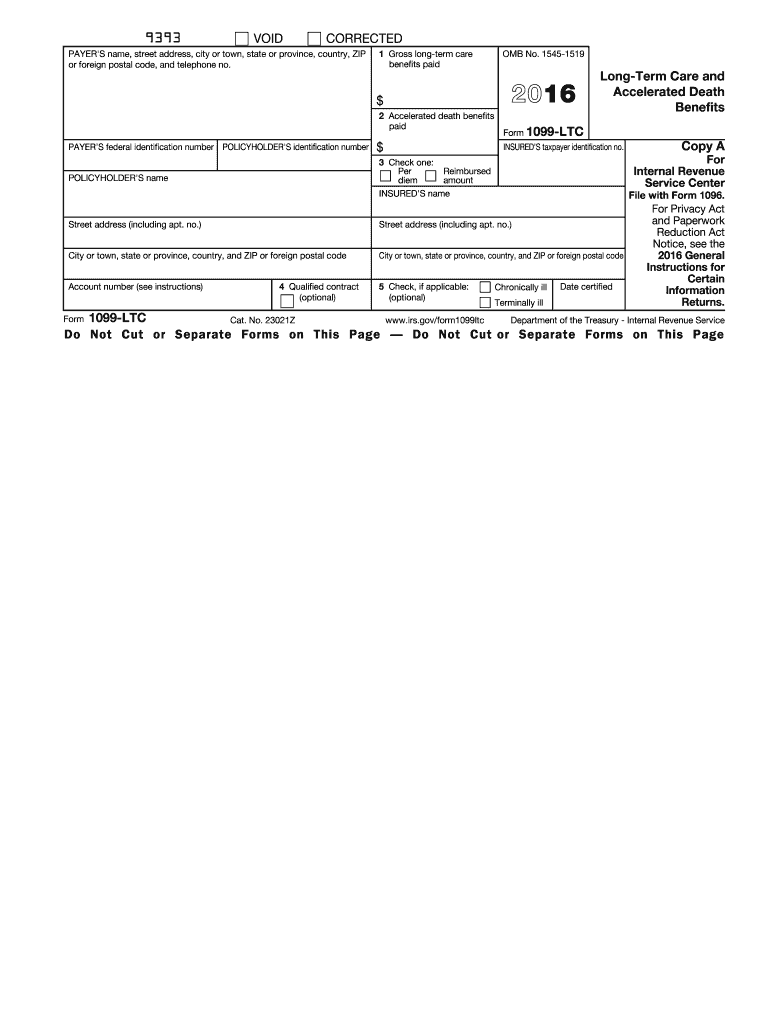

Form 1099 LTC Irs 2016

What is the Form 1099 LTC Irs

The Form 1099 LTC is a tax document used in the United States to report long-term care benefits received by individuals. This form is essential for taxpayers who have received payments from long-term care insurance policies. It helps the IRS track these benefits and ensures that recipients report them accurately on their tax returns. Understanding the purpose of this form is crucial for compliance with tax regulations and for proper financial planning.

How to use the Form 1099 LTC Irs

Using the Form 1099 LTC involves several steps. First, you need to receive the form from the insurance provider if you have received long-term care benefits. Once you have the form, review the information for accuracy, including your name, address, and the amounts reported. When filing your tax return, report the benefits as indicated on the form. It's important to keep a copy of the form for your records, as it may be required for future reference or audits.

Steps to complete the Form 1099 LTC Irs

Completing the Form 1099 LTC requires attention to detail. Here are the steps to follow:

- Obtain the form from your insurance provider or download it from the IRS website.

- Fill in your personal information, including your name and Social Security number.

- Enter the total amount of long-term care benefits received during the tax year in the appropriate box.

- Review the form for any errors and ensure all information is accurate.

- Submit the form with your tax return or keep it for your records if you are not required to file it.

Legal use of the Form 1099 LTC Irs

The legal use of the Form 1099 LTC is governed by IRS regulations. Taxpayers must use this form to report long-term care benefits accurately to avoid penalties. The form serves as a record of the benefits received and must be filed in accordance with tax laws. Failure to report these benefits can lead to tax liabilities and potential legal issues. It is advisable to consult a tax professional if there are any uncertainties regarding the form's usage.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 LTC are aligned with the general tax filing deadlines in the United States. Typically, the form must be provided to recipients by January thirty-first of the year following the tax year in which benefits were received. Additionally, the IRS requires that the form be filed by the end of February if submitted by paper, or by the end of March if filed electronically. Keeping track of these dates is essential for compliance and to avoid penalties.

