Form W 10 1994

What is the Form W-10

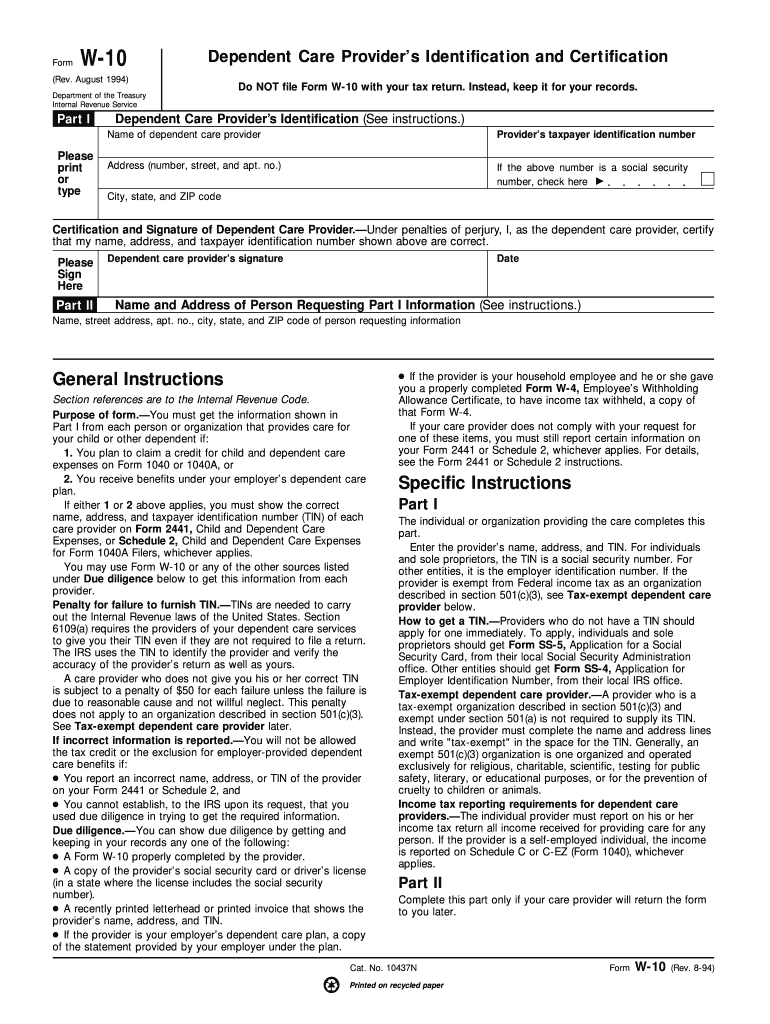

The Form W-10 is a document used by individuals and businesses in the United States to certify that they are eligible for certain tax benefits. This form is particularly relevant for those who are claiming tax treaty benefits or providing information about their foreign status. It serves as a declaration to the Internal Revenue Service (IRS) that the individual or entity meets specific criteria for reduced withholding tax rates on certain types of income. Understanding the purpose of the Form W-10 is essential for ensuring compliance with U.S. tax laws.

How to use the Form W-10

Using the Form W-10 involves several steps to ensure accurate completion and submission. First, gather the necessary information, including your taxpayer identification number (TIN) and any relevant details about your foreign status. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once the form is filled out, it should be submitted to the appropriate withholding agent or financial institution that requires it. This may include banks or other entities that handle payments subject to withholding tax.

Steps to complete the Form W-10

Completing the Form W-10 requires careful attention to detail. Follow these steps for a successful submission:

- Gather your personal information, including your name, address, and TIN.

- Identify the type of income for which you are claiming benefits.

- Complete each section of the form, ensuring accuracy in your responses.

- Sign and date the form to validate your declaration.

- Submit the completed form to the appropriate party, such as a financial institution or withholding agent.

Legal use of the Form W-10

The legal use of the Form W-10 is governed by IRS regulations. To ensure that the form is legally binding, it must be filled out completely and accurately. The information provided must reflect your true tax status and eligibility for benefits. Failure to comply with IRS guidelines can result in penalties or denial of tax benefits. It is crucial to keep a copy of the submitted form for your records, as it may be required for future reference or audits.

IRS Guidelines

The IRS provides specific guidelines for the use of the Form W-10. These guidelines outline who is eligible to use the form, the types of income that qualify for treaty benefits, and the importance of providing accurate information. It is advisable to review the latest IRS publications related to the Form W-10 to stay informed about any changes in regulations or requirements. Adhering to these guidelines helps ensure compliance and maximizes your potential tax benefits.

Required Documents

When completing the Form W-10, certain documents may be required to support your claims. These may include:

- Proof of foreign status, such as a passport or residency certificate.

- Tax identification number (TIN) documentation.

- Any additional forms or documents that pertain to the specific income type.

Having these documents ready can facilitate a smoother completion process and ensure that all necessary information is accurately reported.

Quick guide on how to complete form w 10

Complete Form W 10 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the right form and securely keep it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents promptly without any holdups. Manage Form W 10 on any device using airSlate SignNow Android or iOS applications and enhance any document-driven task today.

How to modify and electronically sign Form W 10 with ease

- Locate Form W 10 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form searches, or mistakes necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form W 10 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 10

Create this form in 5 minutes!

How to create an eSignature for the form w 10

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is Form W 10, and why is it important?

Form W 10 is an essential IRS document used to signNow the eligibility of a taxpayer for certain benefits or exemptions. Understanding and correctly completing Form W 10 can help businesses minimize tax liabilities and ensure compliance with IRS regulations.

-

How can airSlate SignNow help with completing Form W 10?

airSlate SignNow provides a user-friendly platform that makes it easy to fill out and eSign Form W 10. With our solution, you can streamline the documentation process and ensure accuracy, saving you valuable time.

-

Is there a cost associated with using airSlate SignNow for Form W 10?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. Each plan provides the necessary tools to efficiently manage Form W 10 and other essential documents at an affordable cost.

-

What features does airSlate SignNow offer for managing Form W 10?

Our platform includes features such as eSigning, document tracking, and templates specifically for Form W 10. These tools enhance document management efficiency and improve collaboration among teams.

-

Can I integrate airSlate SignNow with other software to manage Form W 10?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enabling you to manage Form W 10 alongside your preferred tools. This integration helps streamline workflows and improves productivity.

-

Are there templates available for Form W 10 in airSlate SignNow?

Yes, airSlate SignNow offers pre-built templates specifically designed for Form W 10. These templates simplify the process of document creation and ensure that all necessary fields are correctly filled out.

-

How secure is my data when using airSlate SignNow for Form W 10?

Security is our top priority at airSlate SignNow. When managing Form W 10 and other sensitive documents, we use advanced encryption and authentication measures to ensure your data remains protected at all times.

Get more for Form W 10

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts where 497305707 form

- Marital legal separation and property settlement agreement adult children parties may have joint property or debts effective 497305708 form

- Idaho dissolution form

- Idaho llc id form

- Living trust for husband and wife with no children idaho form

- Living trust for individual who is single divorced or widow or widower with no children idaho form

- Living trust for individual who is single divorced or widow or widower with children idaho form

- Living trust for husband and wife with one child idaho form

Find out other Form W 10

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy