909 PDF Franchise Tax Board CA Gov 2024-2026

Understanding the Kansas Composite Return 2024

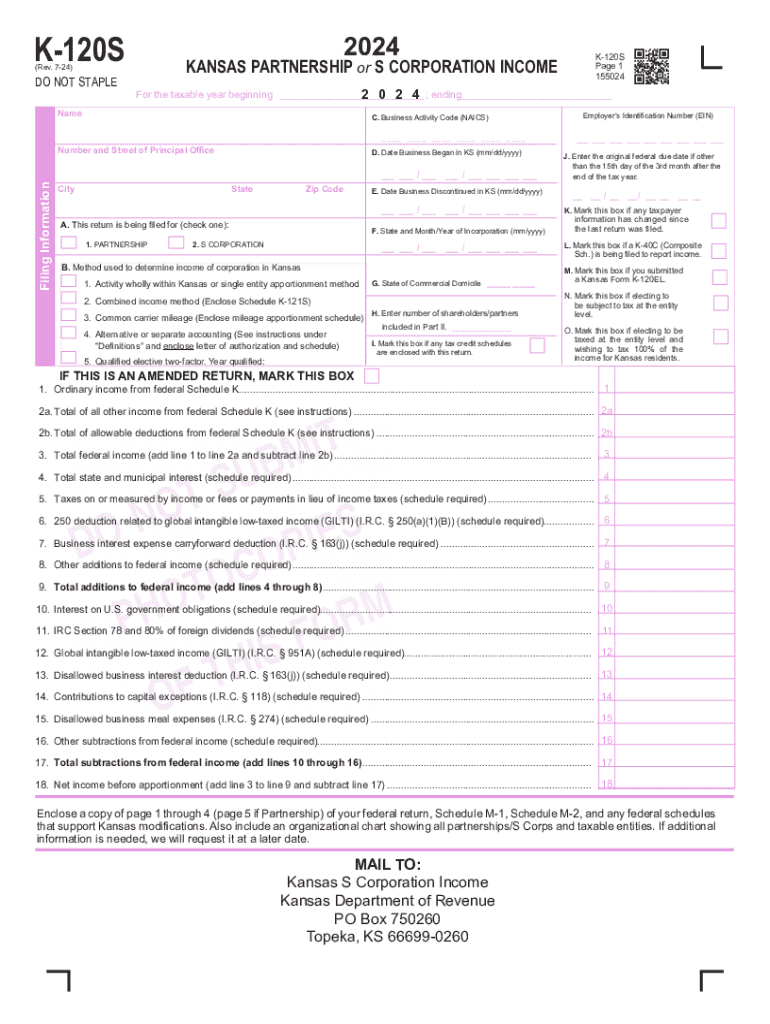

The Kansas Composite Return 2024 is a tax form designed for partnerships, S corporations, and limited liability companies (LLCs) that elect to file a composite return on behalf of their non-resident members. This form simplifies the tax filing process for entities with non-resident partners by allowing them to report and pay Kansas income tax collectively. By using the composite return, individual members do not need to file separate Kansas tax returns, streamlining compliance and reducing administrative burdens.

Steps to Complete the Kansas Composite Return 2024

Completing the Kansas Composite Return involves several key steps:

- Gather necessary documentation, including the entity's federal tax return and details of all non-resident members.

- Calculate the total income attributable to Kansas sources for the entity.

- Determine the appropriate tax rate based on the income level.

- Complete the Kansas Composite Return form, ensuring all fields are accurately filled.

- Review the form for accuracy and completeness before submission.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines for the Kansas Composite Return 2024. Typically, the return is due on the fifteenth day of the fourth month following the end of the entity's tax year. For calendar year filers, this means the return is due by April 15, 2024. Late filings may incur penalties, so timely submission is essential.

Required Documents for the Kansas Composite Return

To successfully file the Kansas Composite Return, the following documents are generally required:

- Federal tax return of the entity.

- Schedule K-1s for each non-resident member, detailing their share of income and deductions.

- Documentation supporting income allocation to Kansas sources.

Form Submission Methods

The Kansas Composite Return can be submitted through various methods, including:

- Online submission via the Kansas Department of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if preferred.

Penalties for Non-Compliance

Failure to file the Kansas Composite Return on time or inaccuracies in reporting can lead to penalties. These may include fines based on the amount of tax owed or a percentage of the unpaid tax. It is important for entities to ensure compliance to avoid unnecessary financial burdens.

Create this form in 5 minutes or less

Find and fill out the correct 909 pdf franchise tax board ca gov

Create this form in 5 minutes!

How to create an eSignature for the 909 pdf franchise tax board ca gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Kansas composite return 2024?

A Kansas composite return 2024 is a tax filing option that allows certain pass-through entities to report income on behalf of their non-resident owners. This simplifies the tax process for businesses and their owners, ensuring compliance with Kansas tax laws. By utilizing this option, businesses can streamline their tax obligations and avoid multiple filings.

-

How can airSlate SignNow help with Kansas composite return 2024?

airSlate SignNow provides an efficient platform for businesses to prepare and eSign documents related to the Kansas composite return 2024. With its user-friendly interface, users can easily manage their tax documents, ensuring they are completed accurately and submitted on time. This helps businesses stay organized and compliant with Kansas tax regulations.

-

What are the pricing options for airSlate SignNow when filing Kansas composite return 2024?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it cost-effective for filing the Kansas composite return 2024. Users can choose from monthly or annual subscriptions, with options that include additional features for enhanced document management. This ensures that businesses can find a plan that fits their budget while accessing essential tools.

-

What features does airSlate SignNow offer for Kansas composite return 2024?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing the Kansas composite return 2024. These tools help streamline the document preparation process, making it easier for businesses to gather necessary information and obtain signatures quickly. Additionally, the platform ensures that all documents are securely stored and easily accessible.

-

Are there any integrations available with airSlate SignNow for Kansas composite return 2024?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing the process of preparing the Kansas composite return 2024. These integrations allow users to import data directly from their accounting systems, reducing manual entry and minimizing errors. This connectivity ensures a smoother workflow for businesses managing their tax filings.

-

What are the benefits of using airSlate SignNow for Kansas composite return 2024?

Using airSlate SignNow for the Kansas composite return 2024 offers numerous benefits, including time savings, improved accuracy, and enhanced compliance. The platform's eSignature feature allows for quick approvals, while its document management tools help keep everything organized. This ultimately leads to a more efficient tax filing process for businesses.

-

Is airSlate SignNow secure for handling Kansas composite return 2024 documents?

Absolutely, airSlate SignNow prioritizes security, ensuring that all documents related to the Kansas composite return 2024 are protected. The platform employs advanced encryption and security protocols to safeguard sensitive information. Users can trust that their data is secure while using the service for their tax filing needs.

Get more for 909 pdf Franchise Tax Board CA gov

Find out other 909 pdf Franchise Tax Board CA gov

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer