Form 2848 2015

What is the Form 2848

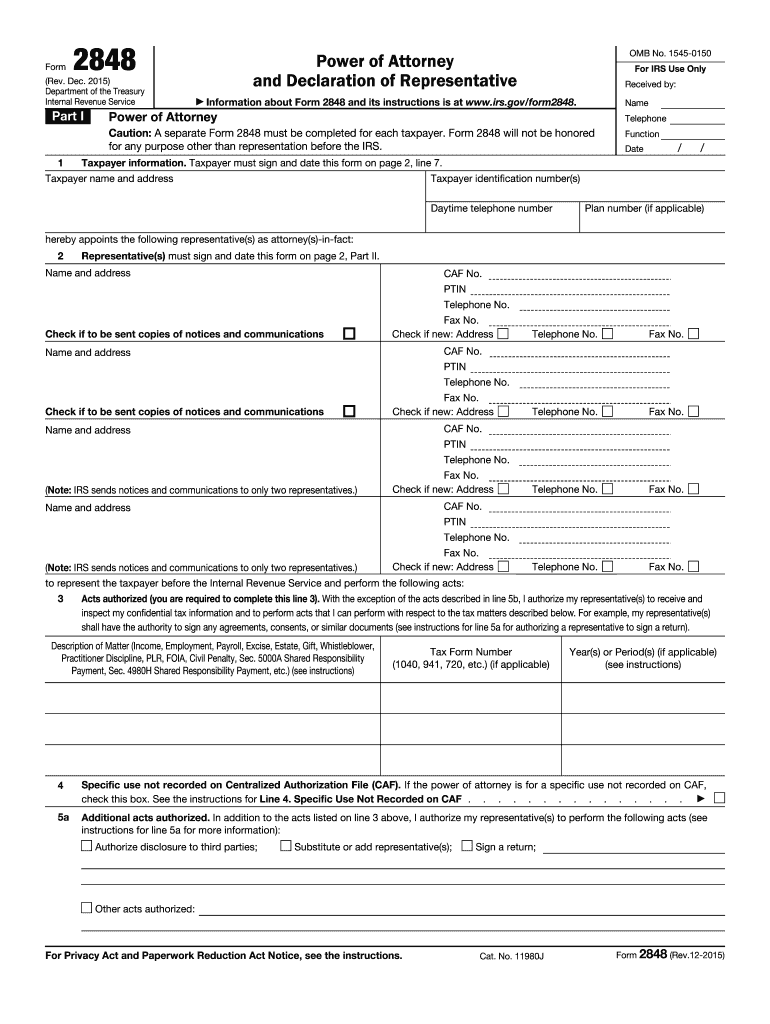

The Form 2848, also known as the Power of Attorney and Declaration of Representative, is an official document issued by the Internal Revenue Service (IRS). This form allows taxpayers to appoint an individual, such as an attorney or accountant, to act on their behalf regarding tax matters. The designated representative can represent the taxpayer in front of the IRS, receive confidential information, and perform various actions on their behalf. Understanding the purpose and implications of this form is essential for effective tax management.

How to use the Form 2848

Using the Form 2848 involves several key steps. First, the taxpayer must complete the form by providing their personal information, including name, address, and Social Security number. Next, the taxpayer must specify the type of tax matters the representative is authorized to handle. This may include income tax, estate tax, or other specific issues. After filling out the necessary information, both the taxpayer and the representative must sign and date the form. Finally, the completed form should be submitted to the IRS for processing.

Steps to complete the Form 2848

Completing the Form 2848 requires careful attention to detail. Follow these steps for accurate submission:

- Begin by downloading the Form 2848 from the IRS website.

- Fill in the taxpayer's information, ensuring accuracy in names and identification numbers.

- Designate the representative by providing their details, including name, address, and phone number.

- Indicate the specific tax matters for which the representative is authorized.

- Both the taxpayer and the representative must sign and date the form.

- Submit the completed form to the IRS, either by mail or electronically, depending on the situation.

Legal use of the Form 2848

The Form 2848 is legally binding once properly executed and submitted to the IRS. This document grants the appointed representative the authority to act on behalf of the taxpayer in tax-related matters. It is crucial to ensure that the form is filled out correctly to avoid any legal complications. The IRS recognizes eSignatures, making it possible to complete this form digitally while maintaining legal validity, provided all requirements are met.

Key elements of the Form 2848

Several key elements must be included when completing the Form 2848 to ensure its validity:

- Taxpayer's full name and address.

- Taxpayer's identification number, usually the Social Security number.

- Representative's name, address, and phone number.

- Specific tax matters for which the representative is authorized.

- Signatures of both the taxpayer and the representative, along with the date.

Form Submission Methods

The Form 2848 can be submitted to the IRS through various methods. Taxpayers can choose to mail the completed form to the appropriate IRS address based on their location and the type of tax involved. Alternatively, the form can be submitted electronically through certain IRS online services. It is important to check the IRS guidelines for the most current submission options and any specific requirements associated with each method.

Quick guide on how to complete form 2848 2015

Complete Form 2848 effortlessly on any device

The management of online documents has gained immense popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing users to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all necessary tools to rapidly create, modify, and electronically sign your documents without delays. Manage Form 2848 across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 2848 with ease

- Find Form 2848 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for such tasks by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional hand-signed signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form: via email, SMS, invite link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign Form 2848 and maintain excellent communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2848 2015

Create this form in 5 minutes!

How to create an eSignature for the form 2848 2015

How to make an eSignature for the Form 2848 2015 online

How to make an electronic signature for your Form 2848 2015 in Google Chrome

How to generate an eSignature for signing the Form 2848 2015 in Gmail

How to generate an eSignature for the Form 2848 2015 right from your smart phone

How to make an electronic signature for the Form 2848 2015 on iOS devices

How to make an electronic signature for the Form 2848 2015 on Android

People also ask

-

What is Form 2848 and why is it important?

Form 2848, also known as the Power of Attorney and Declaration of Representative, is a crucial IRS document that allows you to authorize someone to represent you before the IRS. Understanding how to complete Form 2848 correctly can simplify tax matters and ensure your representative can act on your behalf effectively.

-

How can airSlate SignNow help me with Form 2848?

airSlate SignNow provides an easy-to-use platform to electronically sign and send Form 2848. With our secure eSignature solutions, you can quickly fill out, sign, and share Form 2848 without the hassle of printing or mailing, streamlining the process for you.

-

Are there any costs associated with using airSlate SignNow for Form 2848?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet different needs, including a free trial for new users. Our competitive pricing ensures you can manage Form 2848 and other documents efficiently without breaking the bank.

-

What features does airSlate SignNow offer for handling Form 2848?

With airSlate SignNow, you can easily create, edit, and sign Form 2848 online. Our platform also offers templates, automated reminders, and the ability to securely store your documents, making it the ideal choice for managing important IRS forms.

-

Can I integrate airSlate SignNow with other software to manage Form 2848?

Absolutely! airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to manage Form 2848 alongside your other documents, improving overall workflow efficiency.

-

Is airSlate SignNow compliant with legal and security standards for Form 2848?

Yes, airSlate SignNow is compliant with industry-standard security protocols to ensure the safety of your documents, including Form 2848. We prioritize data encryption and secure access, so you can confidently manage sensitive information.

-

How long does it take to process Form 2848 using airSlate SignNow?

Processing Form 2848 with airSlate SignNow is quick and efficient. Once you complete and send the form, your designated representative can sign it electronically within minutes, signNowly reducing the time compared to traditional methods.

Get more for Form 2848

- 1999 706 filible form

- 941ss for 2001 form

- 2000 form 8863 education credits hope and lifetime learning credits

- 2001 version of 2553 form

- Irs tax form 6559a

- 2000 instructions for w 2 and w 3 2000 instructions for w 2 and w 3 wage and tax statement form

- 1999 706 form

- Form 4506 a rev august 1997 request for public inspection or copy of exempt organization irs form

Find out other Form 2848

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form