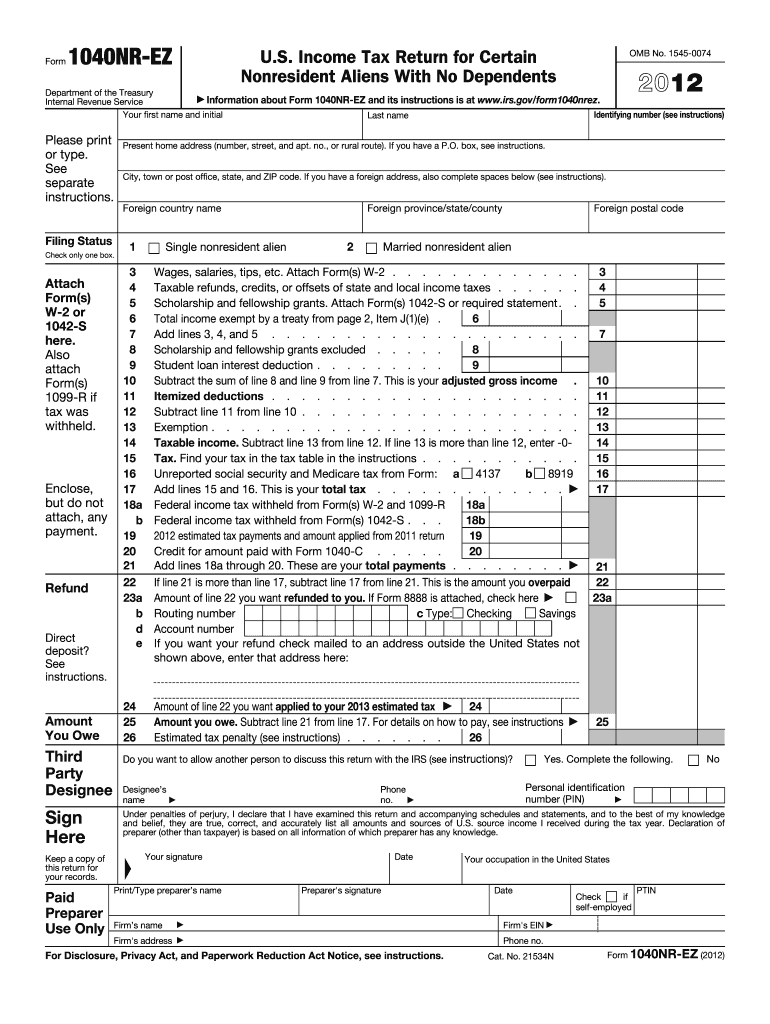

1040nr Ez Form 2012

What is the 1040NR EZ Form

The 1040NR EZ Form is a simplified tax return specifically designed for non-resident aliens in the United States. This form allows eligible individuals to report their income and calculate their tax liability in a straightforward manner. It is primarily used by non-resident aliens who have income from U.S. sources and meet certain criteria, such as not having dependents or claiming tax credits. The 1040NR EZ Form streamlines the filing process, making it easier for users to comply with U.S. tax regulations.

How to Use the 1040NR EZ Form

Using the 1040NR EZ Form involves several key steps to ensure accurate completion. First, gather all necessary documentation, including income statements and any relevant tax forms. Next, fill out the form by entering personal information, such as your name, address, and taxpayer identification number. Report your income from U.S. sources and calculate your tax liability based on the provided instructions. Finally, review the completed form for accuracy before submitting it to the IRS.

Steps to Complete the 1040NR EZ Form

Completing the 1040NR EZ Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather all relevant documents, including W-2s and 1099s.

- Provide your personal information in the designated sections.

- Report your total income from U.S. sources accurately.

- Calculate your tax liability using the tax tables provided in the instructions.

- Sign and date the form to validate your submission.

Legal Use of the 1040NR EZ Form

The 1040NR EZ Form is legally recognized for non-resident aliens to report their income to the IRS. To ensure compliance, it is essential to follow IRS guidelines and accurately disclose all income sources. Failure to use the form correctly can lead to penalties or audits. Additionally, e-filing options may be available, allowing for a more efficient submission process while maintaining legal validity.

Filing Deadlines / Important Dates

Filing deadlines for the 1040NR EZ Form are crucial for compliance. Generally, non-resident aliens must file their tax returns by April fifteenth of the year following the tax year. If you are unable to meet this deadline, you may request an extension, which typically allows an additional six months for filing. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the 1040NR EZ Form, you will need several key documents. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other U.S. income, such as interest or dividends.

- Identification documents, such as a passport or visa.

Form Submission Methods (Online / Mail / In-Person)

The 1040NR EZ Form can be submitted through various methods, allowing flexibility for users. You can file the form electronically using IRS-approved e-filing software, which may expedite processing. Alternatively, you can mail a paper copy of the form to the appropriate IRS address based on your location. In-person submission is generally not available, but you can seek assistance at IRS offices if needed.

Quick guide on how to complete 1040nr ez form 2012

Effortlessly Prepare 1040nr Ez Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers a perfect eco-friendly option to traditional printed and signed paperwork, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage 1040nr Ez Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign 1040nr Ez Form with Ease

- Find 1040nr Ez Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or conceal sensitive data with the tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign 1040nr Ez Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040nr ez form 2012

Create this form in 5 minutes!

How to create an eSignature for the 1040nr ez form 2012

How to generate an electronic signature for a PDF file online

How to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your mobile device

How to make an eSignature for a PDF file on iOS

The best way to generate an eSignature for a PDF document on Android devices

People also ask

-

What is the 1040nr Ez Form and who should use it?

The 1040nr Ez Form is a simplified version of the U.S. tax return for non-resident aliens. It's designed for individuals who meet specific criteria, such as not having dependents and only a limited amount of income. If you are a non-resident alien looking for an easy way to file your taxes, the 1040nr Ez Form is the ideal choice.

-

How can airSlate SignNow help me with my 1040nr Ez Form?

With airSlate SignNow, you can easily upload, sign, and send your 1040nr Ez Form securely online. Our platform simplifies the eSigning process, allowing you to complete your tax forms quickly and efficiently. Plus, with our user-friendly interface, managing your documents has never been easier.

-

Is there a cost associated with using airSlate SignNow for the 1040nr Ez Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there is a nominal fee for our services, the cost is competitive and reflects the value of our easy-to-use, cost-effective solutions for managing your 1040nr Ez Form and other documents.

-

What features does airSlate SignNow offer for managing the 1040nr Ez Form?

AirSlate SignNow provides features such as document templates, customizable workflows, and secure cloud storage for your 1040nr Ez Form. You can also track the status of your documents and receive notifications when they are signed, ensuring you stay organized throughout the filing process.

-

Can I integrate airSlate SignNow with other software for my 1040nr Ez Form?

Absolutely! AirSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and CRM systems. This makes it easier to manage your 1040nr Ez Form alongside your other important documents and business processes.

-

How secure is my information when using airSlate SignNow for the 1040nr Ez Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technologies to protect your personal information while you complete your 1040nr Ez Form. Additionally, our platform complies with industry standards to ensure that your data remains safe and confidential.

-

What are the benefits of using airSlate SignNow for my 1040nr Ez Form?

Using airSlate SignNow for your 1040nr Ez Form provides numerous benefits, including time savings, enhanced efficiency, and ease of use. Our platform allows you to quickly eSign and manage documents from anywhere, helping you meet your tax deadlines without hassle.

Get more for 1040nr Ez Form

- Authorization for anesthesia surgery and dentaldoc form

- About dfs virginia department of forensic science form

- Interventional pain management center in newport news va form

- Cdva employer forms packet

- Aps lesson plan template form

- Pain management orthopedic center form

- Haymarket veterinary service equine ambulatory po box 1005 form

- The american academy of allergy asthma ampampamp immunologyaaaai form

Find out other 1040nr Ez Form

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word