2848 Form 2014

What is the 2848 Form

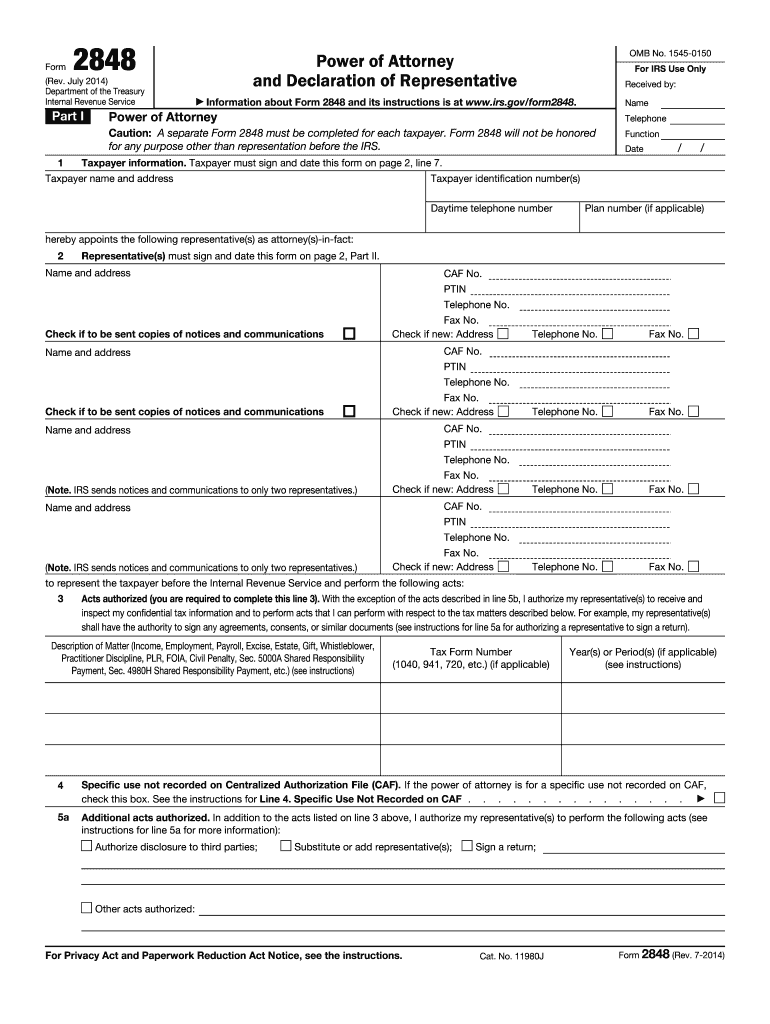

The 2848 Form, officially known as the Power of Attorney and Declaration of Representative, is a document used by taxpayers in the United States to authorize an individual to act on their behalf in dealings with the Internal Revenue Service (IRS). This form is essential for individuals who need assistance with tax matters, allowing the designated representative to receive confidential information and represent the taxpayer in front of the IRS. It is commonly used by tax professionals, such as accountants or enrolled agents, to facilitate communication and resolve issues related to tax filings, audits, and other inquiries.

How to use the 2848 Form

Using the 2848 Form involves several straightforward steps. First, the taxpayer must fill out the form with accurate personal information, including their name, address, and Social Security number. Next, the taxpayer should specify the type of tax matters for which they are granting authority, such as income tax or employment tax. It is important to clearly define the scope of representation to avoid any confusion. After completing the form, the taxpayer must sign and date it, which signifies their consent for the designated representative to act on their behalf. Finally, the form should be submitted to the IRS, either by mail or electronically, depending on the situation.

Steps to complete the 2848 Form

Completing the 2848 Form requires careful attention to detail. Here are the steps to ensure accurate submission:

- Begin by entering the taxpayer's information, including name, address, and Social Security number or Employer Identification Number.

- Designate the representative by providing their name, address, and phone number.

- Specify the tax matters for which the authority is granted, including the relevant tax years or periods.

- Sign and date the form to validate the authorization.

- Submit the completed form to the IRS, ensuring that it is sent to the appropriate address based on the taxpayer's location and the type of tax involved.

Legal use of the 2848 Form

The legal use of the 2848 Form is governed by IRS regulations, which outline the requirements for a valid power of attorney. The form must be signed by the taxpayer to be legally binding, and it must clearly state the scope of authority granted to the representative. It is important to ensure that the representative is eligible to act on behalf of the taxpayer, as certain restrictions may apply. The form remains in effect until the taxpayer revokes it or the IRS processes a new form, making it crucial for taxpayers to keep their information updated.

Filing Deadlines / Important Dates

When using the 2848 Form, it is essential to be aware of relevant filing deadlines and important dates. The form should be submitted as soon as the taxpayer anticipates needing representation, particularly if they are facing an audit or other time-sensitive tax matters. While there is no specific deadline for submitting the form, it is advisable to file it well in advance of any scheduled IRS appointments or deadlines related to tax filings. Keeping track of these dates can help prevent complications and ensure timely representation.

Form Submission Methods (Online / Mail / In-Person)

The 2848 Form can be submitted to the IRS through various methods. Taxpayers have the option to file the form electronically using the IRS e-Services platform, which allows for faster processing. Alternatively, the form can be mailed to the appropriate IRS address based on the taxpayer's location and the type of tax involved. In some cases, taxpayers may also choose to deliver the form in person at their local IRS office. Each submission method has its advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete 2848 2014 form

Effortlessly Prepare 2848 Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely keep it online. airSlate SignNow offers all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle 2848 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign 2848 Form with Ease

- Obtain 2848 Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your edits.

- Choose how you’d like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Edit and electronically sign 2848 Form to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2848 2014 form

Create this form in 5 minutes!

How to create an eSignature for the 2848 2014 form

How to create an eSignature for a PDF document in the online mode

How to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

How to generate an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the 2848 Form?

The 2848 Form, also known as the Power of Attorney and Declaration of Representative, allows individuals to designate someone to represent them before the IRS. Using airSlate SignNow, you can easily fill out and eSign the 2848 Form, streamlining the process of authorizing your representative.

-

How can airSlate SignNow help with eSigning the 2848 Form?

airSlate SignNow simplifies the eSigning process for the 2848 Form by providing a user-friendly interface where you can complete your documents electronically. This ensures that you can sign the 2848 Form from anywhere, saving time and reducing paperwork.

-

What are the pricing options for using airSlate SignNow with the 2848 Form?

airSlate SignNow offers various pricing tiers to cater to individual users and businesses, making it affordable to eSign the 2848 Form. Depending on your needs, you can choose from monthly or annual plans that provide scalable features without breaking the bank.

-

Are there any integrations available with airSlate SignNow for the 2848 Form?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage the 2848 Form within your existing workflow. Popular integrations include Google Drive, Dropbox, and CRM systems, making document management more efficient.

-

What are the benefits of using airSlate SignNow for the 2848 Form?

Using airSlate SignNow for the 2848 Form offers numerous benefits, including enhanced security, compliance with IRS standards, and the ability to track document progress. This simplifies the process of submitting your form and helps you maintain control of your sensitive information.

-

Can I access the 2848 Form on mobile devices using airSlate SignNow?

Absolutely! airSlate SignNow is optimized for mobile devices, allowing you to access and eSign your 2848 Form on the go. This flexibility ensures you can complete important tasks anytime, anywhere, without being tied to a computer.

-

Is it legal to eSign the 2848 Form with airSlate SignNow?

Yes, eSigning the 2848 Form with airSlate SignNow is legally binding and compliant with eSignature laws. The platform adheres to all required regulations, ensuring that your digitally signed documents are valid and accepted by the IRS.

Get more for 2848 Form

Find out other 2848 Form

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now