Form Injured Spouse 2015

What is the Form Injured Spouse

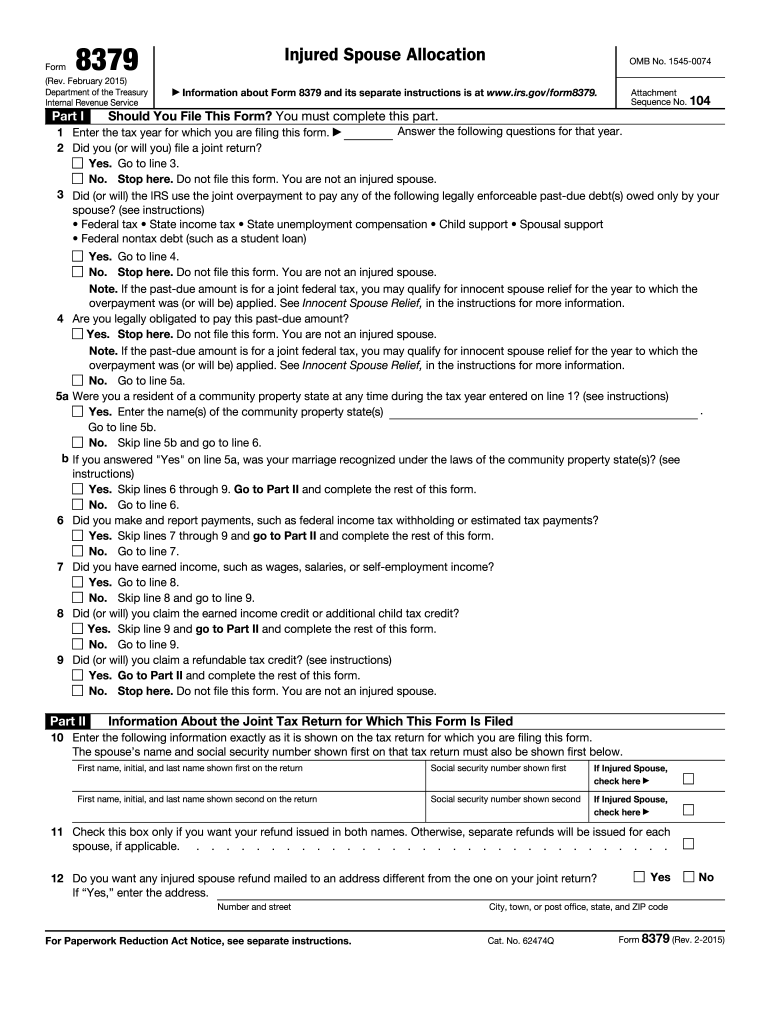

The Form Injured Spouse is a tax form used by individuals in the United States to claim their portion of a tax refund that may be withheld due to the tax liabilities of a spouse. This form is particularly relevant for couples who file jointly but wish to protect their individual tax refunds from being applied to their partner's debts, such as unpaid child support or federal student loans. By submitting this form, the injured spouse can ensure that their share of the refund is returned to them, rather than being diverted to satisfy the other spouse's obligations.

Steps to complete the Form Injured Spouse

Completing the Form Injured Spouse involves several key steps to ensure accuracy and compliance with IRS guidelines. Here are the essential steps to follow:

- Gather necessary information: Collect your tax return details, including your filing status, income, and any relevant financial documents.

- Obtain the form: You can download the Form Injured Spouse from the IRS website or request a physical copy through the IRS.

- Fill out the form: Provide your personal information, your spouse's information, and details about your tax refund. Be sure to clearly indicate your claim as the injured spouse.

- Sign and date the form: Ensure that you sign the form to validate your claim.

- Submit the form: File the completed form along with your tax return, or submit it separately if you have already filed your return.

Legal use of the Form Injured Spouse

The Form Injured Spouse is legally recognized by the IRS and is designed to protect individuals from having their tax refunds seized to pay a spouse's debts. To ensure the legal validity of your claim, it is crucial to complete the form accurately and submit it according to IRS guidelines. The form must be filed in a timely manner, typically alongside your tax return, to be effective. Understanding the legal implications of this form can help individuals safeguard their financial interests and ensure compliance with tax regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form Injured Spouse align with the standard tax filing deadlines in the United States. Generally, individual tax returns are due on April fifteenth of each year. If you are submitting the Form Injured Spouse as part of your tax return, it must be filed by this date. If you miss the deadline, you may lose the opportunity to claim your portion of the refund. Additionally, if you file for an extension, be aware that the extension applies to your entire tax return, including the injured spouse claim.

Who Issues the Form

The Form Injured Spouse is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the necessary forms and guidelines for taxpayers to claim their rightful refunds and protect their financial interests. It is essential to use the most current version of the form, as updates may occur, reflecting changes in tax laws or procedures.

Eligibility Criteria

To qualify as an injured spouse and use the Form Injured Spouse, certain eligibility criteria must be met. You must have filed a joint tax return with your spouse, and you must be entitled to a refund. Additionally, you should not be responsible for the debts that are causing the refund to be withheld. This form is particularly relevant if your spouse has unpaid federal taxes, child support, or other debts that could affect your refund. Understanding these criteria can help you determine if you are eligible to submit the form and reclaim your rightful share of the tax refund.

Quick guide on how to complete 2015 form injured spouse

Complete Form Injured Spouse effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form Injured Spouse on any platform with airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign Form Injured Spouse with ease

- Obtain Form Injured Spouse and then click Get Form to start.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form Injured Spouse and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form injured spouse

Create this form in 5 minutes!

How to create an eSignature for the 2015 form injured spouse

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the Form Injured Spouse and how do I use it?

The Form Injured Spouse is a tax form that allows you to claim your share of a tax refund when you are married to someone who owes back taxes. Using airSlate SignNow, you can easily fill out and eSign the Form Injured Spouse online, ensuring a smooth and secure submission process.

-

How does airSlate SignNow simplify the process of completing the Form Injured Spouse?

airSlate SignNow streamlines the completion of the Form Injured Spouse by providing an intuitive interface for filling out the necessary fields. Our platform allows you to save your progress and access your documents anytime, making it easier to manage your tax filings.

-

What is the pricing structure for using airSlate SignNow for Form Injured Spouse submissions?

airSlate SignNow offers competitive pricing plans that cater to all business sizes, making it a cost-effective solution for eSigning the Form Injured Spouse. You can choose from monthly or annual subscriptions, and even take advantage of a free trial to see how it fits your needs.

-

Can I integrate airSlate SignNow with other software for managing the Form Injured Spouse?

Yes, airSlate SignNow offers seamless integrations with popular software like Google Drive, Dropbox, and Microsoft Office, allowing you to manage your Form Injured Spouse documents efficiently. This ensures that you can easily access, share, and store your important tax documents.

-

What are the benefits of using airSlate SignNow for my Form Injured Spouse submissions?

Using airSlate SignNow for your Form Injured Spouse submissions offers numerous benefits, including enhanced security for your documents and the ability to eSign from anywhere. Additionally, our platform ensures faster processing times and reduces the risk of errors during submission.

-

How secure is my information when using airSlate SignNow for the Form Injured Spouse?

AirSlate SignNow prioritizes your security by employing advanced encryption methods to protect your information while you complete the Form Injured Spouse. Our platform complies with industry standards to ensure that your personal and financial data remains safe.

-

Is there customer support available if I need help with the Form Injured Spouse?

Absolutely! airSlate SignNow provides comprehensive customer support to assist you with any questions or issues related to the Form Injured Spouse. Our dedicated support team is available via chat, email, or phone to ensure you have a smooth experience.

Get more for Form Injured Spouse

Find out other Form Injured Spouse

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT