Schedule 3 2017

What is the Schedule 3

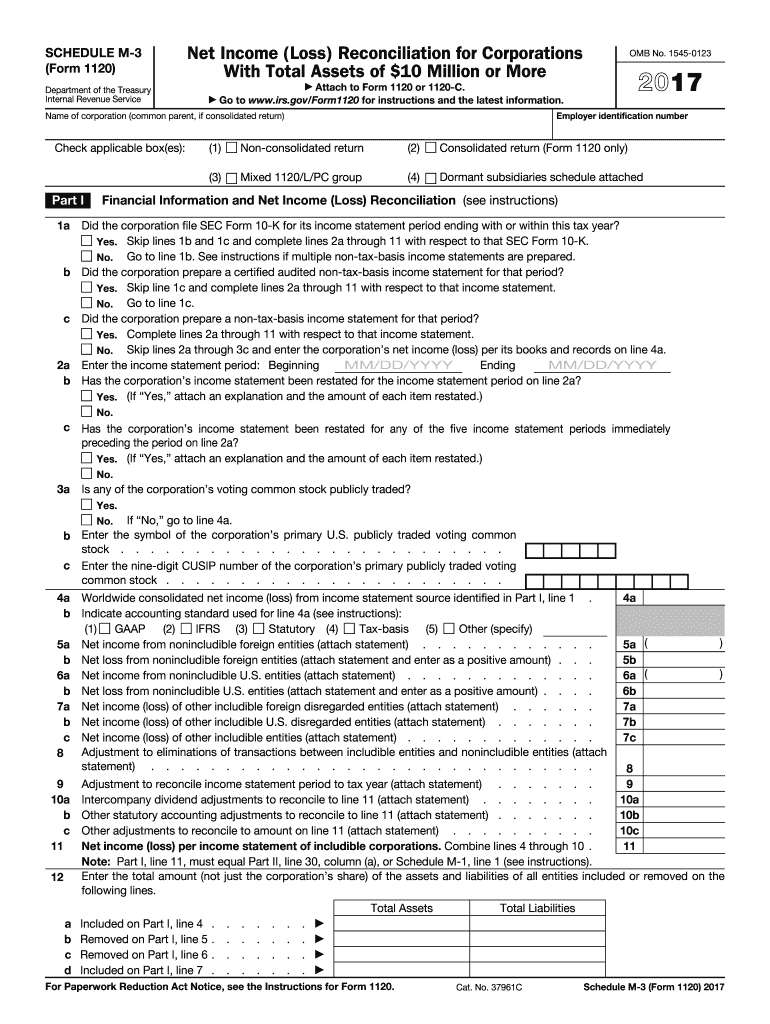

The 2016 Schedule 3 is a crucial component of the 2016 Form 1120, which is used by corporations to report their income, deductions, and credits. Specifically, Schedule 3 focuses on the corporation's income tax credits. This form allows businesses to claim various credits that can reduce their overall tax liability, making it an essential part of the corporate tax filing process.

How to use the Schedule 3

To effectively use the 2016 Schedule 3, businesses must first determine their eligibility for the various credits listed on the form. After identifying applicable credits, corporations should accurately complete the form by providing necessary financial details and calculations. It is important to ensure that all information aligns with the primary Form 1120 to maintain consistency and accuracy in reporting.

Steps to complete the Schedule 3

Completing the 2016 Schedule 3 involves several key steps:

- Gather necessary financial documents, including income statements and prior tax returns.

- Identify applicable tax credits based on the corporation's activities and expenditures.

- Fill out the form by entering required information, ensuring accuracy in calculations.

- Review the completed Schedule 3 for any errors or omissions before submission.

- Attach the Schedule 3 to the completed Form 1120 when filing with the IRS.

Legal use of the Schedule 3

The 2016 Schedule 3 is legally binding when completed accurately and submitted in accordance with IRS regulations. It is essential for corporations to comply with all legal requirements to ensure that credits claimed are valid. Utilizing a reliable eSignature solution can enhance the legal standing of the completed form, providing a secure way to sign and submit documents electronically.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines for the 2016 Schedule 3. Generally, the deadline for filing the 2016 Form 1120, including Schedule 3, is the fifteenth day of the fourth month following the end of the corporation's tax year. For calendar year corporations, this typically falls on April 15. It is important to stay informed about any changes to deadlines that may arise due to IRS updates or extensions.

Examples of using the Schedule 3

Examples of when to use the 2016 Schedule 3 include:

- A corporation that invests in renewable energy may claim credits related to energy-efficient property.

- A business that hires veterans can utilize credits designed to encourage the employment of veterans.

- Corporations involved in research and development can claim credits for qualified research expenses.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 2016 Schedule 3. These guidelines outline eligibility criteria for various credits, required documentation, and instructions for accurate completion. It is crucial for corporations to review these guidelines to ensure compliance and maximize potential tax benefits.

Quick guide on how to complete 2017 form 1120 419924766

Accomplish Schedule 3 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it on the web. airSlate SignNow provides you with all the tools you need to create, alter, and eSign your documents quickly without delays. Manage Schedule 3 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Schedule 3 effortlessly

- Obtain Schedule 3 and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select how you wish to deliver your form, either via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Schedule 3 and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 1120 419924766

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 1120 419924766

How to create an eSignature for the 2017 Form 1120 419924766 online

How to create an electronic signature for the 2017 Form 1120 419924766 in Google Chrome

How to create an eSignature for putting it on the 2017 Form 1120 419924766 in Gmail

How to generate an eSignature for the 2017 Form 1120 419924766 from your mobile device

How to generate an eSignature for the 2017 Form 1120 419924766 on iOS

How to generate an electronic signature for the 2017 Form 1120 419924766 on Android devices

People also ask

-

What is the 2016 schedule 3 and how can it benefit my business?

The 2016 schedule 3 is a specific IRS form used to report additional income and adjustments to income. By using airSlate SignNow, businesses can streamline the eSigning process for these documents, ensuring compliance and efficiency. This can save time and reduce errors while completing your 2016 schedule 3.

-

How much does airSlate SignNow cost for managing my 2016 schedule 3?

airSlate SignNow offers various pricing plans to fit your needs, starting as low as $8 per month. Whether you are a small business or a larger enterprise, you can find a plan that allows you to easily manage your 2016 schedule 3 documents at an affordable price. Our cost-effective solution ensures you have the tools you need without breaking the bank.

-

What features does airSlate SignNow provide for handling the 2016 schedule 3?

With airSlate SignNow, you'll benefit from features such as customizable templates, in-person signing, and mobile accessibility for your 2016 schedule 3 forms. These tools make it easy to create, send, and sign documents, improving your overall workflow and accuracy. SignNow simplifies the signing process, ensuring you can focus on your business.

-

Can I easily integrate airSlate SignNow with other software for my 2016 schedule 3?

Yes, airSlate SignNow supports integrations with various software applications, including CRMs and accounting tools. This allows you to seamlessly link your systems and manage your 2016 schedule 3 alongside other important business documents. Integration enhances productivity by centralizing your document management process.

-

Is airSlate SignNow secure for signing my 2016 schedule 3?

Absolutely! airSlate SignNow follows strict security protocols to protect your documents, including the 2016 schedule 3. With features like data encryption and secure cloud storage, you can confidently sign and share sensitive information without worrying about bsignNowes. Your trust is our priority.

-

What are the benefits of using airSlate SignNow for my 2016 schedule 3 compared to traditional methods?

Using airSlate SignNow for your 2016 schedule 3 offers numerous benefits, such as faster turnaround times, reduced paper usage, and enhanced organization. Unlike traditional methods, digital eSigning allows for easy tracking and management of your documents, improving efficiency. Save time and resources while ensuring compliance with airSlate SignNow.

-

How does airSlate SignNow ensure compliance for my 2016 schedule 3 eSignatures?

airSlate SignNow is compliant with major eSignature laws, ensuring your eSignatures for the 2016 schedule 3 are legally binding. We adhere to standards such as ESIGN and UETA, which provide the legal framework for electronic transactions. This means you can confidently use our platform to manage your compliance needs.

Get more for Schedule 3

Find out other Schedule 3

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online