W 10 Form 2015

What is the W-10 Form

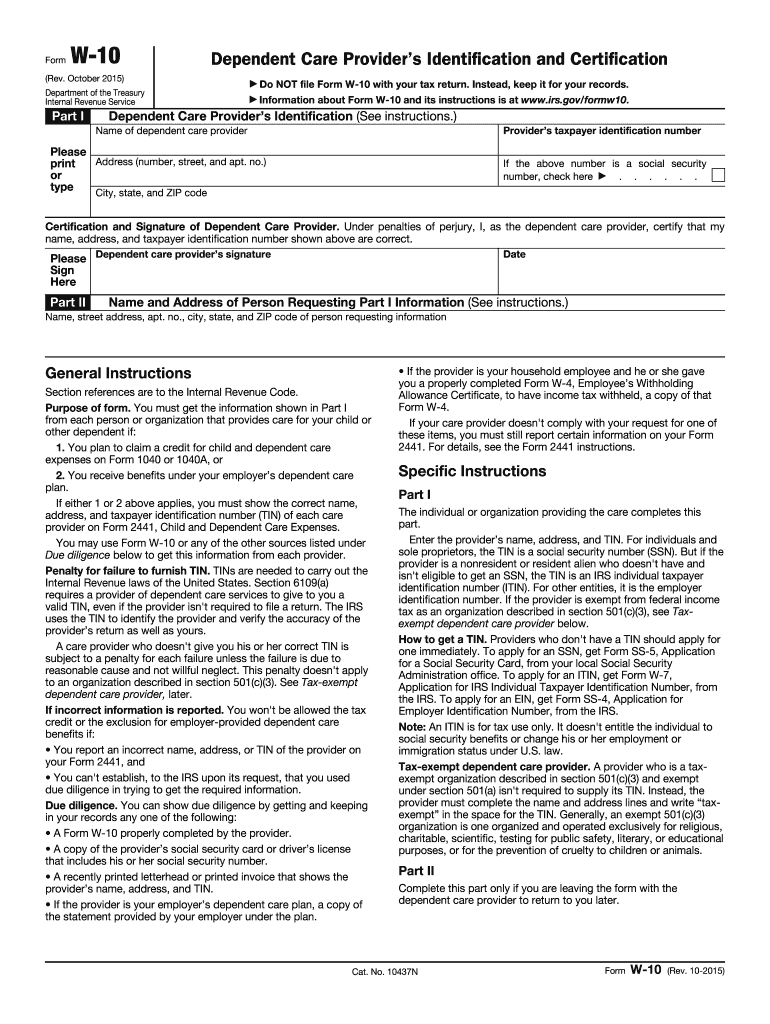

The W-10 Form, also known as the "Dependent Care Provider's Certificate," is a document used in the United States to certify that a provider of dependent care services is eligible for tax deductions. This form is particularly important for taxpayers who wish to claim the Child and Dependent Care Tax Credit. By completing the W-10 Form, dependent care providers can provide necessary information to clients, ensuring compliance with IRS requirements for claiming these credits.

How to use the W-10 Form

The W-10 Form is primarily used by dependent care providers to furnish their clients with essential information needed for tax purposes. Clients who pay for dependent care services can use the information provided on the W-10 Form to claim tax credits. Providers should fill out the form accurately, including their name, address, taxpayer identification number, and the type of services provided. Clients must retain this form for their records when filing their tax returns.

Steps to complete the W-10 Form

Completing the W-10 Form involves several straightforward steps:

- Begin by entering your full name and business name, if applicable.

- Provide your address, including city, state, and ZIP code.

- Include your taxpayer identification number, which may be your Social Security number or Employer Identification Number.

- Indicate the type of dependent care services you provide, such as in-home care or daycare services.

- Sign and date the form to certify that the information is accurate.

Legal use of the W-10 Form

The W-10 Form serves a legal purpose in the context of tax compliance. It provides documentation that allows clients to substantiate their claims for the Child and Dependent Care Tax Credit. By using this form, dependent care providers ensure that they meet IRS regulations, which helps protect both the provider and the client from potential audits or penalties related to tax filings.

Key elements of the W-10 Form

Several key elements are essential to the W-10 Form:

- Name of the provider: The full name of the individual or business providing care.

- Address: The complete mailing address of the provider.

- Taxpayer identification number: This is crucial for tax reporting purposes.

- Type of services provided: A clear description of the dependent care services offered.

- Signature and date: The provider must sign and date the form to validate the information.

Who Issues the Form

The W-10 Form is not issued by a specific agency but is instead a standard IRS form that dependent care providers complete. Providers can find the form online through IRS resources or tax preparation software. It is essential for providers to ensure that they fill out the form correctly to maintain compliance with IRS regulations.

Quick guide on how to complete 2015 w 10 form

Effortlessly Prepare W 10 Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the right form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage W 10 Form across any platform with the airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

The Easiest Way to Modify and Electronically Sign W 10 Form with Ease

- Obtain W 10 Form and click on Get Form to begin.

- Use the available tools to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form navigation, and mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign W 10 Form to ensure effective communication at every stage of your document preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 w 10 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 w 10 form

The best way to make an electronic signature for a PDF file in the online mode

The best way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is a W 10 Form and how is it used?

The W 10 Form is a tax document used by businesses to report payments made to foreign entities. It is essential for ensuring compliance with IRS regulations and for withholding tax on certain payments. With airSlate SignNow, you can easily eSign and send your W 10 Form, streamlining the documentation process.

-

How can airSlate SignNow help me manage my W 10 Form?

airSlate SignNow simplifies the management of your W 10 Form by allowing you to create, edit, and eSign documents electronically. This efficient process reduces the need for physical paperwork and helps ensure that your forms are completed accurately and on time.

-

Is there a cost associated with using airSlate SignNow for W 10 Form transactions?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for managing W 10 Form transactions. Each plan provides access to essential features like unlimited eSigning and document storage, making it a cost-effective solution for your business.

-

Can I integrate airSlate SignNow with other applications for handling the W 10 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, such as CRM and accounting software, to help you manage your W 10 Form more efficiently. This integration allows for better data synchronization and easier access to your documents across platforms.

-

What security features does airSlate SignNow offer for the W 10 Form?

airSlate SignNow prioritizes security, providing features such as encryption, secure authentication, and audit trails to protect your W 10 Form and other sensitive documents. These measures ensure that your information remains confidential and compliant with legal standards.

-

Can I customize my W 10 Form using airSlate SignNow?

Yes, airSlate SignNow allows users to customize their W 10 Form to meet specific business requirements. You can add fields, adjust layouts, and include branding elements, ensuring that your form aligns with your company’s identity and needs.

-

What are the benefits of using airSlate SignNow for my W 10 Form?

Using airSlate SignNow for your W 10 Form offers several benefits, including increased efficiency, reduced paperwork, and faster turnaround times. The platform enhances collaboration by allowing multiple stakeholders to sign documents electronically, making the process more streamlined and effective.

Get more for W 10 Form

Find out other W 10 Form

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free