Unrelated Business Income Tax 'UBIT'Tax Department 2019-2026

What is the Unrelated Business Income Tax 'UBIT' Tax Department

The Unrelated Business Income Tax (UBIT) Tax Department is a specific division within the Internal Revenue Service (IRS) that oversees the taxation of income generated by tax-exempt organizations from activities unrelated to their primary purpose. This tax applies to organizations such as charities, educational institutions, and religious entities when they engage in business activities that are not substantially related to their exempt purposes. The UBIT ensures that these organizations do not gain an unfair advantage over taxable businesses. Understanding UBIT is crucial for compliance and maintaining tax-exempt status.

Steps to complete the Unrelated Business Income Tax 'UBIT' Tax Department

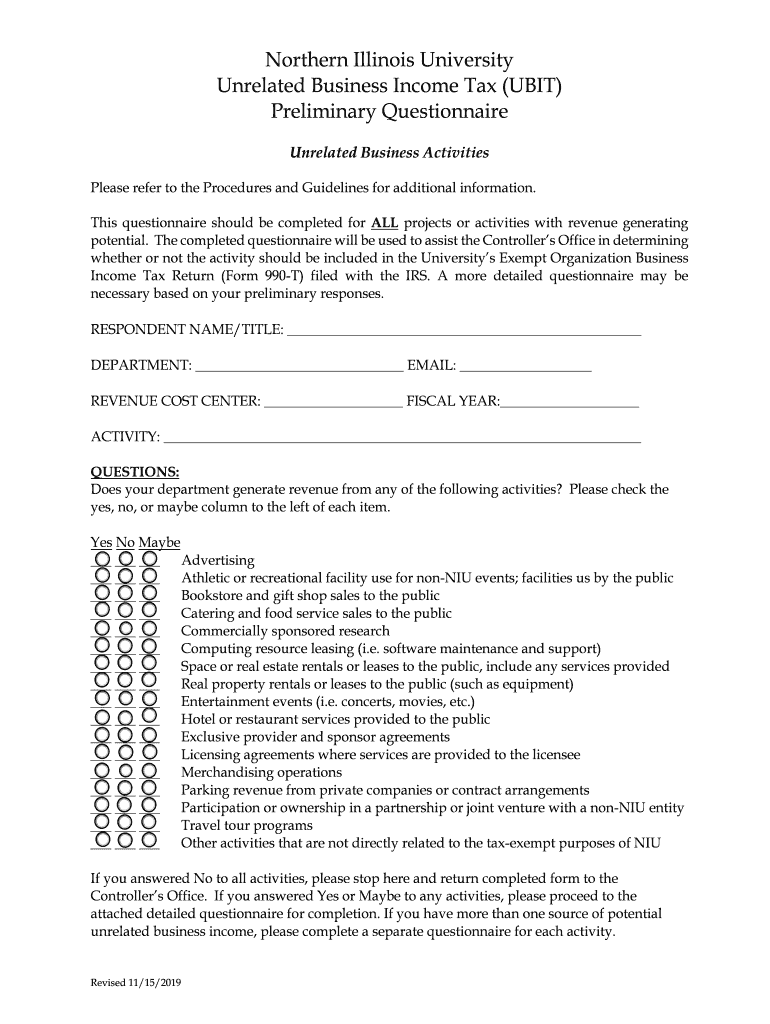

Completing the Unrelated Business Income Tax form involves several key steps. First, organizations must determine if their income is subject to UBIT by assessing whether the income-generating activities are related to their exempt purpose. Next, they should gather necessary financial records, including income statements and expense reports related to the unrelated business activities. After that, organizations must fill out the appropriate IRS forms, typically Form 990-T, which reports UBIT. Finally, it is essential to ensure that all information is accurate and submitted by the required deadlines to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Unrelated Business Income Tax are critical for compliance. Generally, Form 990-T must be filed by the fifteenth day of the fifth month after the end of the organization's tax year. For example, if an organization operates on a calendar year, the form is due by May 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Organizations can also request an extension, but it is important to note that any taxes owed must still be paid by the original due date to avoid interest and penalties.

Legal use of the Unrelated Business Income Tax 'UBIT' Tax Department

The legal use of the Unrelated Business Income Tax Tax Department involves adhering to IRS regulations regarding unrelated business income. Organizations must understand the definitions and criteria set forth by the IRS to determine what constitutes unrelated business income. This includes recognizing exceptions and exclusions that may apply, such as volunteer labor and certain types of investment income. Compliance with these legal requirements is essential to maintain tax-exempt status and avoid potential audits or penalties from the IRS.

Required Documents

To properly file for the Unrelated Business Income Tax, organizations must prepare several key documents. These typically include:

- Form 990-T, which reports unrelated business income.

- Financial statements detailing income and expenses related to unrelated business activities.

- Supporting documentation for deductions claimed, such as receipts and invoices.

- Records of any prior communications with the IRS regarding unrelated business income.

Having these documents organized and readily available will facilitate a smoother filing process and help ensure compliance with IRS requirements.

IRS Guidelines

The IRS provides comprehensive guidelines regarding the Unrelated Business Income Tax, which organizations must follow to ensure compliance. These guidelines outline what constitutes unrelated business income, the types of activities that may be subject to UBIT, and the reporting requirements. Organizations should regularly consult the IRS website or relevant publications to stay informed about any changes to the regulations or procedures related to UBIT. Understanding these guidelines is essential for maintaining tax-exempt status and fulfilling reporting obligations.

Quick guide on how to complete unrelated business income tax ampquotubitampquottax department

Effortlessly Prepare Unrelated Business Income Tax 'UBIT'Tax Department on Any Device

The management of online documents has gained signNow traction among businesses and individuals. It presents an ideal environmentally friendly substitute for conventional printed and signed documents, permitting you to acquire the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without any hold-ups. Manage Unrelated Business Income Tax 'UBIT'Tax Department on any platform using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

How to Modify and Electronically Sign Unrelated Business Income Tax 'UBIT'Tax Department with Ease

- Find Unrelated Business Income Tax 'UBIT'Tax Department and then select Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to store your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns regarding lost or misfiled documents, cumbersome form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Unrelated Business Income Tax 'UBIT'Tax Department to guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the unrelated business income tax ampquotubitampquottax department

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is Unrelated Business Income Tax (UBIT) and how does it affect my organization?

Unrelated Business Income Tax (UBIT) is a tax imposed on the income generated by tax-exempt organizations from activities unrelated to their primary purpose. This means that if your organization earns income from non-related business activities, you may be subject to UBIT. Understanding UBIT is crucial for compliance and avoiding unexpected tax liabilities.

-

How can airSlate SignNow help my Tax Department manage UBIT documentation?

airSlate SignNow provides an efficient platform for your Tax Department to securely send and eSign necessary UBIT documentation. With its user-friendly interface, your team can streamline document management processes, ensuring compliance with tax regulations without the hassle of traditional paperwork.

-

What features does airSlate SignNow offer for handling UBIT forms?

airSlate SignNow offers features like customizable templates, in-app signing, and document tracking that simplify the process of handling UBIT forms. By utilizing these features, your Tax Department can efficiently manage UBIT documentation, ensuring accurate filing and compliance with IRS requirements.

-

Is airSlate SignNow cost-effective for small organizations dealing with UBIT?

Yes, airSlate SignNow provides a cost-effective solution for small organizations navigating UBIT issues. Its pricing plans are designed to accommodate different budgets while ensuring that your Tax Department has access to all necessary tools for efficient document management related to Unrelated Business Income Tax.

-

Can I integrate airSlate SignNow with existing accounting software to manage UBIT?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, allowing your Tax Department to manage UBIT efficiently. This integration helps streamline workflows, enabling easy access to documentation and accurate handling of Unrelated Business Income Tax obligations.

-

What are the benefits of using airSlate SignNow for UBIT management?

Using airSlate SignNow for UBIT management offers numerous benefits, including enhanced efficiency, reduced paperwork, and a secure eSigning process. By automating your Tax Department's document workflows, you can focus more on strategic decisions rather than administrative tasks related to Unrelated Business Income Tax.

-

How does airSlate SignNow ensure the security of UBIT-related documents?

airSlate SignNow prioritizes the security of your UBIT-related documents with advanced encryption and compliance with industry standards. This ensures that your Tax Department's sensitive information is protected, giving you confidence in the management of Unrelated Business Income Tax documentation.

Get more for Unrelated Business Income Tax 'UBIT'Tax Department

- The lincoln national life insurance company massachusetts enrollment form for group insurance

- Fillable online 4000 east charleston blvd fax email print pdffiller form

- Offering patients messages via their preferred method of form

- Email custservsupportteamlfg form

- Small group evidence of insurability statement life and form

- Smith tower form

- New injury form revised 5 24 18 create pdfdocx

- Images for what is tihttpwwwxsbrokerscomsites form

Find out other Unrelated Business Income Tax 'UBIT'Tax Department

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast