Form 8718 2010

What is the Form 8718

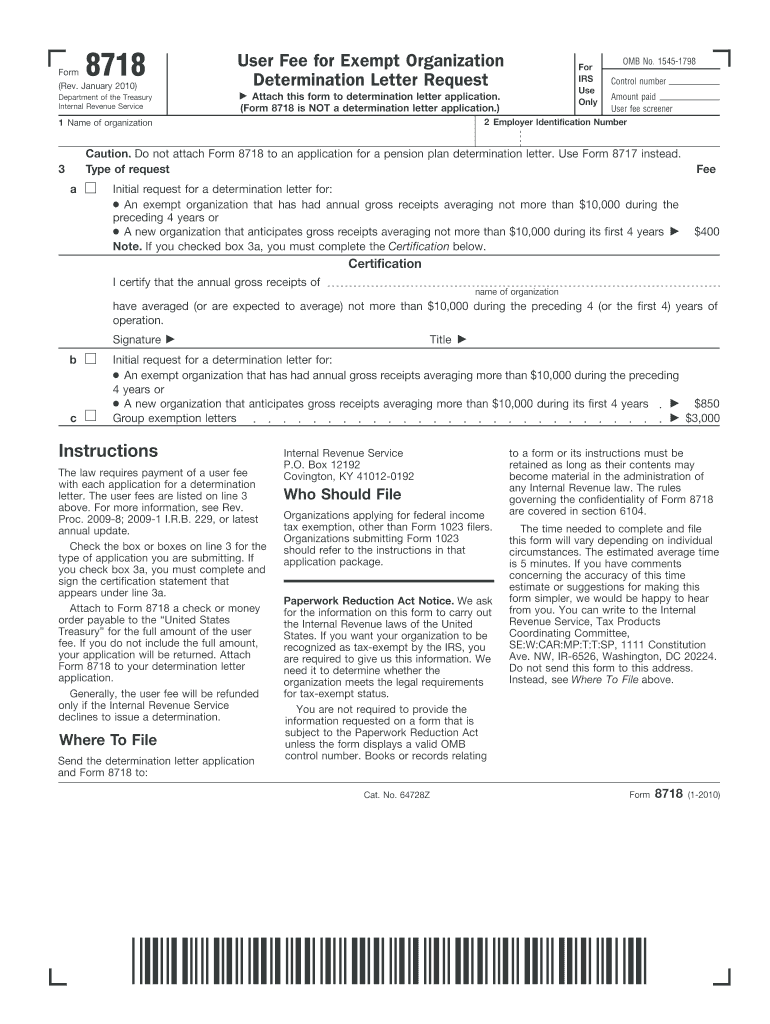

The Form 8718 is an essential document utilized by organizations seeking recognition of tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This form is primarily filed with the Internal Revenue Service (IRS) as part of the application process for obtaining a determination letter, which confirms an organization’s eligibility for tax-exempt status. The form collects critical information about the organization, including its purpose, structure, and activities, ensuring compliance with IRS regulations.

How to use the Form 8718

Using the Form 8718 involves several steps to ensure accurate completion and submission. Organizations must first gather necessary information, including their mission statement, financial data, and details about their governing structure. Once the form is filled out, it must be submitted along with the appropriate application for exemption, typically Form 1023. It is crucial to ensure that all sections are completed thoroughly to avoid delays in processing or potential rejection by the IRS.

Steps to complete the Form 8718

Completing the Form 8718 requires careful attention to detail. Follow these steps:

- Begin by downloading the latest version of Form 8718 from the IRS website.

- Provide the organization’s legal name, address, and Employer Identification Number (EIN).

- Clearly describe the organization’s purpose and activities.

- Include information about the governing body and any affiliations.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 8718

The legal use of Form 8718 is critical for organizations seeking tax-exempt status. The form must be completed in accordance with IRS guidelines to ensure that the application is valid. Submitting an incomplete or inaccurate form can lead to delays or denials of tax-exempt status. Organizations must also retain copies of the completed form and any correspondence with the IRS for their records, as these documents may be required for future audits or compliance checks.

Filing Deadlines / Important Dates

Organizations must be aware of specific filing deadlines associated with Form 8718. Typically, the form should be filed simultaneously with Form 1023, which has its own deadlines based on the organization’s fiscal year. It is advisable to check the IRS website for the most current deadlines and any updates that may affect the filing process. Missing these deadlines can result in penalties or loss of tax-exempt status.

Required Documents

When submitting Form 8718, organizations must include several supporting documents to facilitate the review process. Required documents may include:

- A copy of the organization’s articles of incorporation or bylaws.

- Financial statements or budgets for the current and previous years.

- Detailed descriptions of the organization’s programs and activities.

- Any additional documentation requested by the IRS.

Form Submission Methods (Online / Mail / In-Person)

Form 8718 can be submitted through various methods, depending on the preferences of the organization and IRS guidelines. Organizations may choose to file online through the IRS e-File system or submit a paper form via mail. In-person submissions are generally not accepted for this form. It is essential to confirm the preferred submission method and ensure that all documents are sent to the correct IRS address to avoid processing delays.

Quick guide on how to complete form 8718 2010

Handle Form 8718 seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents promptly without delays. Manage Form 8718 on any device with airSlate SignNow mobile applications for Android or iOS and simplify any document-related procedure today.

The easiest method to modify and electronically sign Form 8718 effortlessly

- Locate Form 8718 and then click Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to store your changes.

- Select your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to the hassle of lost or misplaced documents, time-consuming form hunting, or mistakes that necessitate printing fresh copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Form 8718 and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8718 2010

Create this form in 5 minutes!

How to create an eSignature for the form 8718 2010

The best way to generate an eSignature for a PDF document online

The best way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is Form 8718 and why is it important?

Form 8718 is a crucial document used for requesting a letter of determination from the IRS for organizations seeking tax-exempt status. Completing Form 8718 accurately is essential to ensure compliance and facilitate the review process. Utilizing airSlate SignNow can streamline the eSigning and submission of Form 8718, making it easier for organizations to manage their applications.

-

How can airSlate SignNow help with the completion of Form 8718?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign Form 8718 securely. With customizable templates and a user-friendly interface, you can ensure that all necessary information is included accurately. This efficiency can signNowly reduce the time spent on paperwork, allowing organizations to focus on their core missions.

-

Are there any costs associated with using airSlate SignNow for Form 8718?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including a free trial for new users. The costs may vary depending on the features you choose, such as advanced integrations and additional user seats. Investing in airSlate SignNow can be more cost-effective than traditional methods of handling Form 8718.

-

What features does airSlate SignNow offer for eSigning Form 8718?

airSlate SignNow comes with several features that enhance the eSigning process for Form 8718, including customizable workflows, document templates, and real-time tracking. Users can also enjoy the ability to sign from any device, ensuring that Form 8718 is processed quickly and efficiently. These features boost productivity and streamline administrative tasks.

-

Can I integrate airSlate SignNow with other software for handling Form 8718?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, including CRM, cloud storage, and accounting tools. These integrations allow you to manage Form 8718 alongside your existing systems, enhancing workflow efficiency and data management. This compatibility makes it easier to incorporate Form 8718 into your business processes.

-

Is airSlate SignNow secure for submitting sensitive documents like Form 8718?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and authentication protocols to protect sensitive documents, including Form 8718. The platform is compliant with major security standards, ensuring that your information remains confidential. Users can feel confident that their submissions are secure when using airSlate SignNow.

-

How does airSlate SignNow improve the overall process of handling Form 8718?

By using airSlate SignNow, organizations can streamline the entire process of handling Form 8718—from filling it out to eSigning and submitting it. The automated workflows reduce manual errors and save time, allowing for quicker turnaround times. Overall, airSlate SignNow enhances efficiency and accuracy in managing Form 8718.

Get more for Form 8718

- Scholarship application cover sheet name address city state zip form

- University press building form

- Ss4046ada ttc student services admissions application update form

- Proquest ftpcs submission publishing agreement form

- Ehs incident investigation blank form

- Rescloudinarycom form

- Bachelor of science speech language siue form

- 2020 21 verification worksheet independent form

Find out other Form 8718

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document