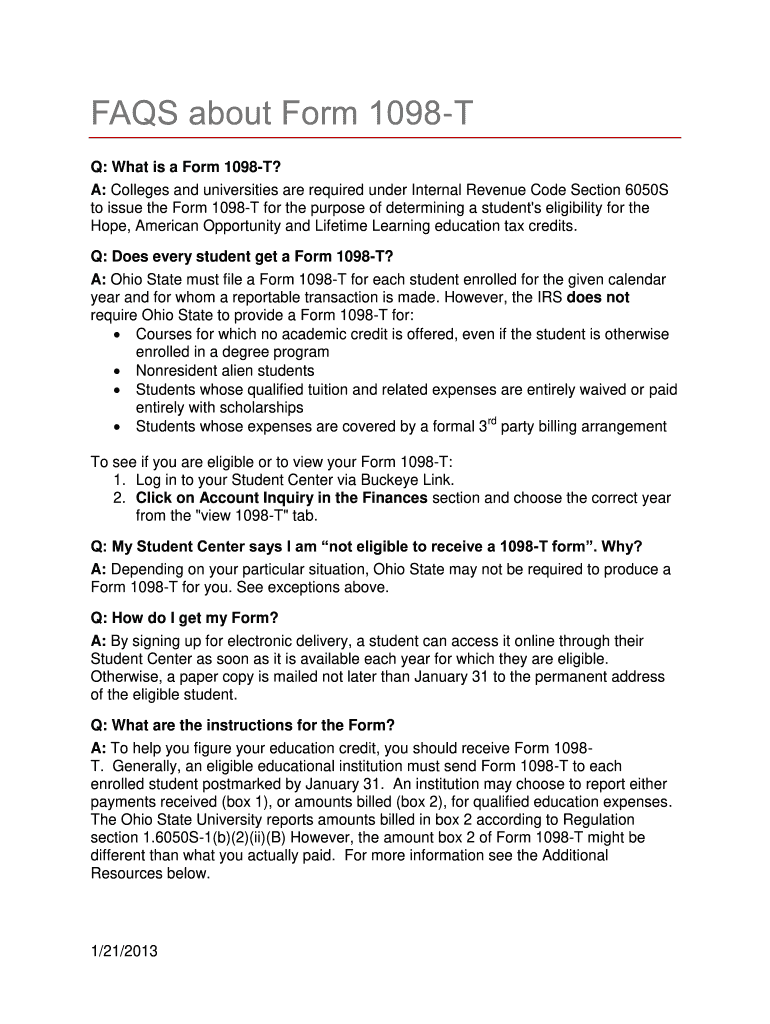

The 1098-T Reasonable Cause Form is a document used by educational institutions to report qualified tuition and related expenses to the Internal Revenue Service (IRS). This form is essential for students and their families as it helps in claiming education-related tax credits. The "T" in 1098-T stands for "tuition," indicating its primary focus on tuition payments. Understanding this form is crucial for ensuring compliance with tax regulations and maximizing potential tax benefits.

How to Use the 1098-T Reasonable Cause Form

Using the 1098-T Reasonable Cause Form involves several steps. First, ensure that you have received the form from your educational institution, which typically issues it by January thirty-first each year. Review the information provided, including your personal details and the amounts reported for qualified tuition and expenses. If you believe there is a reasonable cause for discrepancies in your reported amounts, you may need to provide additional documentation or explanations to the IRS. This form can also be used to support your claims for education tax credits when filing your tax return.

Steps to Complete the 1098-T Reasonable Cause Form

Completing the 1098-T Reasonable Cause Form requires careful attention to detail. Follow these steps:

- Gather all relevant documents, including previous tax returns and receipts for tuition payments.

- Fill out your personal information accurately, ensuring that your name and Social Security number match IRS records.

- Review the amounts reported on the form for accuracy. If you find discrepancies, document the reasons for these differences.

- Attach any necessary supporting documents that justify your reasonable cause claim.

- Submit the completed form to the IRS by the appropriate deadline, typically along with your tax return.

Legal Use of the 1098-T Reasonable Cause Form

The legal use of the 1098-T Reasonable Cause Form is governed by IRS regulations. It serves as a formal declaration of your educational expenses and is crucial for substantiating claims for tax credits such as the American Opportunity Credit and the Lifetime Learning Credit. Proper use of this form can help avoid penalties for incorrect reporting. It is important to ensure that all information is accurate and that any claims for reasonable cause are well-documented to comply with IRS requirements.

Filing Deadlines / Important Dates

Filing deadlines for the 1098-T Reasonable Cause Form align with the general tax filing deadlines. Typically, the IRS requires that this form be submitted by April fifteenth of the tax year in question. However, if you are requesting an extension, ensure that you follow the appropriate procedures to avoid penalties. Keeping track of these dates is essential for timely and compliant tax filing.

Examples of Using the 1098-T Reasonable Cause Form

There are various scenarios in which the 1098-T Reasonable Cause Form may be utilized. For instance, if a student believes that their tuition payments were reported inaccurately due to a clerical error by the institution, they can use this form to provide evidence of their actual payments. Additionally, if a student has incurred unexpected expenses that affect their eligibility for tax credits, this form can help clarify their situation to the IRS. These examples illustrate the importance of accurately completing and submitting the 1098-T Reasonable Cause Form to ensure proper tax treatment.

Quick guide on how to complete 1098t reasonable cause form

Prepare 1098t Reasonable Cause Form effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without any hold-ups. Manage 1098t Reasonable Cause Form on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The simplest way to edit and eSign 1098t Reasonable Cause Form with ease

- Locate 1098t Reasonable Cause Form and click on Get Form to begin.

- Use the tools provided to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invite link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign 1098t Reasonable Cause Form to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1098t reasonable cause form

Create this form in 5 minutes!

How to create an eSignature for the 1098t reasonable cause form

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the 1098t Reasonable Cause Form?

The 1098t Reasonable Cause Form is a document used by students to explain why they may have missed IRS reporting deadlines for educational tax credits. This form helps taxpayers provide justification for late filings, ensuring they don't miss out on potential benefits. Understanding this form is crucial for students and parents looking to optimize their tax situations.

-

How can airSlate SignNow help with the 1098t Reasonable Cause Form?

airSlate SignNow allows you to easily create, send, and eSign your 1098t Reasonable Cause Form electronically. Our user-friendly platform simplifies the process, ensuring that your documents are completed accurately and filed on time. With airSlate SignNow, you can streamline your paperwork, saving you time and reducing stress.

-

Is there a cost associated with using airSlate SignNow for the 1098t Reasonable Cause Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective while providing all the necessary features for creating and managing your 1098t Reasonable Cause Form. Check our website for detailed pricing options and find the plan that works best for you.

-

What features does airSlate SignNow offer for managing the 1098t Reasonable Cause Form?

airSlate SignNow provides a range of features for managing the 1098t Reasonable Cause Form, including customizable templates, electronic signatures, and document tracking. You can also collaborate with others in real-time, ensuring that everyone involved can contribute easily. These features make it a comprehensive solution for your document needs.

-

Can I integrate airSlate SignNow with other applications for the 1098t Reasonable Cause Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your workflow when managing the 1098t Reasonable Cause Form. Whether you're using CRM systems, cloud storage, or other document management tools, our integrations ensure that you can streamline processes and maintain efficiency.

-

How secure is my data when using airSlate SignNow for the 1098t Reasonable Cause Form?

Data security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your information when creating and sending the 1098t Reasonable Cause Form. You can trust that your sensitive data is safe and secure, giving you peace of mind.

-

What are the benefits of using airSlate SignNow for the 1098t Reasonable Cause Form?

Using airSlate SignNow for the 1098t Reasonable Cause Form offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance with IRS regulations. Our platform simplifies document management, allowing you to focus on what matters most—ensuring your educational tax credits are maximized. Plus, with electronic signatures, you can finalize documents faster than ever.

Get more for 1098t Reasonable Cause Form

- Riverside county ccw apli 2011 form

- Dtsc form 1358 2006

- Yosemite national park wilderness permit reservation application form

- Instructor evaluation form

- Mechanical california energy commission state of california ww cash4appliances form

- Cf2r plb 02 e form

- Cash verification form mckinley pta

- Caade registration form

Find out other 1098t Reasonable Cause Form

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval