W7 Form 2013

What is the W7 Form

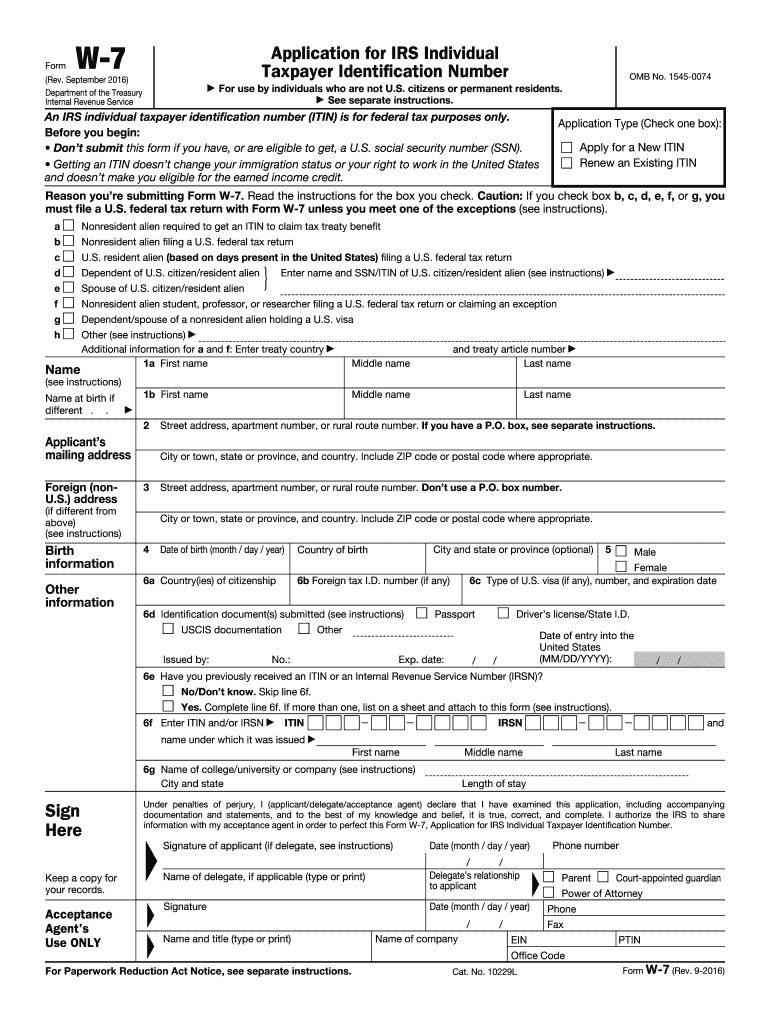

The W7 Form, officially known as the Application for IRS Individual Taxpayer Identification Number (ITIN), is a document used by individuals who are not eligible for a Social Security Number (SSN) but need to file taxes in the United States. This form is primarily utilized by non-resident aliens, their spouses, and dependents. The W7 Form allows these individuals to obtain an ITIN, which is essential for fulfilling tax obligations and ensuring compliance with U.S. tax laws.

How to use the W7 Form

To effectively use the W7 Form, individuals must first determine their eligibility. The form can be used by non-resident aliens who need to file a U.S. tax return, as well as by residents who are required to report income. After confirming eligibility, the applicant should complete the form accurately, providing necessary personal information such as name, address, and foreign status. It is important to include supporting documentation, such as a passport or other identification, to validate the application. Once completed, the form can be submitted to the IRS along with the appropriate tax return or as a standalone application.

Steps to complete the W7 Form

Completing the W7 Form involves several key steps:

- Obtain the W7 Form from the IRS website or other authorized sources.

- Fill out the form with accurate personal information, including your name, mailing address, and foreign status.

- Provide the reason for needing an ITIN, selecting the appropriate box on the form.

- Attach required documentation to prove your identity and foreign status, such as a passport or national identification card.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS either with your tax return or as a separate application.

Required Documents

When submitting the W7 Form, applicants must include specific documents to verify their identity and foreign status. Acceptable documents include:

- A valid passport, which is the only document that can stand alone.

- National identification cards issued by foreign governments.

- U.S. driver's licenses or state-issued identification cards.

- Birth certificates, if accompanied by another form of identification.

It is essential to ensure that all documents are current and clearly legible to avoid delays in processing.

Legal use of the W7 Form

The W7 Form is legally recognized by the IRS as a means for individuals to obtain an ITIN. This form is crucial for those who need to comply with U.S. tax laws but do not qualify for a Social Security Number. Properly completing and submitting the W7 Form ensures that individuals can file their tax returns accurately and fulfill their tax obligations, thus avoiding potential penalties or legal issues.

Filing Deadlines / Important Dates

When filing the W7 Form, it is important to be aware of relevant deadlines. Generally, the form should be submitted along with your tax return by the tax filing deadline, which is typically April 15 for most taxpayers. If you are applying for an ITIN separately, it is advisable to submit the W7 Form as soon as possible to avoid delays in processing your tax return. Keeping track of these deadlines ensures compliance and helps avoid penalties.

Quick guide on how to complete w7 form 2013

Effortlessly prepare W7 Form on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage W7 Form on any platform using the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

The easiest way to modify and eSign W7 Form smoothly

- Locate W7 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign W7 Form to ensure outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w7 form 2013

Create this form in 5 minutes!

How to create an eSignature for the w7 form 2013

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

How to generate an electronic signature for a PDF on Android OS

People also ask

-

What is a W7 Form?

The W7 Form is an IRS application used to obtain an Individual Taxpayer Identification Number (ITIN). This form is essential for individuals who need a U.S. taxpayer identification number but are not eligible for a Social Security number. Using the W7 Form can help streamline the tax filing process for non-residents.

-

How do I fill out a W7 Form using airSlate SignNow?

Using airSlate SignNow, you can easily fill out the W7 Form by uploading the document and utilizing our intuitive electronic signing tools. The platform allows you to complete the form digitally, making it simple to input your information and ensure accuracy. Once filled, you can securely eSign and send the form directly to the IRS.

-

Is there a cost associated with using airSlate SignNow for W7 Form eSigning?

Yes, airSlate SignNow offers different pricing plans tailored to fit various business needs. The plans include access to all of our features, allowing you to eSign the W7 Form and other documents efficiently. We provide cost-effective solutions without compromising on quality or security.

-

What are the benefits of using airSlate SignNow for the W7 Form?

airSlate SignNow enhances the completion of your W7 Form by providing a secure, user-friendly eSigning experience. You can access the platform from anywhere, ensuring that you can fill and send your tax documents anytime. Additionally, our automated workflows help reduce errors and expedite the process.

-

Can I integrate airSlate SignNow with other software for handling the W7 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as CRM tools, email clients, and document management systems. This capability allows you to manage and process your W7 Form and other important documents efficiently, making your workflows more streamlined.

-

Is airSlate SignNow compliant with tax regulations for W7 Form submission?

Yes, airSlate SignNow complies with all relevant regulations governing the electronic submission of documents like the W7 Form. We prioritize security and legal compliance, ensuring that your information remains confidential throughout the eSigning process. Trust us to keep your documents secure and compliant.

-

How can I track the status of my W7 Form after sending it through airSlate SignNow?

With airSlate SignNow, you can easily track the status of your W7 Form after sending it for eSignature. The platform provides real-time notifications and updates, allowing you to see when the form has been viewed, signed, and completed. This transparency helps you stay informed every step of the way.

Get more for W7 Form

Find out other W7 Form

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter