Simple Ira August 5305 Form 2005

What is the Simple IRA August 5305 Form

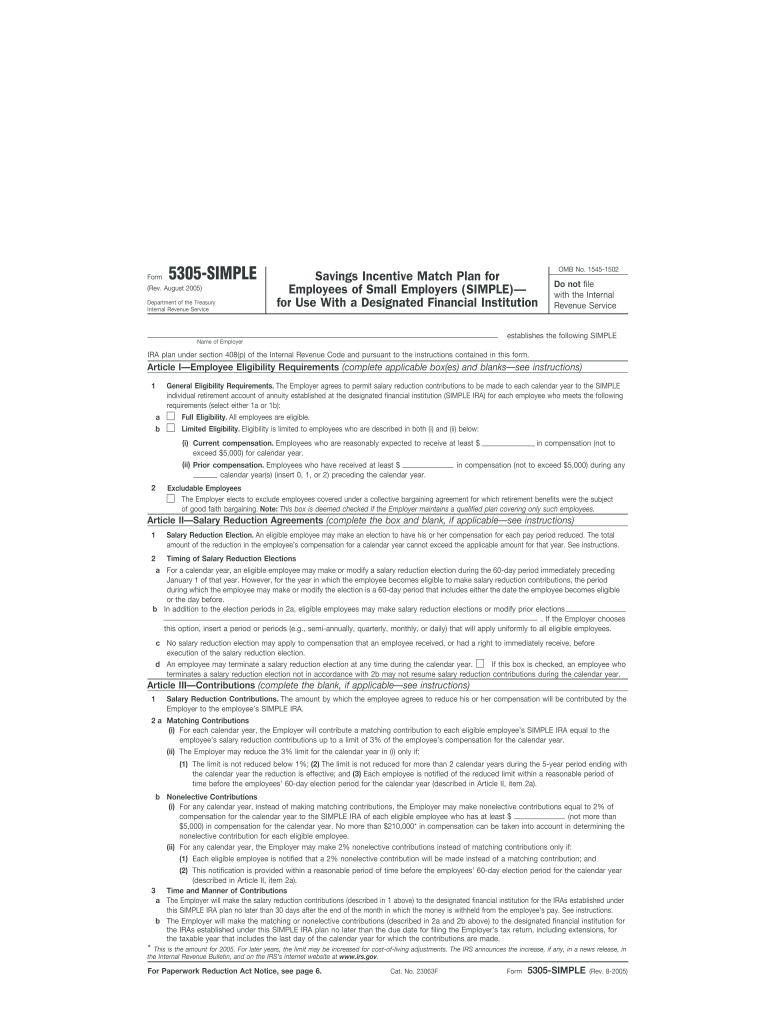

The Simple IRA August 5305 Form is a crucial document used by employers to establish a Savings Incentive Match Plan for Employees (SIMPLE) IRA. This form outlines the terms of the plan and is essential for ensuring compliance with IRS regulations. It allows employees to contribute to their retirement savings through salary deferrals, while employers can make matching contributions. This form is specifically designed for small businesses with fewer than one hundred employees, making it an accessible option for many employers looking to offer retirement benefits.

How to use the Simple IRA August 5305 Form

Using the Simple IRA August 5305 Form involves several key steps. First, employers must complete the form accurately, providing necessary information about the business and the plan. Next, employers should distribute the form to eligible employees, ensuring they understand their options for contributions. Employees need to fill out their sections, indicating their desired contribution amounts. Once completed, the form should be kept on file for record-keeping and compliance purposes. It is important to review the form annually to ensure it meets current IRS guidelines and to make any necessary updates.

Steps to complete the Simple IRA August 5305 Form

Completing the Simple IRA August 5305 Form requires careful attention to detail. Here are the steps to follow:

- Begin by entering the employer's name, address, and tax identification number.

- Specify the plan year and the eligibility criteria for employees.

- Detail the contribution amounts for both employees and employers, including matching contributions.

- Include any additional provisions or options available under the plan.

- Review the form for accuracy and completeness before signing.

Legal use of the Simple IRA August 5305 Form

The Simple IRA August 5305 Form must be used in accordance with IRS regulations to ensure its legal validity. Employers are required to provide this form to all eligible employees and must maintain accurate records of contributions and plan details. By utilizing this form, employers can offer a compliant retirement savings option that meets federal guidelines. Additionally, it is important to keep the form updated and to inform employees of any changes to the plan or its provisions.

Key elements of the Simple IRA August 5305 Form

Several key elements must be included in the Simple IRA August 5305 Form to ensure its effectiveness and compliance:

- Employer information, including name, address, and tax identification number.

- Details of the retirement plan, including eligibility criteria and contribution limits.

- Information about the financial institution where the IRA accounts will be held.

- Provisions for employee salary deferrals and employer matching contributions.

- Signatures from both the employer and employees to confirm agreement to the terms.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Simple IRA August 5305 Form. Employers must adhere to these guidelines to maintain compliance and avoid penalties. Key points include ensuring that the plan is established by October first of the year in which contributions will be made, and that all eligible employees are informed about their options. Additionally, employers must report contributions made to the IRS on their annual tax returns, ensuring that all necessary documentation is in place.

Quick guide on how to complete simple ira august 2005 5305 form

Complete Simple Ira August 5305 Form effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any delays. Manage Simple Ira August 5305 Form on any system with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign Simple Ira August 5305 Form with ease

- Locate Simple Ira August 5305 Form and click Get Form to begin.

- Utilize the functionalities we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced documents, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Simple Ira August 5305 Form while ensuring seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct simple ira august 2005 5305 form

Create this form in 5 minutes!

How to create an eSignature for the simple ira august 2005 5305 form

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The way to generate an eSignature for a PDF file on Android

People also ask

-

What is the Simple IRA August 5305 Form?

The Simple IRA August 5305 Form is a crucial document used to establish a Simple IRA plan, allowing small businesses to provide retirement benefits to their employees. By using this form, employers can set up employee contributions and employer matching effectively.

-

How can I obtain the Simple IRA August 5305 Form?

You can easily obtain the Simple IRA August 5305 Form through the IRS website or various online financial services platforms. Alternatively, airSlate SignNow offers an efficient way to access and eSign this document, streamlining the process for both employers and employees.

-

What are the features of the Simple IRA August 5305 Form?

The Simple IRA August 5305 Form features sections for employee and employer contributions, eligibility requirements, and plan implementation. It ensures compliance with IRS regulations while simplifying the process of offering retirement benefits.

-

How much does it cost to use the Simple IRA August 5305 Form via airSlate SignNow?

Using the Simple IRA August 5305 Form through airSlate SignNow is part of our cost-effective eSigning plans. Subscription options vary based on features needed, making it affordable for businesses of all sizes to manage their documentation efficiently.

-

What benefits does the Simple IRA August 5305 Form provide to small businesses?

The Simple IRA August 5305 Form provides multiple benefits, including tax deductions for employer contributions and the ability to attract and retain talent through retirement benefits. This form also promotes financial responsibility among employees, encouraging better savings habits.

-

Are there any integrations available for managing the Simple IRA August 5305 Form?

Yes, airSlate SignNow offers integrations with various HR and accounting software solutions, making it easy to manage the Simple IRA August 5305 Form alongside other employee-related documents. This integration ensures a seamless workflow for your HR department.

-

Can I edit the Simple IRA August 5305 Form online?

Yes, with airSlate SignNow, you can edit the Simple IRA August 5305 Form directly online before eSigning. Our platform allows easy modifications to meet your specific business needs while ensuring compliance with IRS guidelines.

Get more for Simple Ira August 5305 Form

Find out other Simple Ira August 5305 Form

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement