Use Form 8822 B to Report Change in Identity of Responsible Party 2014

What is the Use Form 8822 B To Report Change In Identity Of Responsible Party

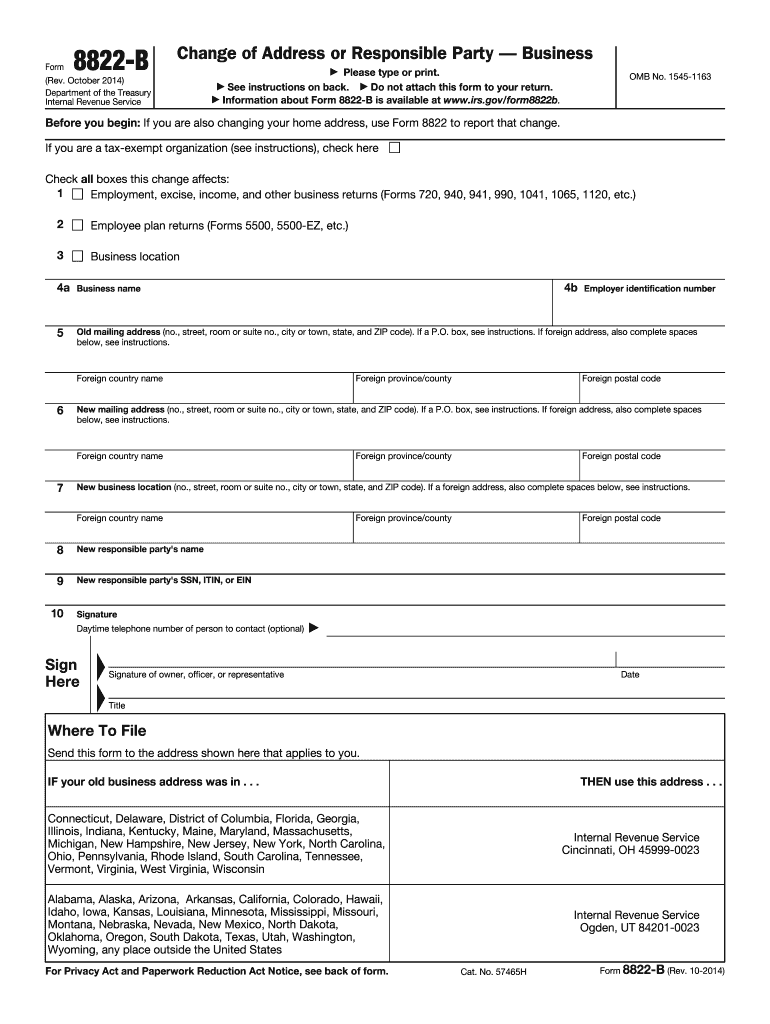

The Use Form 8822 B is an official document utilized by businesses to report a change in the identity of the responsible party to the Internal Revenue Service (IRS). This form is essential for ensuring that the IRS has accurate and up-to-date information regarding who is responsible for the tax obligations of a business entity. The responsible party is typically an individual who has control over the funds and assets of the business, and changes to this designation must be formally communicated to the IRS to maintain compliance with tax regulations.

How to Use the Use Form 8822 B To Report Change In Identity Of Responsible Party

To effectively use the Use Form 8822 B, a business must first obtain the form from the IRS website or other authorized sources. Once the form is acquired, the business should fill it out with the necessary details, including the previous responsible party's information and the new responsible party's information. It is important to ensure that all information is accurate to prevent any delays in processing. After completing the form, it should be submitted to the IRS according to the specified submission guidelines.

Steps to Complete the Use Form 8822 B To Report Change In Identity Of Responsible Party

Completing the Use Form 8822 B involves several key steps:

- Obtain the form from the IRS website.

- Provide the business name and Employer Identification Number (EIN).

- Fill in the previous responsible party's name and address.

- Enter the new responsible party's name and address.

- Sign and date the form to certify the accuracy of the information.

- Submit the completed form to the IRS via mail or electronically, if applicable.

Legal Use of the Use Form 8822 B To Report Change In Identity Of Responsible Party

The legal use of the Use Form 8822 B is crucial for maintaining compliance with federal tax laws. By submitting this form, businesses ensure that the IRS has the correct information regarding their responsible party, which is essential for tax reporting and liability purposes. Failure to report changes may lead to complications, including potential penalties or issues with tax filings. Therefore, it is vital to complete and submit this form promptly whenever a change occurs.

Filing Deadlines / Important Dates

When using the Use Form 8822 B, it is important to be aware of any relevant filing deadlines. Generally, businesses should submit this form as soon as a change in the responsible party occurs. Timely submission helps prevent any disruptions in tax processing and ensures that the IRS has current information. While there are no specific deadlines for submitting this form, it is advisable to do so well in advance of any tax filing deadlines to avoid complications.

Form Submission Methods (Online / Mail / In-Person)

The Use Form 8822 B can be submitted to the IRS through various methods. Currently, the form is primarily submitted via mail. Businesses should send the completed form to the address specified in the instructions accompanying the form. Electronic submission options may be available depending on the specific circumstances of the business and IRS guidelines. It is important to check the latest IRS instructions for any updates regarding submission methods.

Quick guide on how to complete use form 8822 b to report change in identity of responsible party

Complete Use Form 8822 B To Report Change In Identity Of Responsible Party effortlessly on any device

Digital document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Use Form 8822 B To Report Change In Identity Of Responsible Party on any operating system using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to alter and electronically sign Use Form 8822 B To Report Change In Identity Of Responsible Party with ease

- Find Use Form 8822 B To Report Change In Identity Of Responsible Party and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers for that exact purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, lengthy form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Use Form 8822 B To Report Change In Identity Of Responsible Party and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct use form 8822 b to report change in identity of responsible party

Create this form in 5 minutes!

How to create an eSignature for the use form 8822 b to report change in identity of responsible party

How to create an electronic signature for the Use Form 8822 B To Report Change In Identity Of Responsible Party online

How to make an eSignature for the Use Form 8822 B To Report Change In Identity Of Responsible Party in Google Chrome

How to make an eSignature for putting it on the Use Form 8822 B To Report Change In Identity Of Responsible Party in Gmail

How to make an eSignature for the Use Form 8822 B To Report Change In Identity Of Responsible Party from your smartphone

How to create an electronic signature for the Use Form 8822 B To Report Change In Identity Of Responsible Party on iOS devices

How to create an electronic signature for the Use Form 8822 B To Report Change In Identity Of Responsible Party on Android

People also ask

-

What is Form 8822 B and why do I need it?

Form 8822 B is used to report a change in the identity of the responsible party for an entity. You need to use Form 8822 B to report change in identity of the responsible party to ensure that the IRS has up-to-date information regarding your business's authorized representatives.

-

How can airSlate SignNow help me in using Form 8822 B?

airSlate SignNow provides an easy-to-use platform to digitally prepare, sign, and submit Form 8822 B. By using airSlate SignNow, you can streamline the process of reporting a change in identity of the responsible party, ensuring accuracy and compliance.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers features such as eSignature, automated workflows, and document templates, making it simple to use Form 8822 B. These features ensure that you can quickly and efficiently use Form 8822 B to report change in identity of responsible party with minimal hassle.

-

Is there a cost associated with using airSlate SignNow for Form 8822 B?

Yes, airSlate SignNow offers various pricing plans that are affordable and cater to businesses of all sizes. You can choose a plan that meets your needs and utilize it to easily use Form 8822 B to report change in identity of the responsible party.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely! airSlate SignNow integrates with various platforms such as Google Drive, Salesforce, and Dropbox. This allows you to seamlessly manage documents and use Form 8822 B to report a change in identity of the responsible party within your existing workflows.

-

How secure is the process of using airSlate SignNow?

airSlate SignNow employs high-level security measures to protect your documents and data. When you use Form 8822 B to report a change in identity of the responsible party, you can trust that your information is secure and protected during the signing process.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow allows businesses to save time and reduce paperwork. By enabling you to use Form 8822 B to report change in identity of responsible party electronically, the platform increases efficiency and ensures smoother workflows.

Get more for Use Form 8822 B To Report Change In Identity Of Responsible Party

Find out other Use Form 8822 B To Report Change In Identity Of Responsible Party

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document