Form 8822 2012

What is the Form 8822

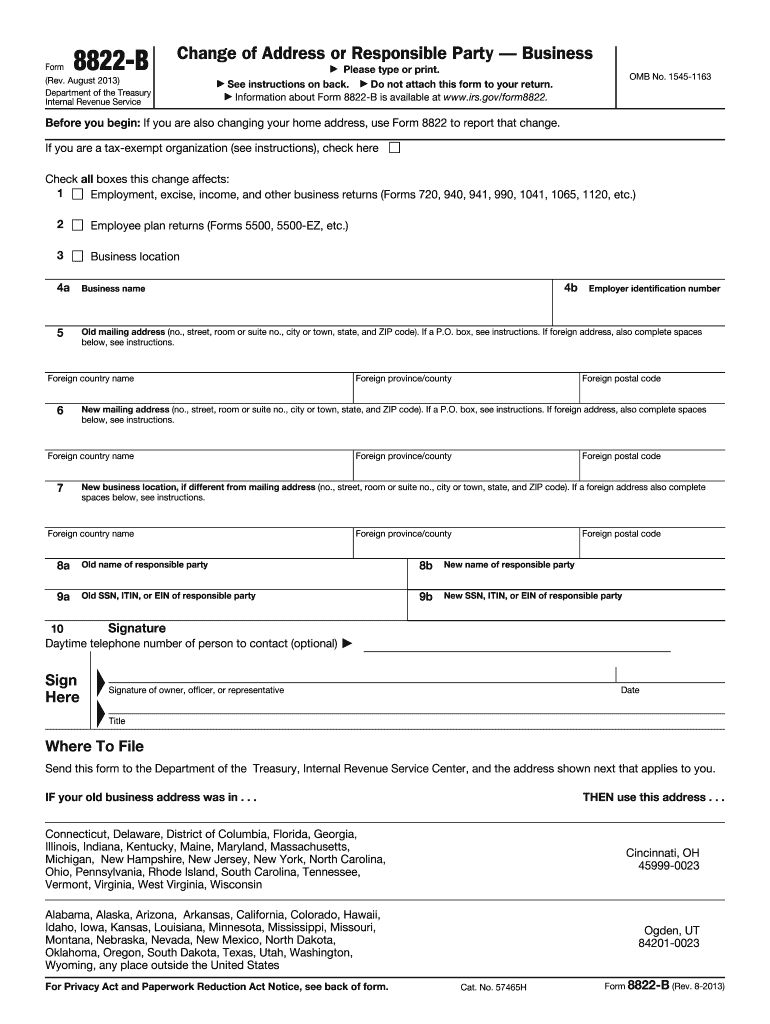

The Form 8822 is a tax form used by individuals in the United States to notify the Internal Revenue Service (IRS) of a change of address. This form is essential for ensuring that the IRS has your current address on file, which is crucial for receiving tax-related correspondence, including refund checks and notices. The form is specifically designed for individual taxpayers, including those who are married and filing jointly, as well as those who are single or head of household.

How to use the Form 8822

Using the Form 8822 involves a straightforward process. First, you need to download the form from the IRS website or obtain a physical copy. After filling out the form with your new address and other required information, you must submit it to the IRS. It is important to ensure that all information is accurate to avoid any delays in processing. The form can be submitted via mail to the address specified in the instructions, and it is advisable to keep a copy for your records.

Steps to complete the Form 8822

Completing the Form 8822 requires several key steps:

- Download the form from the IRS website or request a paper copy.

- Fill in your personal information, including your name, Social Security number, and old address.

- Enter your new address accurately, ensuring that all fields are completed.

- If applicable, provide the information for your spouse if you are filing jointly.

- Sign and date the form to certify that the information is correct.

- Mail the completed form to the appropriate IRS address listed in the instructions.

Legal use of the Form 8822

The legal use of the Form 8822 is governed by IRS regulations. Submitting this form is a formal way to notify the IRS of your address change, which is a requirement under federal tax law. Failure to notify the IRS of a change of address can lead to missed correspondence, including important tax notices or refunds. Therefore, it is crucial to complete and submit the form accurately and promptly to ensure compliance with tax obligations.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the Form 8822, it is recommended to file it as soon as you change your address. Doing so helps ensure that the IRS has your updated information for future tax filings and correspondence. Additionally, if you are filing your tax return for the year in which you changed your address, it is advisable to submit the Form 8822 simultaneously with your tax return to avoid any discrepancies.

Form Submission Methods (Online / Mail / In-Person)

The Form 8822 must be submitted by mail to the IRS; electronic submission is not available for this particular form. After completing the form, you should send it to the address specified in the instructions based on your old address. It is important to use the correct mailing address to ensure timely processing. In-person submission is not an option for this form, as it is designed to be processed through the mail.

Quick guide on how to complete 2012 form 8822

Prepare Form 8822 effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 8822 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest way to adjust and electronically sign Form 8822 without any hassle

- Acquire Form 8822 and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8822 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 8822

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 8822

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

The best way to make an eSignature for a PDF on Android devices

People also ask

-

What is Form 8822, and why do I need it?

Form 8822 is a change of address form used by taxpayers to notify the IRS of a new address. Completing Form 8822 ensures that you receive important tax documents and correspondence at your new address, helping you stay compliant with tax regulations.

-

How can airSlate SignNow help me with Form 8822?

With airSlate SignNow, you can easily create, send, and eSign Form 8822 online. Our platform streamlines the process, allowing you to fill out and submit this important document without any hassle, ensuring that your address change is processed efficiently.

-

Is there a cost to use airSlate SignNow for Form 8822?

airSlate SignNow offers a cost-effective solution for managing documents, including Form 8822. We provide various pricing plans to fit your needs, ensuring you can eSign and manage your documents without breaking the bank.

-

What features does airSlate SignNow offer for completing Form 8822?

airSlate SignNow offers features like customizable templates, easy document sharing, and secure eSignature capabilities for Form 8822. These tools make it simple to complete and send your address change form quickly and securely, enhancing your overall experience.

-

Can I integrate airSlate SignNow with other software for Form 8822?

Yes, airSlate SignNow seamlessly integrates with popular business applications, allowing you to manage Form 8822 alongside your other workflows. This integration helps streamline your document management process and keeps everything organized in one place.

-

How secure is my information when using airSlate SignNow for Form 8822?

Your security is our top priority at airSlate SignNow. When you use our platform to complete Form 8822, your data is protected with industry-standard encryption and security protocols, ensuring that your sensitive information remains confidential.

-

Can I track the status of my Form 8822 submission with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Form 8822 submission. You’ll receive notifications when your document is opened, signed, and completed, giving you peace of mind throughout the process.

Get more for Form 8822

- 1 introduction hi may i speak with my name is form

- Cancer in the fire service firefighter close calls form

- Professional leave notification form bvsd bvsd

- Release of medical information request authorization of

- Initial patient intake form primewellnessofctcom

- Supported recovery housing forms advanced behavioral

- Self management programs state of oregon form

- 17985dcpdf musculoskeletal history questionnaire application supplement individual disability dc form

Find out other Form 8822

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF