886 Form 2014

What is the 886 Form

The 886 Form, officially known as the "Application for Tentative Refund," is a tax form used by individuals and businesses in the United States to claim a refund of overpaid taxes. This form is particularly relevant for taxpayers who have made an error on a previous tax return, allowing them to rectify the mistake and receive a refund without having to wait for the standard processing time of an amended return. The 886 Form is essential for ensuring that taxpayers receive the correct amount of refund based on their actual tax liability.

How to use the 886 Form

Using the 886 Form involves several steps to ensure accuracy and compliance with IRS regulations. First, taxpayers must gather all relevant documents, including previous tax returns and any supporting documentation that justifies the refund claim. Next, the form should be filled out with precise information, including the taxpayer's identification details, the tax year in question, and the specific reasons for the refund request. After completing the form, it should be reviewed for errors before submission to the IRS, either electronically or via mail.

Steps to complete the 886 Form

Completing the 886 Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including prior tax returns and any supporting evidence.

- Fill out the form accurately, ensuring all personal information is correct.

- Clearly state the reason for the refund request in the designated section.

- Double-check the form for any errors or omissions.

- Submit the completed form to the IRS, either electronically or by mail.

Legal use of the 886 Form

The 886 Form is legally binding when filled out correctly and submitted according to IRS guidelines. It is crucial for taxpayers to understand that any false information provided on the form can lead to penalties or legal repercussions. Therefore, it is advisable to consult with a tax professional if there are uncertainties regarding the completion of the form or the refund claim process.

Filing Deadlines / Important Dates

Filing deadlines for the 886 Form are critical to ensure that refund claims are processed in a timely manner. Generally, the form must be submitted within three years from the original tax return due date or within two years from the date the tax was paid, whichever is later. Missing these deadlines can result in losing the opportunity to claim a refund, making it essential for taxpayers to be aware of these important dates.

Required Documents

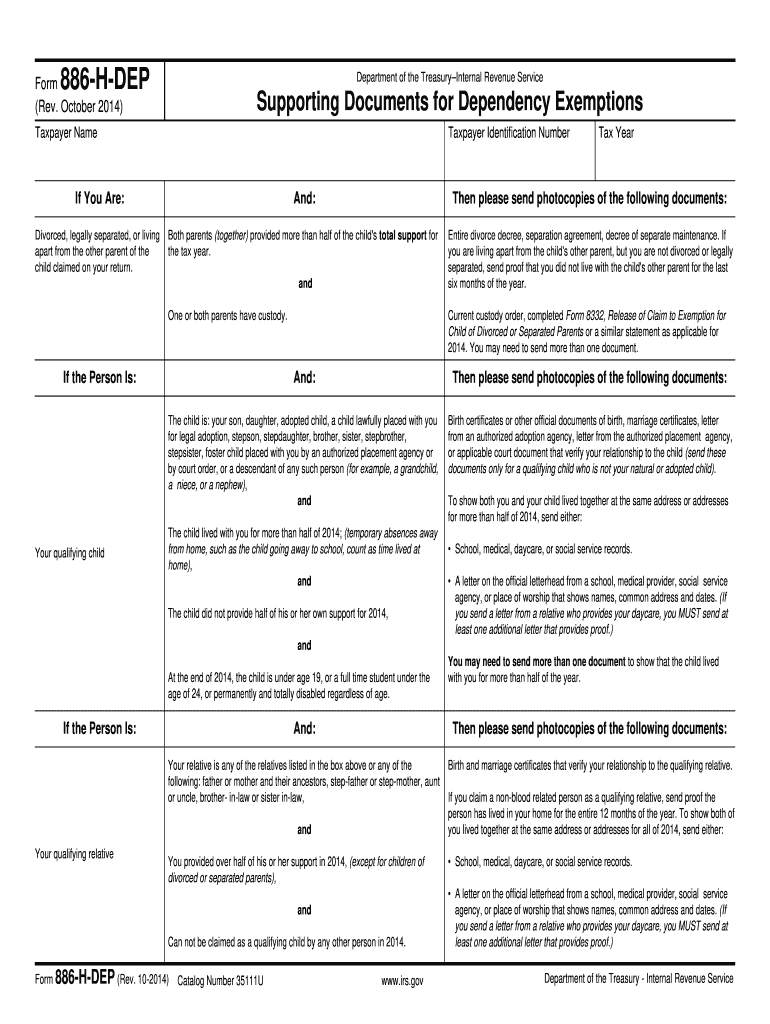

To successfully complete the 886 Form, several documents are necessary. Taxpayers should have their previous tax returns, any notices received from the IRS, and documentation that supports the refund claim, such as W-2s, 1099s, or other relevant financial records. Having these documents on hand will facilitate a smoother filing process and help substantiate the refund request.

Examples of using the 886 Form

There are various scenarios in which the 886 Form may be utilized. For instance, a taxpayer who discovers they overpaid their taxes due to a miscalculation can use the form to claim a refund. Additionally, if a business realizes it has been incorrectly classified and has overpaid taxes as a result, it can also file the 886 Form to request a refund. These examples illustrate the form's versatility in addressing different tax situations.

Quick guide on how to complete 2014 886 form

Complete 886 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage 886 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The most efficient way to edit and eSign 886 Form with ease

- Locate 886 Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign 886 Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 886 form

Create this form in 5 minutes!

How to create an eSignature for the 2014 886 form

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

How to make an electronic signature for a PDF on Android devices

People also ask

-

What is the 886 Form and how is it used?

The 886 Form is a crucial document used for specific tax-related purposes, particularly for claiming certain tax benefits. It simplifies the process of filing taxes and helps ensure that individuals and businesses receive the potential deductions they qualify for. Using airSlate SignNow, you can easily eSign and send the 886 Form securely.

-

How can airSlate SignNow help me with the 886 Form?

AirSlate SignNow streamlines the process of completing and submitting the 886 Form by providing an intuitive interface for eSigning and sharing documents. With customizable templates, you can prepare the form quickly while ensuring that all necessary fields are filled out correctly. This efficiency saves time and minimizes the chance of errors.

-

Is airSlate SignNow affordable for businesses filing the 886 Form?

Yes, airSlate SignNow offers a cost-effective solution for businesses managing the 886 Form and other documentation needs. Our pricing plans cater to various business sizes, ensuring you can access all features without breaking the bank. Plus, the potential savings from optimized operations with the platform can outweigh the subscription costs.

-

What features does airSlate SignNow offer for managing the 886 Form?

AirSlate SignNow provides several features tailored for managing the 886 Form, including customizable templates, secure cloud storage, and real-time collaboration tools. Moreover, users can track the status of documents and receive notifications once they are eSigned. These features enhance efficiency and organization when dealing with important tax documents.

-

Can I integrate airSlate SignNow with other software while working on the 886 Form?

Absolutely! AirSlate SignNow seamlessly integrates with various applications, making it easy to manage the 886 Form alongside your other business software. These integrations allow for improved workflows and enhanced data synchronization, ensuring that your tax documentation process is as efficient as possible.

-

What security measures does airSlate SignNow have for the 886 Form?

AirSlate SignNow prioritizes document security, especially for sensitive forms like the 886 Form. We employ advanced encryption protocols, secure access controls, and comprehensive audit trails to protect your data. This commitment to security ensures that your tax documents remain confidential and comply with regulatory standards.

-

Is it easy to get started with airSlate SignNow for the 886 Form?

Getting started with airSlate SignNow for the 886 Form is incredibly simple. After signing up, you can quickly access customizable templates and tutorial resources to guide you through the signing process. Our user-friendly interface makes it accessible for businesses of all sizes to manage their documentation efficiently.

Get more for 886 Form

Find out other 886 Form

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form