Irs M 3 Form 2018-2026

What is the IRS M-3 Form

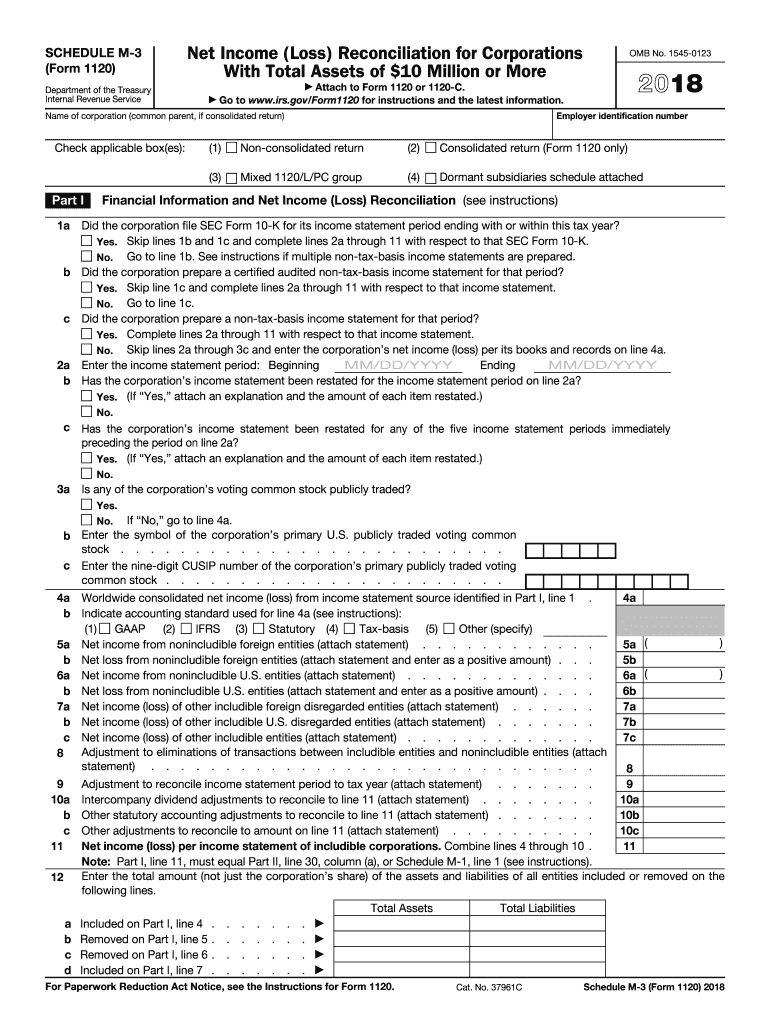

The IRS M-3 Form, also known as the 2018 Form 1120 M-3, is a crucial document used by corporations to provide detailed information regarding their financial activities. This form is specifically designed for corporations that are required to file Form 1120, the U.S. Corporation Income Tax Return. The M-3 form helps the IRS understand the differences between financial accounting income and taxable income, ensuring transparency in corporate tax reporting. It includes sections that require corporations to disclose their total assets, liabilities, and other significant financial details.

How to use the IRS M-3 Form

Using the IRS M-3 Form involves several steps to ensure accurate reporting of financial information. Corporations must first determine if they meet the filing requirements based on their total assets. If total assets exceed ten million dollars, they are mandated to file the M-3 along with their Form 1120. The form is structured into various parts, each requiring specific financial data, including reconciliations of income and deductions. It is essential to carefully follow the instructions provided by the IRS to complete the form correctly, as errors may lead to compliance issues.

Steps to complete the IRS M-3 Form

Completing the IRS M-3 Form involves a systematic approach. Here are the key steps:

- Gather all necessary financial statements and records from the tax year.

- Determine if your corporation's total assets exceed ten million dollars, which necessitates filing the M-3.

- Fill out Part I of the form, which includes basic identification information about the corporation.

- Complete Part II, which requires a reconciliation of financial statement income to taxable income.

- Provide detailed information in Part III regarding the corporation's balance sheet.

- Review the completed form for accuracy and ensure all required signatures are included.

Legal use of the IRS M-3 Form

The IRS M-3 Form is legally binding and must be completed in accordance with IRS regulations. Corporations are required to file this form to comply with federal tax laws, particularly if they meet the asset threshold. Failure to file the M-3 when required can result in penalties, including fines and increased scrutiny from the IRS. It is important for corporations to maintain accurate records and ensure that the information reported on the M-3 aligns with their financial statements to uphold legal compliance.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the IRS M-3 Form. The due date for filing Form 1120, along with the M-3, is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations may also apply for an extension, but it is crucial to file the M-3 by the extended deadline to avoid penalties.

Penalties for Non-Compliance

Non-compliance with the IRS M-3 filing requirements can lead to significant penalties. If a corporation fails to file the M-3 when required, it may incur a penalty of up to twenty-five thousand dollars. Additionally, inaccuracies or omissions on the form can result in further penalties and interest on unpaid taxes. It is essential for corporations to ensure that all information is accurate and submitted on time to avoid these financial repercussions.

Quick guide on how to complete 2017 form 1120 2018 2019

Complete Irs M 3 Form seamlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle Irs M 3 Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to alter and electronically sign Irs M 3 Form effortlessly

- Find Irs M 3 Form and then click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and electronically sign Irs M 3 Form to ensure clear communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 1120 2018 2019

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 1120 2018 2019

How to make an electronic signature for your 2017 Form 1120 2018 2019 online

How to create an electronic signature for your 2017 Form 1120 2018 2019 in Google Chrome

How to generate an eSignature for signing the 2017 Form 1120 2018 2019 in Gmail

How to create an electronic signature for the 2017 Form 1120 2018 2019 from your smartphone

How to generate an electronic signature for the 2017 Form 1120 2018 2019 on iOS devices

How to generate an electronic signature for the 2017 Form 1120 2018 2019 on Android

People also ask

-

What is the 2018 Form 1120?

The 2018 Form 1120 is the United States Corporation Income Tax Return that C Corporations must file to report their income, gains, losses, deductions, and credits. Properly completing the 2018 form 1120 is crucial for compliance with tax regulations. Using airSlate SignNow helps ensure that your documents are properly signed and submitted on time.

-

How can airSlate SignNow help with the 2018 Form 1120?

airSlate SignNow streamlines the process of signing and managing documents, including the 2018 Form 1120. With our platform, you can easily send, eSign, and store your tax documents securely, ensuring that you stay organized and compliant. This can save time and reduce the risk of errors when filing your 2018 Form 1120.

-

What features does airSlate SignNow offer for managing the 2018 Form 1120?

airSlate SignNow provides features such as customizable templates, secure eSigning, and automated workflows specifically designed to facilitate the completion of documents like the 2018 Form 1120. Our platform also offers sharing options and real-time tracking to keep you informed of the document's status. This ensures you are always in control of your important filings.

-

Is airSlate SignNow compatible with accounting software for the 2018 Form 1120?

Yes, airSlate SignNow integrates seamlessly with a variety of accounting software platforms, making it convenient to manage your 2018 Form 1120 alongside your financial data. These integrations facilitate smooth workflows, allowing you to pull and send necessary documents without hassle. This compatibility enhances efficiency when preparing for tax submissions.

-

What are the benefits of using airSlate SignNow for the 2018 Form 1120?

Using airSlate SignNow for the 2018 Form 1120 offers numerous benefits, including time savings, improved accuracy, and better collaboration. Our platform allows for easy tracking of document statuses and enables multiple signers to review and sign forms electronically. This can signNowly reduce turnaround time for tax submissions.

-

What is the pricing for airSlate SignNow when filing the 2018 Form 1120?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes seeking to manage documents like the 2018 Form 1120 effectively. Our plans provide access to essential features at competitive rates, allowing you to choose an option that best fits your business needs. Sign up today to discover the value we provide in document management.

-

Can I use airSlate SignNow for collaborative work on the 2018 Form 1120?

Absolutely! airSlate SignNow enables multiple users to collaborate on the 2018 Form 1120 in real-time, ensuring that all necessary parties can contribute and provide their input directly on the document. This feature enhances teamwork and ensures that your tax returns are completed more efficiently and accurately.

Get more for Irs M 3 Form

- Cabarrus county coaches background check form

- Homestead application mower county minnesota co carver mn form

- Change of address form catawba county catawbacountync

- Request to defer traffic infraction chelan county co chelan wa form

- How to get a restraining order clackamas coontyorder form

- Clearfield county public defenders office form

- Guardianship petition application cobb county form

- Dte form 100 2012

Find out other Irs M 3 Form

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document