Who Issues the Form

The Form 1099 LTC is issued by insurance companies or other entities that provide long-term care benefits. These issuers are responsible for compiling the necessary information regarding the benefits paid to policyholders during the tax year. It is crucial for recipients to ensure they receive this form from their insurance provider, as it is necessary for accurate tax reporting.

Penalties for Non-Compliance

Non-compliance with the reporting requirements of the Form 1099 LTC can result in significant penalties. The IRS may impose fines for failing to file the form or for inaccuracies in the reported information. Additionally, taxpayers who do not report long-term care benefits may face underreporting penalties, which can increase their overall tax liability. It is important to adhere to all filing requirements to avoid these consequences.

Quick guide on how to complete 2016 form 1099 ltc irs

Accomplish Form 1099 LTC Irs effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without interruptions. Manage Form 1099 LTC Irs on any device using the airSlate SignNow apps for Android or iOS and streamline any document-based process today.

The simplest way to alter and electronically sign Form 1099 LTC Irs with ease

- Find Form 1099 LTC Irs and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Form 1099 LTC Irs and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 1099 ltc irs

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 1099 ltc irs

The way to create an eSignature for your PDF in the online mode

The way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF on Android OS

People also ask

-

What is Form 1099 LTC Irs and who needs to file it?

Form 1099 LTC Irs is a tax document used to report long-term care insurance benefits. It is typically required for individuals who have received payments from long-term care insurance policies. Understanding this form is essential for accurate tax reporting and compliance.

-

How does airSlate SignNow help with Form 1099 LTC Irs?

airSlate SignNow provides an efficient platform for managing the electronic signing of documents like Form 1099 LTC Irs. Users can easily create, send, and sign this form online, ensuring a streamlined and hassle-free process. Our solution simplifies document handling for both individuals and businesses.

-

What are the pricing plans for using airSlate SignNow for Form 1099 LTC Irs?

airSlate SignNow offers competitive pricing plans designed for businesses of all sizes looking to manage Form 1099 LTC Irs efficiently. Our subscription options provide flexibility, allowing users to choose plans based on their signing needs. Explore our pricing page to find a plan that suits your organization.

-

Can I integrate airSlate SignNow with other accounting tools for Form 1099 LTC Irs?

Yes, airSlate SignNow seamlessly integrates with a variety of accounting and financial software products, making it easier to manage Form 1099 LTC Irs. This integration allows for smooth data transfer and enhances workflow efficiency. Check our integrations page for a list of compatible tools.

-

Is it safe to use airSlate SignNow for sensitive documents like Form 1099 LTC Irs?

Absolutely! AirSlate SignNow ensures that all documents, including Form 1099 LTC Irs, are protected with advanced encryption and security measures. We prioritize user privacy and compliance, helping you confidently manage your sensitive information.

-

What features does airSlate SignNow offer for managing Form 1099 LTC Irs?

Our platform offers a range of features tailored for Form 1099 LTC Irs management, including customizable templates, bulk sending, and real-time tracking. These tools allow users to efficiently prepare and send their forms. Streamlining the eSigning process enhances overall productivity.

-

How can businesses benefit from using airSlate SignNow for Form 1099 LTC Irs?

Businesses can signNowly benefit from airSlate SignNow by reducing time spent on paperwork associated with Form 1099 LTC Irs. Our user-friendly platform enhances the accuracy and speed of document handling, thus improving overall efficiency. This translates to cost savings and a better focus on core business operations.

Get more for Form 1099 LTC Irs

- 1040n mil form 487829077

- Form 900

- Sppa nhs forms

- Cdtfa 146 res exemption certificate and statement of delivery in indian country exemption certificate and statement of delivery 522372514 form

- 2020 form 8453 c california e file return authorization for

- 2020 form 100x amended corporation franchise or income tax return

- Business entities records request california secretary form

- Application for certified copy of a tennessee certificate of birth form

Find out other Form 1099 LTC Irs

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe