Form 2848 2018

What is the Form 2848

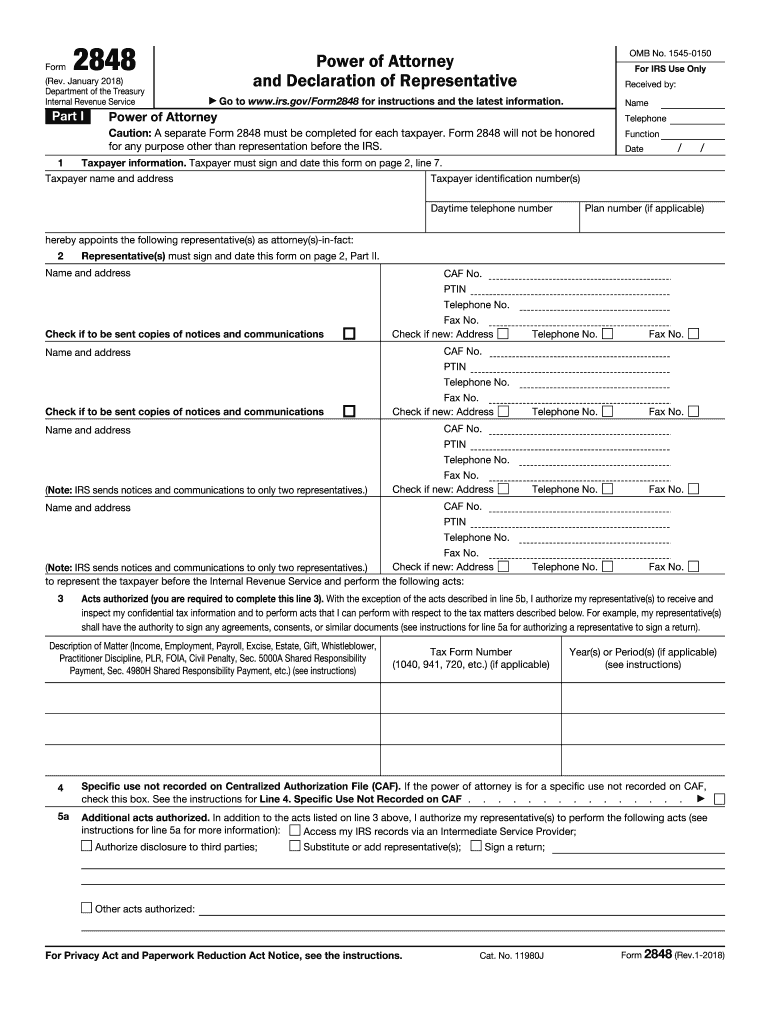

The Form 2848, officially known as the Power of Attorney and Declaration of Representative, is a document used in the United States to authorize an individual or entity to act on behalf of a taxpayer in dealings with the Internal Revenue Service (IRS). This form allows the designated representative, such as an attorney, accountant, or other authorized person, to receive confidential tax information and represent the taxpayer during audits or other IRS matters. Understanding this form is crucial for anyone needing assistance with their tax obligations.

How to use the Form 2848

The Form 2848 is utilized when a taxpayer wishes to grant authority to a third party to manage their tax affairs. This includes the ability to discuss tax matters, receive copies of notices, and represent the taxpayer in front of the IRS. To use the form effectively, the taxpayer must fill it out completely, ensuring that all required information is accurate. Once completed, the form should be submitted to the IRS, which will then process the authorization. This process ensures that the representative can act on the taxpayer's behalf without any legal hurdles.

Steps to complete the Form 2848

Completing the Form 2848 involves several key steps:

- Provide personal information of the taxpayer, including full name, address, and taxpayer identification number.

- List the representative's details, including their name, address, and phone number.

- Specify the tax matters for which the representative is authorized, such as specific forms or tax years.

- Sign and date the form to validate the authorization.

After completing these steps, the taxpayer should submit the form to the appropriate IRS office. It is advisable to keep a copy for personal records.

Key elements of the Form 2848

The Form 2848 includes several essential components that must be filled out correctly to ensure its validity. Key elements include:

- Taxpayer information: This includes the taxpayer's name, address, and identification number.

- Representative information: Details about the individual or organization being authorized.

- Tax matters: A clear description of the tax issues the representative is authorized to handle.

- Signatures: Both the taxpayer and the representative must sign the form to confirm their agreement.

Ensuring that all these elements are accurately completed is vital for the form's acceptance by the IRS.

Legal use of the Form 2848

The legal use of the Form 2848 is governed by IRS regulations, which outline the conditions under which a taxpayer can authorize a representative. This form serves as a legal document that grants the representative the authority to act on behalf of the taxpayer in specific tax matters. It is important for both the taxpayer and the representative to understand the legal implications of this authorization, including the responsibilities and limitations imposed by the IRS. Misuse of the form can lead to penalties or denial of representation.

Form Submission Methods

The Form 2848 can be submitted to the IRS through various methods, ensuring flexibility for taxpayers. The primary submission methods include:

- Mail: The completed form can be sent to the appropriate IRS address based on the taxpayer's location.

- Fax: In certain cases, the IRS allows fax submissions, which can expedite the process.

- Online: Taxpayers may also have the option to submit the form electronically, depending on their circumstances.

Choosing the right submission method can affect the processing time, so it is advisable to consider the urgency of the request when deciding how to submit the form.

Quick guide on how to complete power of attorney form 2848 2018

Discover the most efficient method to complete and endorse your Form 2848

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers an improved solution for completing and endorsing your Form 2848 and related forms for public services. Our advanced electronic signature platform equips you with all the essentials to manage documents swiftly and in compliance with official standards - robust PDF editing, managing, safeguarding, signing, and sharing capabilities all available within a user-friendly interface.

Just a few steps are needed to complete and endorse your Form 2848:

- Upload the fillable template to the editor using the Get Form button.

- Verify what information you need to supply in your Form 2848.

- Navigate through the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to populate the fields with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is truly signNow or Conceal fields that are no longer relevant.

- Click on Sign to generate a legally valid electronic signature using your preferred method.

- Insert the Date next to your signature and finish your task with the Done button.

Store your completed Form 2848 in the Documents folder within your account, download it, or export it to your preferred cloud storage. Our platform also facilitates easy file sharing. There’s no need to print your forms when you can send them directly to the appropriate public office - simply use email, fax, or request a USPS “snail mail” delivery from your account. Give it a try now!

Create this form in 5 minutes or less

Find and fill out the correct power of attorney form 2848 2018

FAQs

-

Can power of attorney in fact forms be filled out and authorized completely online?

Note: I am not an attorney. Even if I were an attorney, I am not your attorney. This is merely the opinion of a fairly savvy Citizen. It is not legal advice. If you want legal advice hire an actual attorney. In the U.S.A. "signing" something like a Power of Attorney electronically is generally not enforcable* because many (most?) Courts require that the authorizing of them usually requires a "wet" signature which has been signNowd. You could try it but, because they are such powerful documents, almost any court (or business for that matter) will require that the signature be signNowd before allowing them to be enforced and used.In fact many businesses simply have a policy of not recognizing them without a confirming court order as well. This is especially true in health care.This is mainly because the business wants to make damned sure that any liability for errors or misunderstandings lies with someone other than the business. *Note that "not enforcable" =/= "illegal" (or even sick hawk).There's no law preventing you from doing it. It's just completely pointless; because if you complete the Power of Attorney electronically anybody who knows anything about law or contracts or fiduciary duty will simply ignore it... along with any instructions you might try to give them under it.Do yourself a favor by getting an attorney and doing it right.

-

How do I fill out the BHU's form of B.Com in 2018 and crack it?

you can fill from to go through bhu portal and read all those instruction and download previous year question paper . that u will get at the portal and solve more and more question paper and read some basics from your study level .focus on study save ur time and energy .do best to achieve your goal .for more detail discus with gajendra ta mtech in iit bhu .AND PKN .good luck .

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

Create this form in 5 minutes!

How to create an eSignature for the power of attorney form 2848 2018

How to generate an eSignature for the Power Of Attorney Form 2848 2018 online

How to make an eSignature for your Power Of Attorney Form 2848 2018 in Chrome

How to create an electronic signature for signing the Power Of Attorney Form 2848 2018 in Gmail

How to generate an electronic signature for the Power Of Attorney Form 2848 2018 right from your smart phone

How to create an eSignature for the Power Of Attorney Form 2848 2018 on iOS

How to generate an eSignature for the Power Of Attorney Form 2848 2018 on Android devices

People also ask

-

What is Form 2848 and how can airSlate SignNow help?

Form 2848 is a Power of Attorney and Declaration of Representative form used by taxpayers to authorize someone to represent them before the IRS. airSlate SignNow simplifies the process of completing and eSigning Form 2848, making it easy for users to manage their tax-related documents securely and efficiently.

-

Is there a cost to use airSlate SignNow for submitting Form 2848?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Each plan includes features that streamline the process of filling out and eSigning Form 2848, providing a cost-effective solution for managing your tax documents.

-

Can I integrate airSlate SignNow with other software to manage Form 2848?

Absolutely! airSlate SignNow seamlessly integrates with various applications, making it easy to manage Form 2848 alongside your existing tools. This integration enhances document workflow, ensuring that your tax documents are organized and accessible.

-

What features does airSlate SignNow offer for handling Form 2848?

airSlate SignNow provides a range of features for handling Form 2848, including customizable templates, secure eSigning, and real-time document tracking. These features ensure that the completion and submission of Form 2848 are efficient and secure.

-

How secure is airSlate SignNow when handling sensitive forms like Form 2848?

Security is a top priority at airSlate SignNow. When handling sensitive documents like Form 2848, we use advanced encryption methods and secure cloud storage to protect your information, ensuring that your tax documents remain confidential.

-

Can multiple users collaborate on Form 2848 using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on Form 2848. You can invite team members to review and eSign the document, making it easier to manage the approval process and ensure everyone is on the same page.

-

How can airSlate SignNow improve the efficiency of submitting Form 2848?

By using airSlate SignNow, you can streamline the process of submitting Form 2848. The platform allows for quick eSigning, automatic reminders, and easy sharing of documents, signNowly reducing the time it takes to complete your tax forms.

Get more for Form 2848

Find out other Form 2848

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast