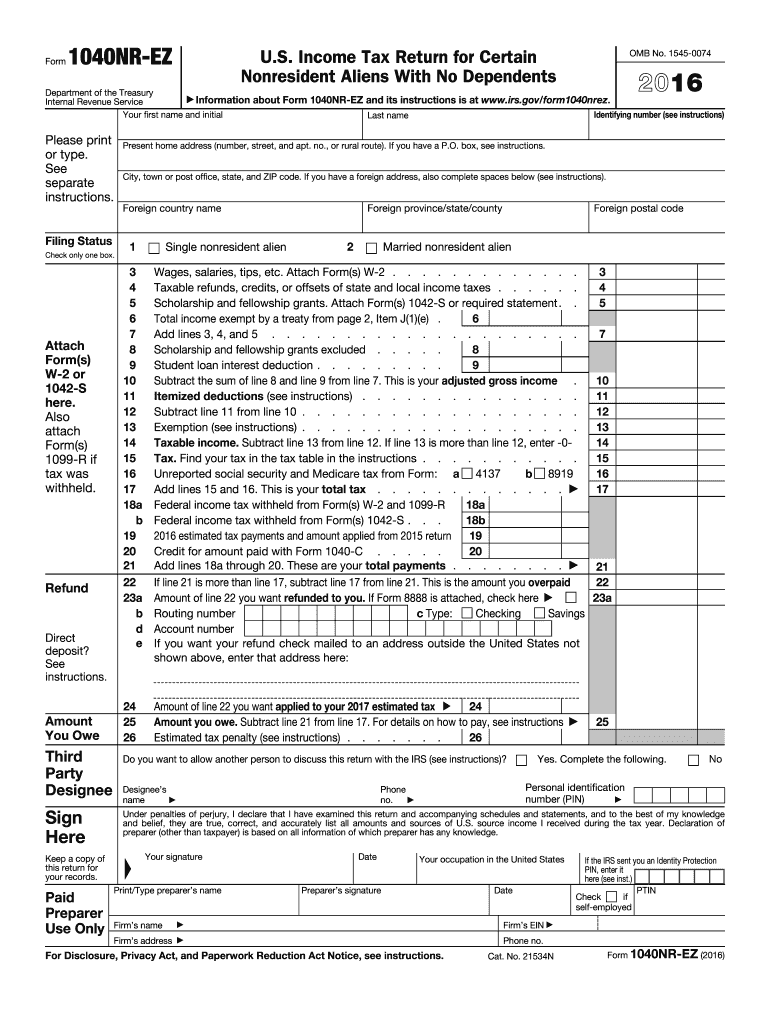

Form 1040nr Ez 2016

What is the Form 1040NR-EZ

The Form 1040NR-EZ is a simplified tax return specifically designed for non-resident aliens in the United States. This form allows eligible individuals to report their income and calculate their tax liability efficiently. It is primarily intended for those who do not have dependents and are not claiming certain credits or deductions, making it a straightforward option for many non-resident taxpayers.

How to use the Form 1040NR-EZ

To utilize the Form 1040NR-EZ effectively, individuals must first ensure they meet the eligibility criteria. This includes being a non-resident alien for tax purposes and having income that falls within the specified limits. Once eligibility is confirmed, the form can be filled out by entering personal information, income details, and any applicable deductions. After completing the form, it must be signed and submitted to the IRS by the designated deadline.

Steps to complete the Form 1040NR-EZ

Completing the Form 1040NR-EZ involves several key steps:

- Gather all necessary documents, including income statements and any relevant tax documents.

- Fill in personal information, such as name, address, and taxpayer identification number.

- Report all sources of income, ensuring accuracy in amounts and types.

- Calculate the total tax owed using the provided tax tables.

- Sign and date the form before submission.

Legal use of the Form 1040NR-EZ

The Form 1040NR-EZ must be used in accordance with IRS regulations. It is essential to file the form accurately and on time to avoid penalties. Non-compliance with tax laws can lead to legal consequences, including fines and interest on unpaid taxes. Taxpayers should ensure they are using the most current version of the form to maintain compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040NR-EZ are crucial for non-resident aliens. Typically, the form must be submitted by April 15 of the year following the tax year. However, if the taxpayer is outside the United States on the due date, they may qualify for an automatic extension until June 15. It is important to check for any updates or changes to these dates each tax year.

Form Submission Methods (Online / Mail / In-Person)

The Form 1040NR-EZ can be submitted through various methods. Non-resident aliens have the option to file the form by mail, which involves sending a physical copy to the IRS. Additionally, some tax preparation software may support electronic filing for this form, allowing for a more efficient submission process. It is important to verify the submission method that aligns with individual circumstances and preferences.

Quick guide on how to complete form 1040nr ez 2016

Uncover the easiest method to complete and endorse your Form 1040nr Ez

Are you still spending time creating your official paperwork on physical copies instead of handling it online? airSlate SignNow offers a superior way to finalize and endorse your Form 1040nr Ez and comparable forms for governmental services. Our intelligent electronic signature solution equips you with everything required to manage documents swiftly and in accordance with official standards - robust PDF editing, managing, securing, endorsing, and distributing tools all at your fingertips within a user-friendly interface.

Only a few steps are needed to complete to fill out and endorse your Form 1040nr Ez:

- Add the editable template to the editor using the Get Form button.

- Review the information you need to input in your Form 1040nr Ez.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the spaces with your details.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what truly counts or Redact areas that are no longer necessary.

- Select Sign to create a legally valid electronic signature using any method you prefer.

- Insert the Date next to your signature and conclude your work with the Done button.

Store your completed Form 1040nr Ez in the Documents directory within your account, download it, or transfer it to your preferred cloud storage. Our solution also provides flexible form sharing. There's no need to print your forms when you need to send them to the appropriate public office - accomplish it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Test it out today!

Create this form in 5 minutes or less

Find and fill out the correct form 1040nr ez 2016

FAQs

-

Can I ask US tax refund for 2014 in 2016 using 1040NR EZ form?

Yes, you can refile your tax return, HOWEVER be sure to file it prior to 04–15–2017 because the Statute of Limitations apply and you will not receive a refund (if you’re due to receive one be the Statute expired). If you kept a copy of the return you filed (which I highly recommend), then make another copy and sign that return. Remember, the Statute of Limitations expire for refunds this April (4–15–2017).Hope this is helpful.

-

What am I supposed to fill in line 24 of 1040NR-EZ?

Enter the amount of your 2017 refund that you want applied to your estimated tax for 2018.In other words, let's say you were planning on making an estimated federal tax payment of $1,000 in 2018. If you had a refund of $5,000 coming to you for 2017, you should enter $1,000 on line 24. Instead of getting a refund of $5,000 for the 2017 tax year, you will receive $4,000 instead.Another way to look at it is you could get a refund of $5,000, then turn right around and pay the government $1,000 as an estimated tax payment. Instead of doing that, the government just refunds you $4,000, which creates basically the same effect.If you're not receiving a refund, line 24 does not apply to you and you should enter $0 (zero).

-

How do I report cryptocurrency gain or loss in Form 1040NR-EZ?

Hello Shaunak,You cannot report cryptocurrency gain or loss on Form 1040NR-EZ. This can be reported on either form 1040NR or 1040.Further, Cryptocurrency gain or loss are treated as short term or long term Capital gain or loss depending on the period you have held it for.Thank youHetal

-

Am I supposed to report income which is earned outside of the US? I have to fill the 1040NR form.

If you are a US citizen, resident(?), or company based within the US or its territories, you are required by the IRS to give them a part of whatever you made. I'm not going to go into specifics, but as they say, "the only difference between a tax man and a taxidermist is that the taxidermist leaves the skin" -Mark Twain

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

Where Can I find 1040NR EZ form for Year 2015? I can’t find it in the IRS website. Can some one guide me on how to get it?

1040NR-EZ link is: https://www.irs.gov/pub/irs-pdf/...

-

If a foreign citizen lives in the US on a working visa for more than a year, then what is his status? What tax form will such a person fill out when filing for taxes at the end of the tax year? Is the 1040NR the form to fill out?

In most situations, a person who is physically present in the United States for at least 183 days out of any calendar year is a US resident for tax purposes and must file Form 1040 as a tax resident. There are exceptions to this general rule, but none of them apply to people who are present in the United States in H-1B (guest worker) status. Furthermore, H-1B workers are categorically resident aliens for tax purposes and must pay taxes on the income they earn while in H-1B status as a resident alien in every year in which they earn more than the personal exemption limit. This includes both the first year and last year, even if the first or last year contains less than 183 days of residence in the United States. The short years may result in a filing as a “dual-status” alien.An H-1B worker will therefore only file Form 1040NR as his or her primary tax return in the tax year in which he or she leaves the United States permanently, and all US-connected income during that year will be taxed as if the taxpayer was a US resident, under the dual-status rules. All other tax returns during that person’s residence in the United States will be on Form 1040. The first year’s return may be under dual-status rules, with a Form 1040NR attached as a “dual status statement” as per the procedure in Chapter 6 of Publication 519 (2016), U.S. Tax Guide for Aliens. A person who resides the entire year in the United States in H-1B status may not use Form 1040NR, and is required to pay US income tax on his or her worldwide income, excepting only that income which is subject to protection under a tax treaty.See Publication 519 (2016), U.S. Tax Guide for Aliens for more information. The use of a tax professional, especially in the first and last year of H-1B status, is highly recommended as completing a dual-status return correctly is exceedingly challenging.

Create this form in 5 minutes!

How to create an eSignature for the form 1040nr ez 2016

How to generate an electronic signature for the Form 1040nr Ez 2016 in the online mode

How to generate an eSignature for the Form 1040nr Ez 2016 in Google Chrome

How to make an eSignature for putting it on the Form 1040nr Ez 2016 in Gmail

How to generate an electronic signature for the Form 1040nr Ez 2016 right from your mobile device

How to create an eSignature for the Form 1040nr Ez 2016 on iOS devices

How to make an eSignature for the Form 1040nr Ez 2016 on Android devices

People also ask

-

What is Form 1040nr Ez and who should use it?

Form 1040nr Ez is a simplified tax form designed for non-resident aliens in the United States, typically used by international students or foreign workers. If you meet certain criteria, including having no dependents and earning income from US sources, this form is an efficient way to file your taxes. Using Form 1040nr Ez can streamline your filing process.

-

How can airSlate SignNow help with Form 1040nr Ez?

With airSlate SignNow, you can easily complete and eSign your Form 1040nr Ez online. Our platform provides a user-friendly interface that simplifies document preparation, making the tax filing process smoother and more efficient. Additionally, you can securely store and share your completed forms with your tax advisor.

-

Is there a cost associated with using airSlate SignNow for Form 1040nr Ez?

Yes, airSlate SignNow offers flexible pricing plans to cater to different needs, including options for occasional users and businesses. Depending on the plan you choose, you can enjoy a range of features to assist in completing and eSigning Form 1040nr Ez at a cost-effective price. Check our pricing page for more details.

-

What features does airSlate SignNow offer for completing Form 1040nr Ez?

AirSlate SignNow offers various features that enhance your experience when completing Form 1040nr Ez. You can easily drag and drop fields, add your signature electronically, and collaborate with others in real time. These tools ensure that your form is completed accurately and efficiently.

-

Can I integrate airSlate SignNow with other applications while working on Form 1040nr Ez?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, allowing you to work on Form 1040nr Ez alongside your favorite tools. Whether you use cloud storage services, CRM systems, or accounting software, our platform supports integrations that enhance your workflow.

-

What are the benefits of using airSlate SignNow for Form 1040nr Ez?

Using airSlate SignNow for Form 1040nr Ez delivers several benefits, including time savings and enhanced security. Our platform ensures that your personal information is protected while allowing you to file your taxes efficiently. Plus, the ease of eSigning documents simplifies the overall process.

-

How does eSigning work for Form 1040nr Ez with airSlate SignNow?

eSigning with airSlate SignNow for Form 1040nr Ez is straightforward and secure. Once you complete the form, you can sign it electronically using a mouse or touchscreen. This feature not only saves time but also ensures that your signature is legally binding and recognized by tax authorities.

Get more for Form 1040nr Ez

Find out other Form 1040nr Ez

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will