W7 Form 2012

What is the W-7 Form

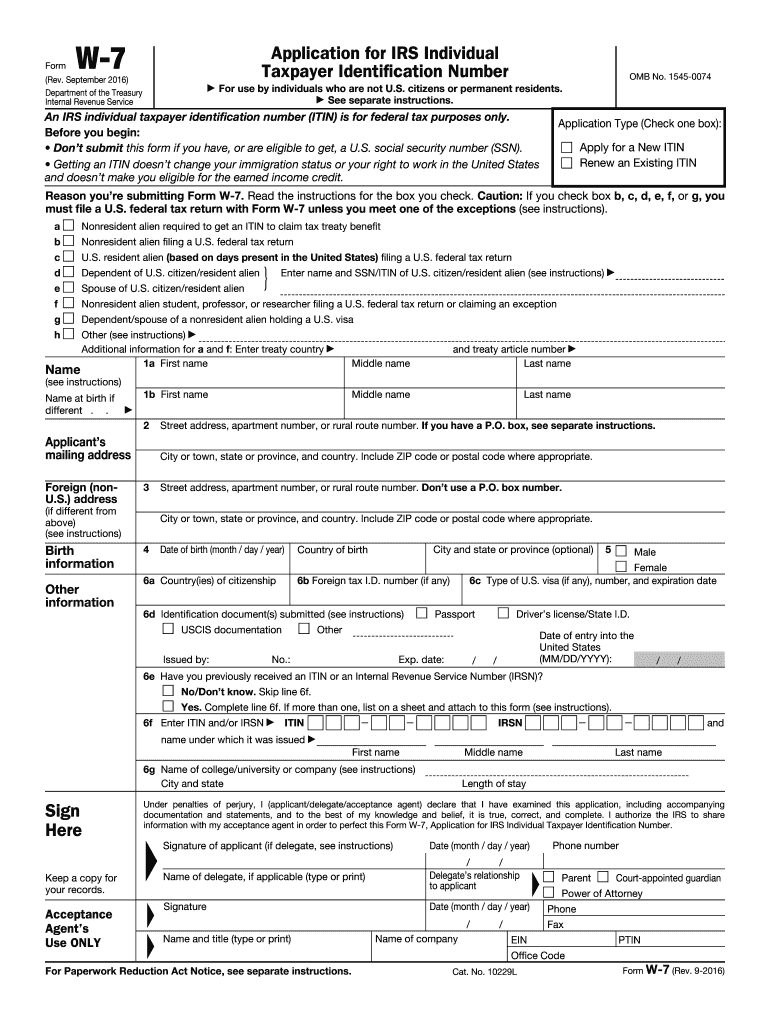

The W-7 Form, officially known as the Application for IRS Individual Taxpayer Identification Number (ITIN), is a crucial document for individuals who need a tax identification number but do not qualify for a Social Security Number (SSN). This form is primarily used by non-resident aliens, their spouses, and dependents who require an ITIN to comply with U.S. tax laws. The W-7 Form helps facilitate the filing of federal tax returns and ensures that individuals meet their tax obligations in the United States.

How to Use the W-7 Form

Using the W-7 Form involves a few key steps. First, individuals must complete the form accurately, providing necessary personal information, including name, address, and reason for needing an ITIN. Next, applicants must submit the W-7 Form along with a valid federal income tax return, unless they meet specific exceptions. It’s essential to ensure that all information is correct to avoid delays in processing. Once submitted, the IRS will review the application and issue an ITIN if approved, allowing the individual to file taxes and fulfill their financial responsibilities.

Steps to Complete the W-7 Form

Completing the W-7 Form involves several important steps:

- Gather required documents, including proof of identity and foreign status.

- Fill out the W-7 Form, ensuring all fields are completed accurately.

- Attach the required federal tax return, unless you qualify for an exception.

- Submit the completed form and documents to the IRS by mail or through an acceptance agent.

Following these steps carefully helps ensure a smooth application process and timely receipt of the ITIN.

Required Documents

When applying for an ITIN using the W-7 Form, specific documents are required to verify identity and foreign status. These documents may include:

- A valid passport.

- National identification card.

- U.S. driver's license.

- Birth certificate (for dependents).

It's important to provide original documents or certified copies, as the IRS requires verification of identity to process the W-7 Form.

IRS Guidelines

The IRS has established guidelines for completing and submitting the W-7 Form. Applicants must ensure that they meet eligibility criteria, including the need for an ITIN for tax purposes. The form must be filled out in English, and all supporting documents should be in their original language with certified translations if necessary. Adhering to these guidelines helps avoid processing delays and ensures compliance with U.S. tax laws.

Penalties for Non-Compliance

Failure to comply with U.S. tax laws, including not obtaining an ITIN when required, can result in penalties. Individuals may face fines, interest on unpaid taxes, and potential legal consequences. It is crucial for those who need an ITIN to complete the W-7 Form accurately and submit it in a timely manner to avoid these penalties and ensure compliance with IRS regulations.

Quick guide on how to complete 2012 w7 form

Complete W7 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Handle W7 Form on any device through the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to alter and eSign W7 Form with ease

- Locate W7 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or by downloading it to your computer.

Eliminate the hassle of lost or misplaced files, the frustration of searching for forms, or the need to print new document copies due to errors. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign W7 Form to ensure effective communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 w7 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 w7 form

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is a W7 Form and why is it important?

The W7 Form is an IRS application used to apply for an Individual Taxpayer Identification Number (ITIN). It's crucial for non-resident aliens or individuals who are not eligible for a Social Security Number but need to file taxes in the U.S. Using airSlate SignNow, you can easily eSign and send your W7 Form securely, streamlining the process.

-

How does airSlate SignNow simplify the W7 Form submission process?

airSlate SignNow simplifies the W7 Form submission process by providing an intuitive platform for eSigning and sending documents. With features like templates and automated workflows, you can complete your W7 Form efficiently without the hassle of printing and mailing. Our solution ensures that your documents are signed and sent quickly.

-

Is there a cost associated with using airSlate SignNow for W7 Form eSigning?

Yes, airSlate SignNow offers several pricing plans designed to fit various needs, including a free trial. The cost of using our service for W7 Form eSigning is competitive, making it a cost-effective solution for individuals and businesses alike. Choose a plan that fits your requirements and start eSigning your documents today.

-

Can I integrate airSlate SignNow with other applications for handling W7 Forms?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including Google Drive, Dropbox, and CRM systems. This allows you to manage your W7 Form documents alongside your other important files and workflows, enhancing productivity and organization.

-

What security measures does airSlate SignNow implement for W7 Form documents?

airSlate SignNow prioritizes the security of your documents, including W7 Forms. We employ industry-standard encryption, secure access controls, and compliance with regulations to ensure that your information remains confidential and protected during the eSigning process.

-

Can I track the status of my W7 Form after sending it through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including your W7 Form. You will receive notifications when your document is viewed, signed, or completed, giving you peace of mind and keeping you informed throughout the process.

-

What features does airSlate SignNow offer for W7 Form management?

airSlate SignNow offers a range of features tailored for effective W7 Form management, including customizable templates, automated reminders, and in-app messaging. These tools make it easy to create, send, and manage your W7 Form efficiently, ensuring a smooth eSigning experience.

Get more for W7 Form

- Sc 2800 a rev 6 ago 10 sc 2800 a rev 6 ago 10 form

- Form ct w4na effective january 1 2021 employees withholding

- Of an international insurer or an form

- Sc 6042 26 oct 17pmd form

- Informative return for

- Individual income tax return inst 2018pmd form

- Form 499r 2cw 2cpr electronic filing puerto rico

- Fr 399 qualified high technology companies otrcfodcgov form

Find out other W7 Form

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy