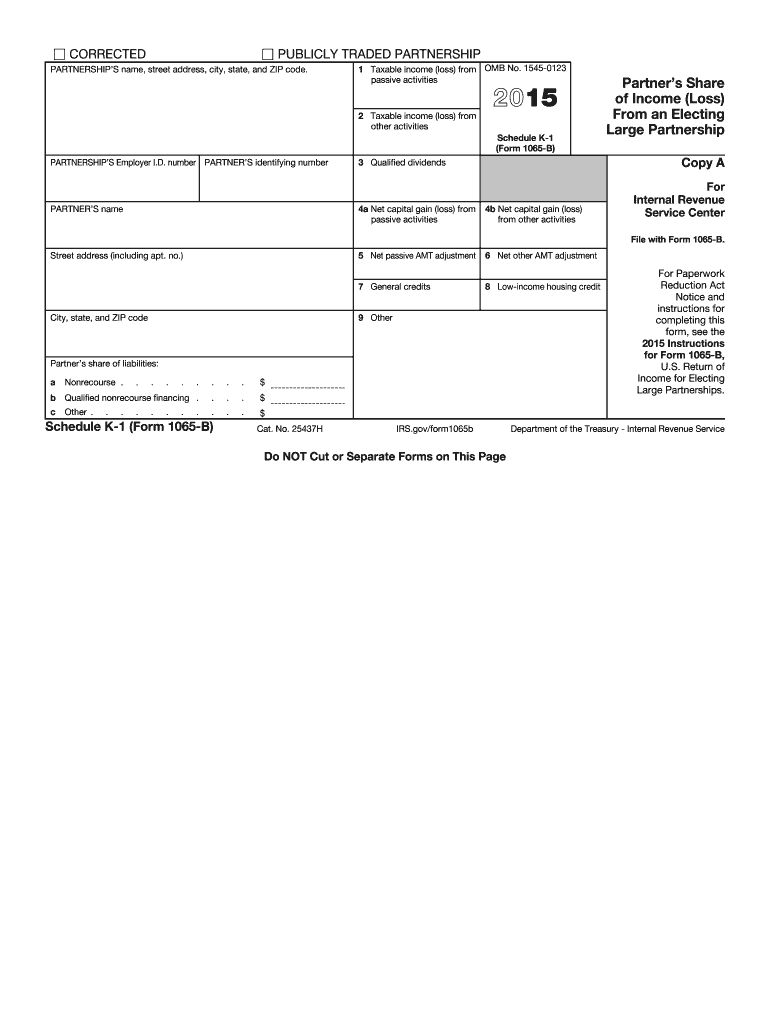

Irs K 1 Form 2015

What is the IRS K-1 Form

The IRS K-1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. Each partner or shareholder receives a K-1, which details their share of the entity's income, losses, and other tax-related items. This form is crucial for individuals who are part of pass-through entities, as it ensures that income is reported correctly on their personal tax returns. The K-1 helps the IRS track income that may not be subject to withholding, making it an essential part of the tax compliance process.

How to Use the IRS K-1 Form

Using the IRS K-1 Form involves several steps. First, individuals should carefully review the information provided on the form, ensuring that all details are accurate. The K-1 includes various sections that report different types of income, such as ordinary business income, rental income, and capital gains. Taxpayers must then transfer the relevant information from the K-1 to their personal tax returns, typically on Form 1040. It's important to consult the IRS instructions or a tax professional if there are any uncertainties regarding the reporting process.

Steps to Complete the IRS K-1 Form

Completing the IRS K-1 Form requires attention to detail. Here are the general steps involved:

- Gather necessary information about the partnership or S corporation, including its EIN (Employer Identification Number).

- Fill out the entity's details, including the name, address, and type of entity.

- Report the partner’s or shareholder’s information, such as their name, address, and ownership percentage.

- Complete the income and deduction sections, ensuring that all figures are accurate and reflect the entity's financial activity.

- Review the form for accuracy before submitting it to the IRS and providing copies to all partners or shareholders.

Legal Use of the IRS K-1 Form

The IRS K-1 Form is legally required for entities classified as partnerships and S corporations to report income to their partners and shareholders. Each recipient must include the information from their K-1 on their personal tax returns, as failure to do so can result in penalties. The form must be filed with the IRS by the entity, and copies must be distributed to all relevant parties. Compliance with IRS regulations regarding the K-1 is essential to avoid issues during tax audits.

Filing Deadlines / Important Dates

Filing deadlines for the IRS K-1 Form vary depending on the type of entity. Generally, partnerships must file their K-1s by March 15 for calendar year filers, while S corporations have the same deadline. Individual partners or shareholders must report the information from their K-1s on their personal tax returns by April 15. It's crucial to keep track of these dates to ensure timely compliance and avoid penalties.

Who Issues the Form

The IRS K-1 Form is issued by partnerships, S corporations, estates, and trusts. Each entity is responsible for preparing and distributing K-1s to their partners or shareholders. This process ensures that each individual receives the necessary information to report their income accurately on their tax returns. The issuing entity must ensure that the K-1 is completed correctly and sent out by the required deadlines to maintain compliance with IRS regulations.

Quick guide on how to complete 2015 irs k 1 form

Prepare Irs K 1 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Irs K 1 Form on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Irs K 1 Form with ease

- Find Irs K 1 Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns regarding lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Irs K 1 Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 irs k 1 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 irs k 1 form

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is an IRS K 1 Form and why do I need it?

The IRS K 1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It's essential for individuals who receive income from these entities as it ensures accurate reporting on your personal tax return. Using the IRS K 1 Form helps you understand your share of the entity's financial activity and is crucial for compliance with tax obligations.

-

How can I easily eSign my IRS K 1 Form with airSlate SignNow?

With airSlate SignNow, you can quickly eSign your IRS K 1 Form by uploading the document to our platform. Our user-friendly interface allows you to add your signature and date with just a few clicks, streamlining your signing process. This saves you time and ensures that your IRS K 1 Form is signed securely and efficiently.

-

Is there a cost to eSign the IRS K 1 Form using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to fit your needs, including a free trial for new users. After the trial, our subscription plans are competitively priced, providing excellent value for the features you receive, including eSigning your IRS K 1 Form. This cost-effective solution helps businesses manage their documents without breaking the bank.

-

What features does airSlate SignNow offer for managing the IRS K 1 Form?

airSlate SignNow provides a comprehensive set of features for managing your IRS K 1 Form, including customizable templates, automated workflows, and secure cloud storage. Our platform ensures that your documents are not only easy to sign but also organized and accessible whenever you need them. These features enhance your productivity and simplify your tax reporting processes.

-

Can I integrate airSlate SignNow with other applications for managing IRS K 1 Forms?

Yes, airSlate SignNow seamlessly integrates with numerous applications such as Google Drive, Dropbox, and CRM systems, making it easier to manage your IRS K 1 Form and other documents. These integrations streamline your workflow, allowing you to access and send your forms directly from your preferred applications. This flexibility enhances your overall document management experience.

-

What security measures are in place for signing the IRS K 1 Form with airSlate SignNow?

airSlate SignNow prioritizes security by implementing advanced encryption and authentication protocols for signing the IRS K 1 Form. Your documents are stored in a secure environment, ensuring that your sensitive information is protected. This commitment to security allows you to eSign your forms with confidence.

-

How does airSlate SignNow help streamline the process of submitting the IRS K 1 Form?

airSlate SignNow simplifies the submission process for your IRS K 1 Form by allowing you to sign and send documents electronically. This eliminates the need for physical paperwork and reduces delays associated with traditional mailing. Our platform ensures that your forms are submitted promptly and trackable, enhancing your efficiency during tax season.

Get more for Irs K 1 Form

Find out other Irs K 1 Form

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement