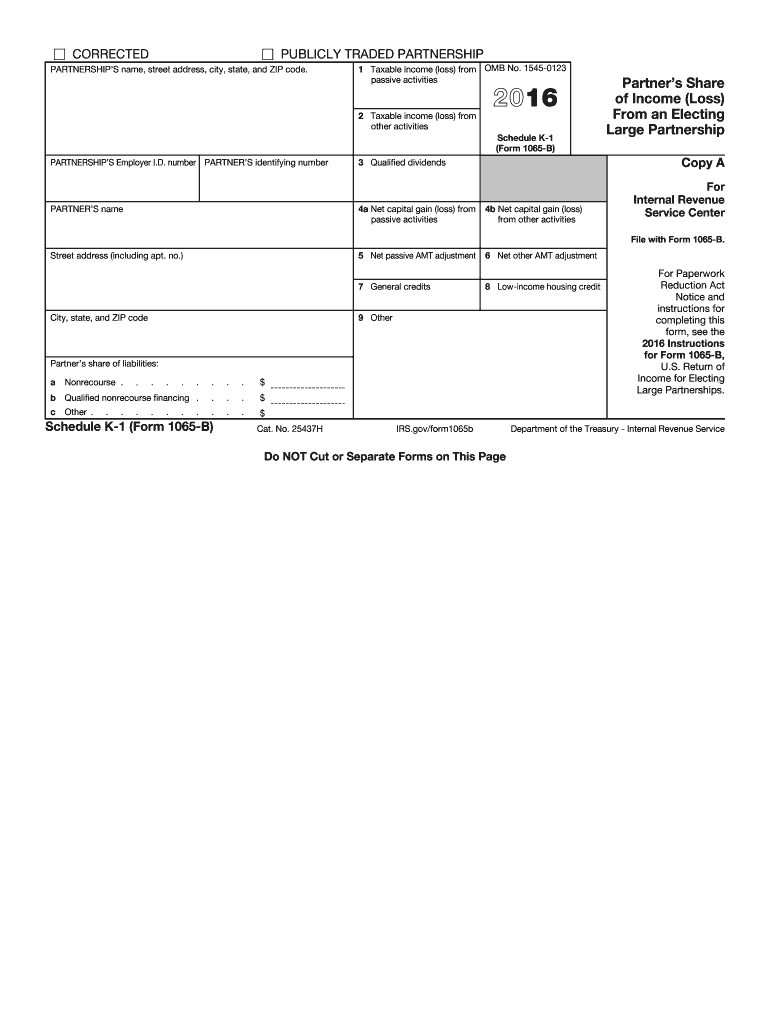

Irs K 1 Form 2016

What is the IRS K-1 Form

The IRS K-1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It provides detailed information about each partner's or shareholder's share of income, which is essential for accurate tax reporting. The form is issued by partnerships and S corporations to their partners or shareholders, ensuring they have the necessary information to complete their individual tax returns. Understanding the IRS K-1 Form is crucial for taxpayers involved in these entities, as it directly impacts their tax obligations.

How to Obtain the IRS K-1 Form

To obtain the IRS K-1 Form, individuals should first contact the partnership or S corporation they are involved with. These entities are responsible for preparing and distributing the form to their partners or shareholders. The IRS K-1 Form can also be accessed online through the IRS website, where taxpayers can find the necessary forms and instructions. It is important to ensure that you receive the correct version of the form based on your specific situation, whether you are a partner in a partnership or a shareholder in an S corporation.

Steps to Complete the IRS K-1 Form

Completing the IRS K-1 Form involves several steps to ensure accuracy and compliance with tax regulations:

- Review the information provided by the partnership or S corporation, including your share of income, deductions, and credits.

- Fill out the form by entering your personal information, including your name, address, and taxpayer identification number.

- Transfer the amounts reported on the K-1 to your individual tax return, specifically on Schedule E for reporting income or losses from partnerships and S corporations.

- Ensure that all figures are accurate and that you have included any additional documentation required for your tax return.

Legal Use of the IRS K-1 Form

The IRS K-1 Form is legally binding and must be used in accordance with IRS regulations. It serves as an official record of income and deductions that must be reported on individual tax returns. Failing to accurately report the information from the K-1 can lead to penalties or audits by the IRS. It is essential for taxpayers to retain a copy of the K-1 Form for their records and to ensure compliance with tax laws.

Key Elements of the IRS K-1 Form

The IRS K-1 Form includes several key elements that are vital for accurate tax reporting:

- Partnership Information: This section includes the name, address, and taxpayer identification number of the partnership or S corporation.

- Partner or Shareholder Information: This section captures the individual’s name, address, and identification number.

- Income Items: Details about the partner's or shareholder's share of ordinary business income, rental income, and other types of income are provided.

- Deductions and Credits: Information regarding any deductions or credits that the partner or shareholder can claim on their tax return is included.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the IRS K-1 Form. Partnerships and S corporations must typically file their tax returns by March 15 for calendar year filers. Consequently, they must provide the K-1 Forms to partners and shareholders by the same date. Taxpayers should ensure they receive their K-1 Forms in a timely manner to complete their individual tax returns accurately and on time, avoiding potential late filing penalties.

Quick guide on how to complete 2016 irs k 1 form

Effortlessly Prepare Irs K 1 Form on Any Device

The management of documents online has become increasingly favored among businesses and individuals. It serves as an excellent eco-conscious substitute for traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Irs K 1 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

The Easiest Way to Edit and Electronically Sign Irs K 1 Form

- Find Irs K 1 Form and click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form: by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Edit and electronically sign Irs K 1 Form while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 irs k 1 form

Create this form in 5 minutes!

How to create an eSignature for the 2016 irs k 1 form

How to create an electronic signature for the 2016 Irs K 1 Form in the online mode

How to create an eSignature for your 2016 Irs K 1 Form in Google Chrome

How to create an electronic signature for signing the 2016 Irs K 1 Form in Gmail

How to create an electronic signature for the 2016 Irs K 1 Form from your smart phone

How to generate an electronic signature for the 2016 Irs K 1 Form on iOS

How to make an eSignature for the 2016 Irs K 1 Form on Android

People also ask

-

What is an IRS K 1 Form and why is it important?

The IRS K 1 Form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts. It’s essential for accurate tax reporting as it provides individual partners or shareholders with their share of the entity's income, ensuring compliance with IRS regulations.

-

How can airSlate SignNow help with my IRS K 1 Form signing process?

airSlate SignNow offers a streamlined solution for electronically signing and managing your IRS K 1 Form documents. With its user-friendly interface, you can easily send, receive, and eSign your K 1 Forms, making the process efficient and secure.

-

Is there a cost associated with using airSlate SignNow for IRS K 1 Forms?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. You can choose a plan that fits your requirements for handling IRS K 1 Forms and other document management tasks, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for managing IRS K 1 Forms?

airSlate SignNow includes features like customizable templates, real-time status tracking, and secure cloud storage, all designed to simplify the management of IRS K 1 Forms. These features enhance collaboration and ensure that all parties can easily access and sign necessary documents.

-

Can I integrate airSlate SignNow with other software for IRS K 1 Form management?

Absolutely! airSlate SignNow provides seamless integrations with various accounting and tax software, making it easy to manage your IRS K 1 Forms alongside your other financial documents. This integration helps streamline your workflow and maintain accuracy in your tax reporting.

-

How secure is my data when using airSlate SignNow for IRS K 1 Forms?

Security is a top priority for airSlate SignNow. When managing your IRS K 1 Forms, your data is protected with advanced encryption and secure cloud storage, ensuring that sensitive information remains confidential and compliant with industry standards.

-

Can I track the status of my IRS K 1 Form once sent with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your IRS K 1 Form in real time. You’ll receive notifications when the document is viewed, signed, or completed, giving you peace of mind and keeping you informed throughout the process.

Get more for Irs K 1 Form

- Walter charley memorial scholarship application form

- Pumpco application form

- Nmfs southwest region hms form

- Jarvis leadership hall information and application

- Direct payment plan south dakota state employee health plan benefits sd form

- Felony questionnaire the ocdp board ocdp ohio form

- Samba beneficiary form

- Infoieseduorg form

Find out other Irs K 1 Form

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple