Ein Application 2001

What is the EIN application?

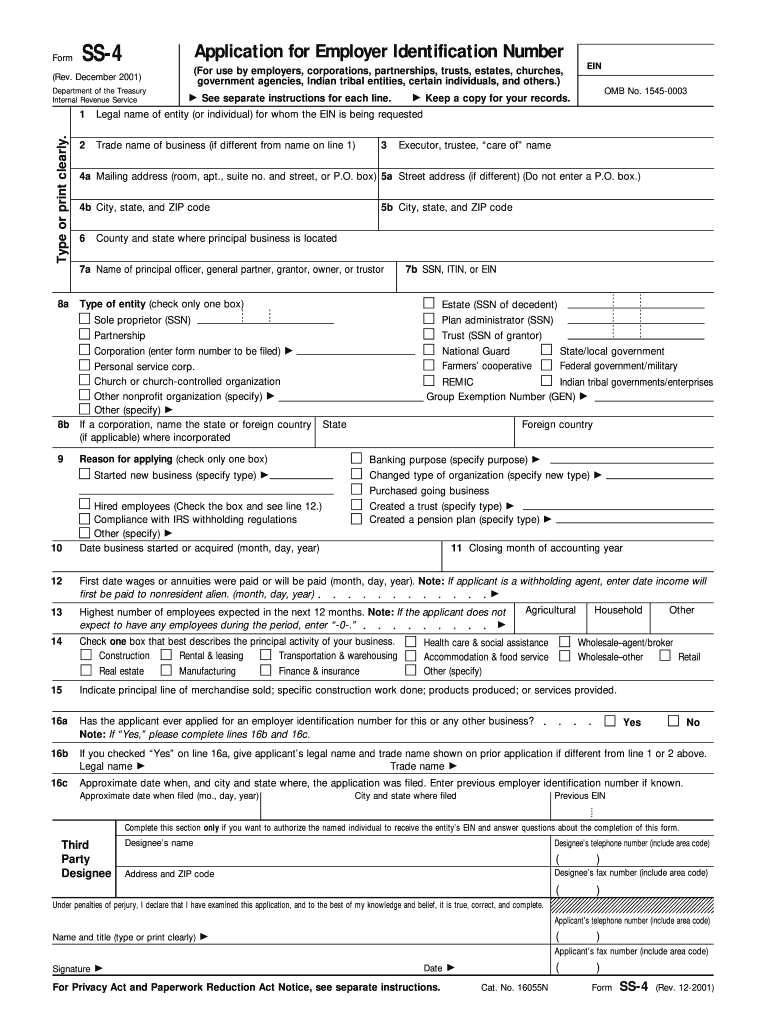

The EIN application is a formal request to obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). This unique nine-digit number is used to identify businesses for tax purposes. It is essential for various business activities, including opening a business bank account, applying for business licenses, and filing tax returns. The EIN is often referred to as a federal tax ID number or FEIN (Federal Employer Identification Number), and it is required for corporations, partnerships, and certain sole proprietorships.

Steps to complete the EIN application

Completing the EIN application involves several key steps to ensure accuracy and compliance with IRS requirements. Here’s a straightforward process to follow:

- Determine eligibility: Ensure that your business structure qualifies for an EIN. Most businesses, including LLCs, corporations, and partnerships, need one.

- Gather necessary information: Collect details such as the legal name of the business, the structure of the business entity, and the responsible party's information.

- Choose the application method: Decide whether to apply online, by mail, or by fax. The online application is the fastest method.

- Complete the application: Fill out the EIN application form accurately, ensuring all information is correct to avoid delays.

- Submit the application: Follow the chosen method to submit your application to the IRS.

How to obtain the EIN application

The EIN application can be obtained through the IRS website. The online application process is the most efficient way to receive your EIN immediately upon completion. Alternatively, you can download the Form SS-4, the official application form for an EIN, and submit it by mail or fax. Ensure you have all required information ready before starting the application to facilitate a smooth process.

Legal use of the EIN application

The EIN application is legally binding and must be completed accurately to ensure compliance with federal regulations. The information provided in the application must reflect the true nature of the business entity. Misrepresentation or errors can lead to penalties or delays in obtaining your EIN. It is important to understand that the EIN is not only a tax identification number but also a crucial component for establishing your business's credibility and legal standing.

Required documents

When applying for an EIN, certain documents and information are required to validate your application. These may include:

- The legal name of the business entity

- The business structure (LLC, corporation, etc.)

- The responsible party's name and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Business address and contact information

- Details about the nature of the business activities

Application process & approval time

The application process for obtaining an EIN is generally straightforward. If applying online, you can receive your EIN immediately after completing the application. For applications submitted by mail or fax, processing times may vary. Typically, you can expect to receive your EIN within four to six weeks. It is advisable to apply for your EIN as early as possible to avoid delays in starting your business operations.

Quick guide on how to complete ein application

Effortlessly complete Ein Application on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Ein Application on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign Ein Application effortlessly

- Obtain Ein Application and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Ein Application and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ein application

Create this form in 5 minutes!

How to create an eSignature for the ein application

The way to make an eSignature for a PDF document in the online mode

The way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The way to make an electronic signature for a PDF on Android devices

People also ask

-

What is an EIN application and why do I need it?

An EIN application is a request for an Employer Identification Number, which is crucial for businesses that plan to hire employees or operate as a corporation. Having an EIN allows you to manage payroll, file taxes, and open a business bank account efficiently. It's an essential step in formally establishing your business.

-

How does airSlate SignNow facilitate the EIN application process?

airSlate SignNow streamlines the EIN application process by allowing you to complete, sign, and send all necessary documents electronically. This not only saves time but also ensures that your applications are handled securely and efficiently. With our platform, you can easily collaborate with your team and ensure everything is in order.

-

What are the costs associated with using airSlate SignNow for my EIN application?

airSlate SignNow offers affordable pricing plans that cater to businesses of all sizes. The cost includes access to features that simplify the EIN application process, such as document templates and electronic signatures. Additionally, we provide a free trial so you can experience the benefits before making a commitment.

-

Can I use airSlate SignNow to submit my EIN application directly to the IRS?

While airSlate SignNow does not submit EIN applications directly to the IRS, it provides all the necessary tools to prepare and sign your application securely. Once completed, you can easily download or print the document for submission. Our platform ensures your application is accurate and compliant.

-

What features of airSlate SignNow can help with managing my EIN application?

airSlate SignNow offers features like customizable templates, team collaboration tools, and secure electronic signatures that enhance your EIN application experience. You can track the status of your documents in real-time and send reminders to ensure timely completion. These features save you effort and reduce the risk of errors.

-

How does airSlate SignNow ensure the security of my EIN application?

Security is a top priority at airSlate SignNow. We use advanced encryption technology to protect your EIN application and all sensitive data associated with it. Additionally, our platform complies with industry standards to ensure that your information remains confidential and secure throughout the process.

-

What integrations does airSlate SignNow offer to assist with my EIN application?

airSlate SignNow integrates seamlessly with various platforms such as Google Drive, Dropbox, and CRM systems to facilitate your EIN application workflow. These integrations allow for easy document storage and retrieval, increasing efficiency and streamlining the entire application process. You can centralize all related documents in one place.

Get more for Ein Application

Find out other Ein Application

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement