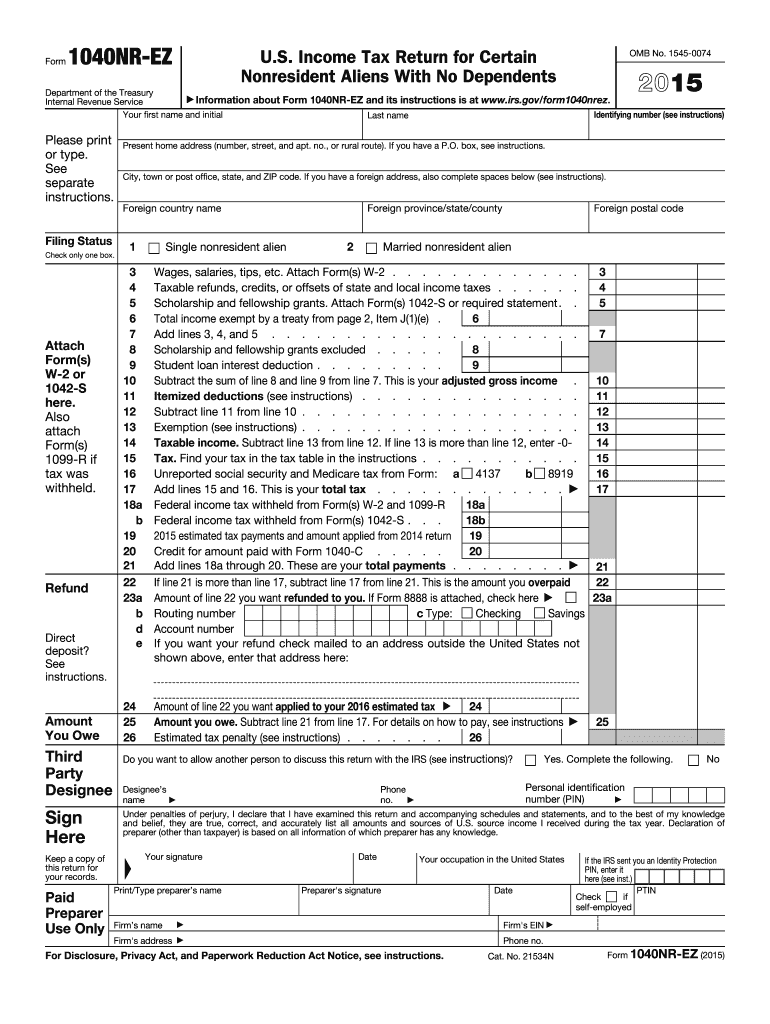

1040nr Form 2015

What is the 1040NR Form

The 1040NR Form is a U.S. tax return specifically designed for non-resident aliens who earn income in the United States. This form allows individuals who do not meet the criteria for residency under the Internal Revenue Service (IRS) guidelines to report their income and calculate their tax liability. It is essential for non-resident aliens to file this form to comply with U.S. tax laws and to ensure that they pay the appropriate amount of taxes on income generated within the country.

How to use the 1040NR Form

Using the 1040NR Form involves several steps to ensure accurate reporting of income and deductions. First, gather all necessary documents, including income statements and any relevant tax treaties. Next, fill out the form by entering your personal information, income details, and any applicable deductions. It is crucial to follow the instructions provided with the form carefully to avoid errors. After completing the form, review it thoroughly before submitting it to the IRS.

Steps to complete the 1040NR Form

Completing the 1040NR Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents such as W-2s, 1099s, and any other income statements.

- Provide your personal information, including your name, address, and taxpayer identification number.

- Report your income, including wages, salaries, and any other earnings from U.S. sources.

- Claim any deductions you are eligible for, such as expenses related to your income.

- Calculate your tax liability based on the income reported and deductions claimed.

- Sign and date the form before submitting it to the IRS.

Legal use of the 1040NR Form

The 1040NR Form is legally binding when filled out correctly and submitted on time. It is crucial for non-resident aliens to understand the legal implications of filing this form. Failure to submit the form can result in penalties, including fines and interest on unpaid taxes. Additionally, accurate reporting is essential to avoid issues with the IRS, which may lead to audits or further legal complications.

Filing Deadlines / Important Dates

Filing deadlines for the 1040NR Form are critical for compliance with U.S. tax laws. Generally, non-resident aliens must file their tax returns by April fifteenth of the year following the tax year. If you are a non-resident alien who received wages subject to U.S. tax withholding, you may be eligible for an automatic extension until June fifteenth. However, any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To complete the 1040NR Form, specific documents are necessary to ensure accurate reporting. These documents typically include:

- W-2 forms from employers showing wages and taxes withheld.

- 1099 forms for other income sources, such as freelance work or interest.

- Tax identification numbers, including Social Security numbers or Individual Taxpayer Identification Numbers (ITIN).

- Records of any deductions or credits you plan to claim.

Eligibility Criteria

Eligibility to file the 1040NR Form is determined by your residency status under IRS guidelines. Non-resident aliens typically include individuals who are not U.S. citizens and do not meet the substantial presence test. Factors such as visa type, length of stay in the U.S., and income sources will influence your eligibility. It is essential to review these criteria carefully to determine if the 1040NR Form is the appropriate tax return for your situation.

Quick guide on how to complete 2015 1040nr form

Complete 1040nr Form with ease on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage 1040nr Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign 1040nr Form effortlessly

- Obtain 1040nr Form and then click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate worries about lost or mishandled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Modify and eSign 1040nr Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1040nr form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1040nr form

The way to make an eSignature for your PDF file online

The way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The way to make an electronic signature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the 1040nr Form and who needs to file it?

The 1040nr Form is a tax return form used by non-resident aliens in the United States to report their income and calculate their tax obligations. If you are a non-resident alien earning income in the U.S., you will need to file a 1040nr Form to comply with IRS regulations. Understanding this form is crucial for ensuring that you meet your tax responsibilities accurately.

-

How can airSlate SignNow help with the 1040nr Form filing process?

airSlate SignNow simplifies the process of signing and sending the 1040nr Form by providing an easy-to-use platform for electronic signatures. With our cost-effective solution, you can quickly prepare, sign, and send your 1040nr Form, ensuring that it signNowes the IRS securely and on time. This streamlines your filing process and reduces the need for paper documents.

-

What features does airSlate SignNow offer for managing the 1040nr Form?

airSlate SignNow offers features tailored for managing the 1040nr Form, including customizable templates, secure document storage, and real-time tracking. You can easily create and modify your 1040nr Form using our intuitive interface, ensuring you have all the necessary information before submission. Additionally, our platform ensures compliance and security throughout the signing process.

-

Is there a cost associated with using airSlate SignNow for the 1040nr Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for individuals who need to file the 1040nr Form. Our pricing is competitive, and we provide a cost-effective solution for electronic signatures and document management. You can choose a plan that fits your budget while ensuring you can efficiently manage your tax forms.

-

Can I integrate airSlate SignNow with other software for the 1040nr Form?

Absolutely! airSlate SignNow seamlessly integrates with various popular software solutions, making it easier to manage your 1040nr Form alongside your existing tools. Whether you use accounting software or CRM systems, our integration options enhance your workflow and simplify the document management process. This ensures you can handle your tax filings efficiently.

-

What are the benefits of using airSlate SignNow for the 1040nr Form?

Using airSlate SignNow for your 1040nr Form offers numerous benefits, including increased efficiency, enhanced security, and ease of use. Our platform allows you to electronically sign and send your tax forms quickly, reducing the time spent on paperwork. Additionally, our secure environment ensures that your sensitive information is protected throughout the process.

-

How do I get started with airSlate SignNow for my 1040nr Form?

Getting started with airSlate SignNow for your 1040nr Form is simple! Just visit our website, sign up for an account, and explore our user-friendly interface. You can start by creating or uploading your 1040nr Form, and then utilize our features to eSign and send it effortlessly, streamlining your tax filing process.

Get more for 1040nr Form

Find out other 1040nr Form

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form