Equifax Dispute Form

What is the Equifax Dispute

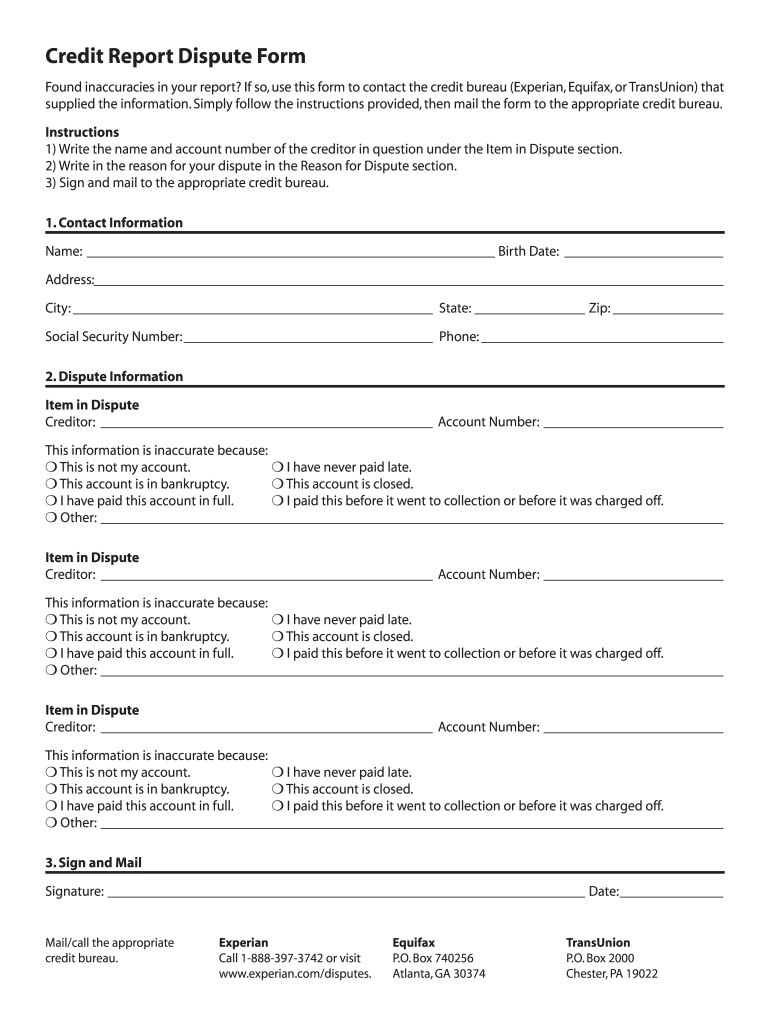

The Equifax dispute process allows consumers to challenge inaccuracies on their credit reports. A credit report is a detailed record of an individual's credit history, including personal information, credit accounts, payment history, and inquiries. When a consumer identifies an error, such as incorrect account balances or fraudulent accounts, they can file a dispute with Equifax, one of the three major credit bureaus in the United States. This process is essential for maintaining accurate credit records, which can impact loan approvals, interest rates, and overall financial health.

Steps to Complete the Equifax Dispute

Completing an Equifax dispute involves several key steps to ensure that your concerns are addressed properly. First, gather all relevant documentation that supports your claim, such as account statements or correspondence with creditors. Next, visit the Equifax website or use their mobile app to initiate the dispute. You will need to provide personal information and details about the inaccuracies. After submitting your dispute, Equifax will investigate the claim, typically within 30 days. They will notify you of the results and provide a copy of your updated credit report if changes are made.

Legal Use of the Equifax Dispute

The legal framework governing credit disputes is primarily based on the Fair Credit Reporting Act (FCRA). This federal law ensures that consumers have the right to dispute inaccurate information on their credit reports. When filing a dispute, it is crucial to follow the prescribed procedures to ensure compliance with the FCRA. This includes providing accurate information and submitting disputes in a timely manner. If a dispute is resolved in your favor, the credit bureau must correct the inaccuracies, thereby ensuring your credit report reflects your true financial history.

Required Documents

When filing an Equifax dispute, specific documents are necessary to support your claim. Essential documents may include:

- Identification proof, such as a driver's license or passport

- Social Security number for verification

- Account statements or bills that highlight discrepancies

- Any correspondence with creditors regarding the disputed information

Having these documents ready can expedite the dispute process and improve the chances of a favorable outcome.

Form Submission Methods

Equifax offers multiple methods for submitting a dispute, catering to different preferences. Consumers can file disputes online through the Equifax website, which is the most efficient method. Alternatively, disputes can be submitted via mail, where consumers must send a detailed letter outlining the inaccuracies along with supporting documents. In-person submissions are also an option at designated Equifax offices, though this method is less common. Each method has its own processing times, with online submissions typically being the fastest.

Examples of Using the Equifax Dispute

Common scenarios for using the Equifax dispute process include:

- Disputing a late payment that was reported in error

- Challenging an account that does not belong to you

- Correcting personal information, such as an incorrect address

Each of these examples illustrates how consumers can take control of their credit reports and ensure accuracy, which is vital for financial health.

Quick guide on how to complete equifax dispute

Complete Equifax Dispute effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to craft, modify, and eSign your documents promptly without interruptions. Manage Equifax Dispute on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign Equifax Dispute with ease

- Obtain Equifax Dispute and click Get Form to begin.

- Use the tools provided to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal authority as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Equifax Dispute and guarantee outstanding communication at any point of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the equifax dispute

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is an Equifax Dispute and how can airSlate SignNow help?

An Equifax Dispute involves challenging inaccuracies on your credit report with Equifax, one of the major credit bureaus. With airSlate SignNow, you can easily create, send, and eSign dispute letters, ensuring your documentation is handled promptly and securely, which can accelerate the resolution process.

-

How much does it cost to use airSlate SignNow for Equifax Disputes?

airSlate SignNow offers flexible pricing plans that cater to different needs, including a plan that is ideal for managing Equifax Disputes. You can choose from monthly or annual subscriptions, making it a cost-effective solution for individuals and businesses looking to streamline their dispute processes.

-

What features does airSlate SignNow offer for handling Equifax Disputes?

airSlate SignNow provides a range of features designed to simplify the Equifax Dispute process, including customizable templates for dispute letters, secure eSigning, and real-time tracking of document status. These features ensure that your disputes are filed efficiently and that you stay informed throughout the process.

-

Can I integrate airSlate SignNow with other tools for managing Equifax Disputes?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage your Equifax Disputes alongside your existing tools. Whether you use CRM software or document management systems, these integrations enhance your workflow and improve your efficiency.

-

Is airSlate SignNow secure for sending Equifax Dispute letters?

Absolutely! airSlate SignNow prioritizes security, offering bank-level encryption to protect your sensitive information while sending Equifax Dispute letters. This ensures that your personal data remains confidential and secure throughout the dispute process.

-

How can airSlate SignNow improve my chances of a successful Equifax Dispute?

By using airSlate SignNow, you can ensure that your Equifax Dispute letters are professionally formatted and comply with credit reporting regulations. The ease of eSigning and tracking capabilities also help you maintain proper documentation, which can signNowly increase your chances of a successful dispute outcome.

-

What types of documents can I eSign using airSlate SignNow for Equifax Disputes?

With airSlate SignNow, you can eSign a variety of documents related to your Equifax Dispute, including dispute letters, supporting documents, and acknowledgment receipts. This flexibility allows you to manage all necessary paperwork efficiently in one secure platform.

Get more for Equifax Dispute

- Application for licensure new jersey division of consumer form

- Ots 2 go screening form hamilton health sciences

- Faculty of nursing student academic appeals committee form

- Access and overview for new personnel english form

- Occupational therapist job description salary skills ampampamp more form

- Student registration and attestation form confidential

- Application to degree program for alumni ocad university form

- Confirmation deposit payment form lakehead university

Find out other Equifax Dispute

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template