Srsp 2019-2026

What is the SRSP?

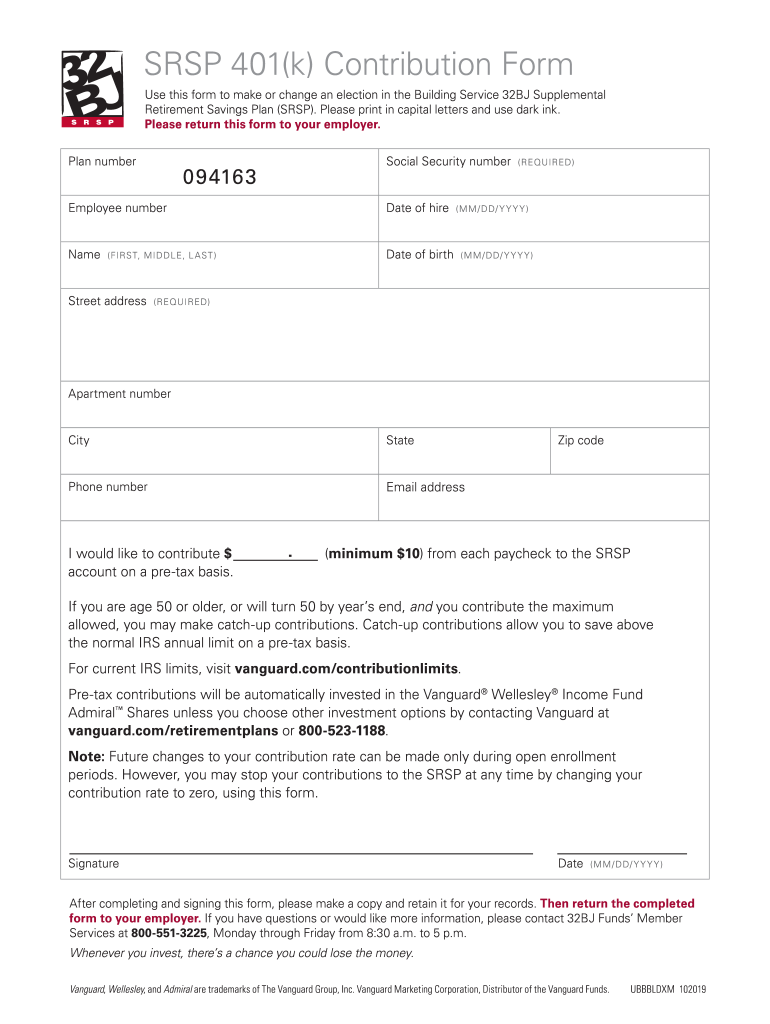

The SRSP, or Society Retirement Savings Plan, is a retirement savings vehicle designed to help employees save for their future. This plan allows participants to contribute a portion of their salary into a tax-advantaged account, which can grow over time through investments. The Vanguard 401(k) is a popular choice for many individuals, as it offers a range of investment options and low fees, making it an attractive option for long-term savings.

Steps to Complete the SRSP

Completing the SRSP involves several key steps to ensure that your contributions are processed correctly and efficiently. First, gather all necessary documents, including your employment details and personal identification. Next, fill out the 401(k) contribution form accurately, ensuring that all required fields are completed. After filling out the form, review it for any errors before submitting it. Finally, submit the completed form through the designated method, whether online or via mail, to ensure it is processed in a timely manner.

Legal Use of the SRSP

The legal use of the SRSP is governed by federal regulations, including the Employee Retirement Income Security Act (ERISA). This law sets standards for the management and operation of retirement plans, ensuring that participants' rights are protected. To maintain compliance, it is essential that all contributions and withdrawals are conducted according to these regulations. Additionally, using a reliable eSignature solution, like airSlate SignNow, can help ensure that all documents related to the SRSP are executed legally and securely.

Required Documents

To successfully enroll in the SRSP, you will need to provide several key documents. These typically include proof of employment, such as a pay stub or employment verification letter, and personal identification, like a driver's license or Social Security card. Additionally, you may need to submit any prior retirement account statements if you are rolling over funds into your Vanguard 401(k). Having these documents ready can streamline the enrollment process and help avoid delays.

Form Submission Methods

Submitting your SRSP form can be done through various methods, depending on your employer's policies. The most common methods include online submission, where you can fill out and eSign the form digitally, and mailing a physical copy to the appropriate department. Some employers may also allow in-person submissions, where you can hand in your completed form directly. Choosing the method that best suits your needs can help ensure that your contributions are processed without any issues.

IRS Guidelines

The IRS provides specific guidelines regarding retirement savings plans, including contribution limits and tax implications. For the Vanguard 401(k), it is important to stay informed about annual contribution limits, which can change each year. Additionally, understanding the tax benefits associated with contributions can help you maximize your savings. Following IRS guidelines is crucial to ensure compliance and to take full advantage of the benefits offered by the SRSP.

Quick guide on how to complete srsp

Accomplish Srsp seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Srsp on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The simplest method to adjust and eSign Srsp effortlessly

- Obtain Srsp and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or black out sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your updates.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and eSign Srsp and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct srsp

Create this form in 5 minutes!

How to create an eSignature for the srsp

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is a Vanguard 401(k)?

A Vanguard 401(k) is a retirement savings plan offered by Vanguard that allows employees to set aside a portion of their paycheck for retirement in a tax-advantaged account. It provides various investment options, including mutual funds and ETFs, empowering employees to grow their savings over time.

-

What are the key benefits of using a Vanguard 401(k)?

The primary benefits of a Vanguard 401(k) include low fees, a variety of investment options, and the ability to take advantage of employer matching contributions. This can signNowly enhance your retirement savings, making it a compelling choice for long-term financial planning.

-

How does the Vanguard 401(k) compare to other retirement plans?

Compared to other retirement plans, a Vanguard 401(k) stands out due to its low management fees and extensive fund selection. Additionally, Vanguard’s customer service is highly rated, making it easier for users to manage their investments wisely.

-

What are the contribution limits for a Vanguard 401(k)?

The contribution limits for a Vanguard 401(k) typically follow IRS guidelines, which can change annually. For the 2023 tax year, employees can contribute up to $22,500, or $30,000 if they are aged 50 or older, allowing for substantial tax-advantaged savings.

-

Can I manage my Vanguard 401(k) online?

Yes, you can easily manage your Vanguard 401(k) online through Vanguard’s user-friendly platform. You have access to your account information, investment options, and various tools to assist in planning your retirement strategy effectively.

-

Are there any fees associated with a Vanguard 401(k)?

While Vanguard 401(k) plans are known for their relatively low fees, there may still be administrative fees and expense ratios for the funds you choose. It’s important to review these costs as they can impact your overall retirement savings.

-

What types of investments are available in a Vanguard 401(k)?

A Vanguard 401(k) offers a diverse range of investment options, including target-date funds, index funds, and actively managed funds. This variety allows participants to build a personalized portfolio that fits their risk tolerance and retirement goals.

Get more for Srsp

Find out other Srsp

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement