Form 1120 Schedule 2016

What is the Form 1120 Schedule

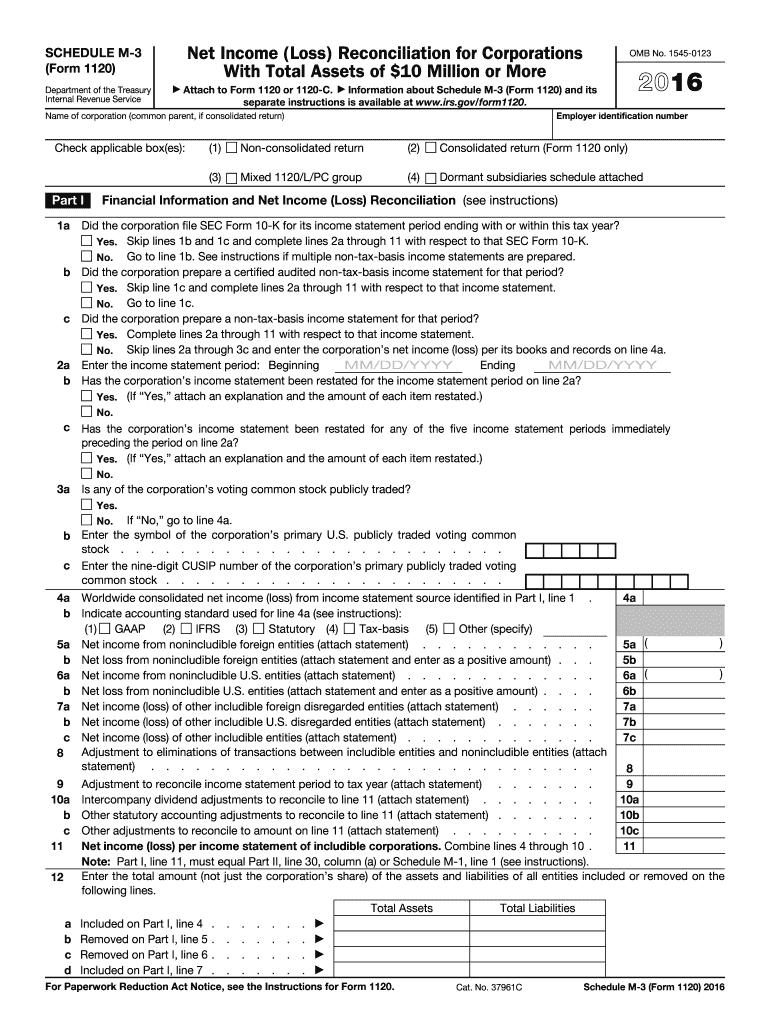

The Form 1120 Schedule is a crucial document used by corporations in the United States to report their income, gains, losses, deductions, and credits to the Internal Revenue Service (IRS). This form is part of the corporate tax return process and is specifically designed for C corporations. It allows businesses to provide detailed information about their financial activities for the tax year, ensuring compliance with federal tax regulations.

Each corporation must accurately complete the Form 1120 Schedule to calculate its taxable income and determine the amount of tax owed. This form is essential for maintaining transparency and accountability in corporate financial reporting.

How to use the Form 1120 Schedule

Using the Form 1120 Schedule involves several key steps that ensure accurate reporting of a corporation's financial information. First, gather all necessary financial records, including income statements, balance sheets, and any relevant documentation regarding deductions and credits.

Next, fill out the form by entering the required information in the designated sections. This includes reporting total income, deductions, and calculating taxable income. It is important to follow the instructions provided by the IRS to ensure that all information is correctly reported. After completing the form, review it for accuracy before submission.

Steps to complete the Form 1120 Schedule

Completing the Form 1120 Schedule requires careful attention to detail. Start by entering the corporation's name, address, and Employer Identification Number (EIN) at the top of the form. Then, proceed with the following steps:

- Report Income: Include all sources of income, such as sales revenue, dividends, and interest.

- Deduct Expenses: List all allowable deductions, including operating expenses, salaries, and benefits.

- Calculate Taxable Income: Subtract total deductions from total income to determine taxable income.

- Complete Additional Schedules: If applicable, attach any additional schedules that provide further details on specific income or deductions.

- Review and Sign: Ensure that all information is accurate and sign the form before submission.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1120 Schedule to ensure compliance with tax laws. These guidelines include detailed instructions on how to report various types of income and deductions, as well as information on eligibility criteria for certain tax credits.

It is important for corporations to familiarize themselves with these guidelines to avoid common mistakes that could lead to penalties or audits. Regularly reviewing the IRS website for updates on tax regulations can also help corporations stay compliant with the latest requirements.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the Form 1120 Schedule to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April fifteenth.

If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Corporations may also apply for an extension, allowing additional time to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Form 1120 Schedule can result in significant penalties for corporations. Common penalties include fines for late filing, inaccuracies in reported information, and failure to pay taxes owed by the deadline.

To mitigate these risks, corporations should maintain accurate financial records, adhere to filing deadlines, and ensure that all information reported on the form is correct. Engaging a tax professional for assistance can also help corporations navigate complex tax regulations and avoid non-compliance issues.

Quick guide on how to complete 2016 form 1120 schedule

Complete Form 1120 Schedule effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, as you can find the appropriate form and securely save it online. airSlate SignNow provides you with all the resources you need to create, alter, and eSign your documents promptly without hindrances. Manage Form 1120 Schedule on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form 1120 Schedule without any hassle

- Find Form 1120 Schedule and click on Get Form to begin.

- Employ the tools we offer to finalize your document.

- Emphasize signNow sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages your needs in document organization in just a few clicks from a device of your choice. Edit and eSign Form 1120 Schedule and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1120 schedule

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1120 schedule

The best way to make an eSignature for your PDF document in the online mode

The best way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 1120 Schedule and who needs it?

Form 1120 Schedule is a vital document for C corporations, used to report income, losses, and deductions. Businesses that qualify as C corporations or have elected to be taxed as one must file this schedule to maintain compliance with the IRS. Understanding how to fill out this form correctly can signNowly impact your tax obligations.

-

How does airSlate SignNow assist in filing Form 1120 Schedule?

airSlate SignNow simplifies the process of preparing and managing Form 1120 Schedule by allowing users to eSign and send necessary documents securely. Our platform provides templates and guidance on completing the form efficiently, making it easier for businesses to meet their tax filing requirements. This streamlines your workflow, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow with Form 1120 Schedule?

airSlate SignNow offers flexible pricing plans designed to fit any budget. Whether you're a small business or a larger corporation, our subscription options provide access to features that enhance your ability to manage documents like Form 1120 Schedule efficiently. Visit our pricing page to find the plan that suits your needs.

-

What features does airSlate SignNow offer for businesses preparing Form 1120 Schedule?

Our platform includes features such as template creation, document tracking, and seamless eSigning capabilities specifically designed for documents like Form 1120 Schedule. Businesses can collaborate on documents in real-time and ensure compliance with regulatory requirements easily. These features contribute to a smoother filing process and increased efficiency.

-

Can airSlate SignNow integrate with accounting software for filing Form 1120 Schedule?

Yes, airSlate SignNow integrates with various accounting software solutions, making it easy to manage your documents related to Form 1120 Schedule. This integration allows users to transfer data seamlessly between platforms, reduce manual entry errors, and simplify the overall filing process. Check our integrations page for a list of compatible software.

-

Why should I choose airSlate SignNow for eSigning Form 1120 Schedule?

Choose airSlate SignNow for its robust security features and compliance with eSignature laws, ensuring your Form 1120 Schedule is safe and legally binding. Our user-friendly interface makes the eSigning process straightforward, allowing you to focus more on business and less on paperwork. Experience the benefits of an efficient, cost-effective solution today.

-

Is there customer support available when using airSlate SignNow for Form 1120 Schedule?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any questions or issues related to filing Form 1120 Schedule. Our team of experts is available through various channels to ensure you get the help you need quickly. We prioritize customer satisfaction and are here to support your business.

Get more for Form 1120 Schedule

- 2020 instructions for form 6251 instructions for form 6251 alternative minimum taxindividuals

- 2020 instructions for schedule c internal revenue service form

- 2020 instructions for form 990 ez instructions for form 990 ez short form return of organization exempt from income tax under

- Sanctions programs and country informationus

- Notice of post qualification form

- Multi purpose loan application form pag ibig

- About form 8865 return of us persons with respect to irs

- 2200 mpdf ftp bir gov form

Find out other Form 1120 Schedule

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online