Ss4 98 Form 1998

What is the Ss4 98 Form

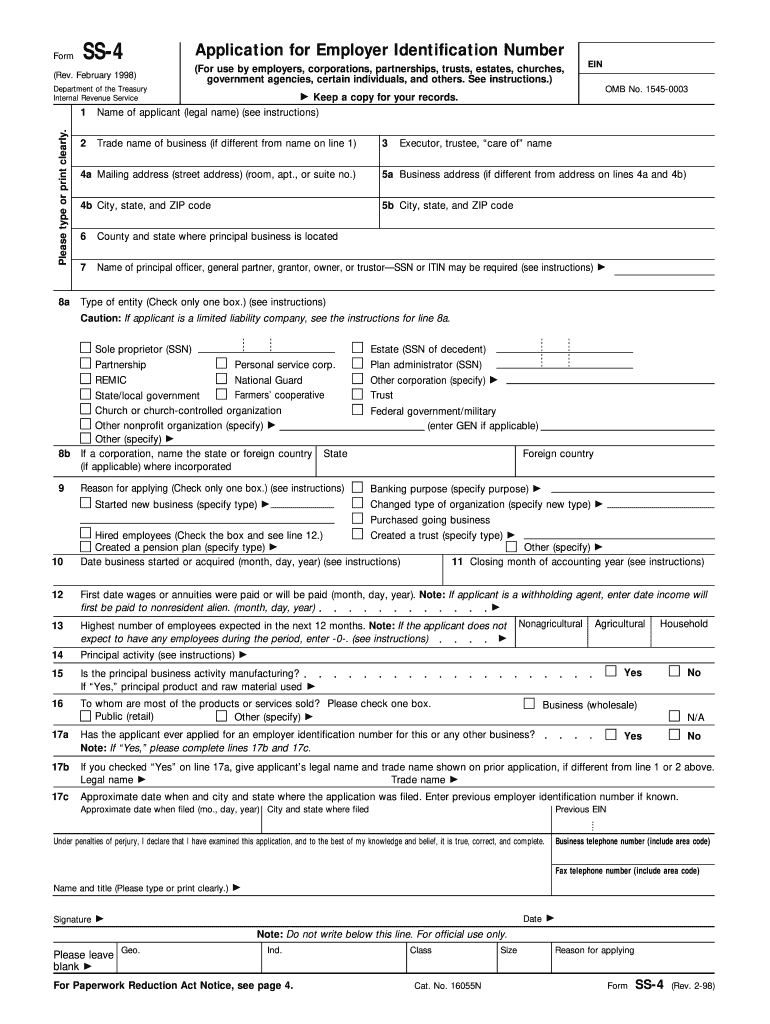

The Ss4 98 Form, officially known as the Application for Employer Identification Number (EIN), is a crucial document used by businesses in the United States to obtain their unique Employer Identification Number from the Internal Revenue Service (IRS). This number is essential for various business activities, including filing taxes, opening bank accounts, and hiring employees. The form is applicable to various business structures, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs).

How to use the Ss4 98 Form

Using the Ss4 98 Form involves several straightforward steps. First, determine your eligibility to apply for an EIN, ensuring that your business is located in the United States or its territories. Next, gather the necessary information, including the legal name of the entity, the type of entity, and the reason for applying. Once you have completed the form, you can submit it online, by mail, or by fax, depending on your preference and urgency. Ensure that all information is accurate to avoid delays in processing.

Steps to complete the Ss4 98 Form

Completing the Ss4 98 Form requires careful attention to detail. Follow these steps:

- Provide the legal name of the business and any trade names.

- Select the type of entity that best describes your business.

- Fill in the responsible party's information, including their Social Security Number or Individual Taxpayer Identification Number.

- Indicate the reason for applying for an EIN.

- Complete the remaining sections as required, ensuring all information is accurate.

After filling out the form, review it for any errors before submitting it to the IRS.

Legal use of the Ss4 98 Form

The Ss4 98 Form is legally recognized as the official application for obtaining an EIN. It is essential for compliance with federal tax regulations. Businesses must use this form to ensure they are properly registered with the IRS, which helps in maintaining accurate tax records. Failure to apply for an EIN when required can result in penalties and complications with tax filings.

How to obtain the Ss4 98 Form

The Ss4 98 Form can be obtained through several methods. The most efficient way is to access it directly from the IRS website, where it is available for download in PDF format. Additionally, businesses can request a paper copy by contacting the IRS or visiting a local IRS office. It is important to ensure that you are using the most current version of the form to avoid any issues during the application process.

Form Submission Methods (Online / Mail / In-Person)

There are multiple submission methods for the Ss4 98 Form, allowing flexibility based on your needs:

- Online: The fastest method is to complete and submit the form online through the IRS website, which provides immediate confirmation of your EIN.

- Mail: You can print the completed form and send it to the appropriate IRS address. Processing times for mailed submissions may vary.

- Fax: If you are applying from within the United States, you can fax the completed form to the IRS. This method also allows for quicker processing than mail.

Each method has its own processing times, so choose the one that best fits your timeline.

Quick guide on how to complete ss4 98 1998 form

Complete Ss4 98 Form effortlessly on any device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any holdups. Handle Ss4 98 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign Ss4 98 Form with ease

- Obtain Ss4 98 Form and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight important sections of your documents or obscure sensitive details with tools offered specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Select how you would like to deliver your form, whether through email, text message (SMS), or invite link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Ss4 98 Form and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ss4 98 1998 form

Create this form in 5 minutes!

How to create an eSignature for the ss4 98 1998 form

The best way to create an electronic signature for a PDF document online

The best way to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

The way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is the Ss4 98 Form?

The Ss4 98 Form is an application for an Employer Identification Number (EIN) that businesses use when registering for various tax-related purposes. It is essential for any company that hires employees or operates as a corporation or partnership. Accurately completing the Ss4 98 Form can simplify your business's financial processes.

-

How can airSlate SignNow help with the Ss4 98 Form?

airSlate SignNow provides a user-friendly platform for electronically signing and sending the Ss4 98 Form. Our solution allows you to complete the form efficiently, ensuring that all necessary information is accurately filled out and securely transmitted. This streamlines the process of obtaining your EIN, enabling you to focus on running your business.

-

What are the pricing options for airSlate SignNow when using the Ss4 98 Form?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you're a solo entrepreneur or part of a large corporate team, our cost-effective solutions allow you to prepare and eSign the Ss4 98 Form without breaking the bank. You can choose a plan that fits your needs and budget.

-

Are there any features specifically for managing the Ss4 98 Form on airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for efficiently managing the Ss4 98 Form. These features allow you to fill in the necessary details, track the signing progress, and store the completed form securely. With our platform, you will never lose any important documentation related to your EIN application.

-

Can I integrate airSlate SignNow with other applications for the Ss4 98 Form?

Absolutely! airSlate SignNow provides seamless integration with numerous applications, making it easy to manage your business documents, including the Ss4 98 Form. These integrations streamline workflows and ensure you have all your critical business tools connected for maximum efficiency.

-

What are the benefits of using airSlate SignNow for the Ss4 98 Form?

Using airSlate SignNow for the Ss4 98 Form streamlines the process of obtaining your EIN, saving you time and reducing potential errors. The platform is designed for ease of use, helping you navigate the complexities of tax documentation. Additionally, the secure eSigning feature protects your sensitive information during this important process.

-

Is there customer support available when using airSlate SignNow for the Ss4 98 Form?

Yes, airSlate SignNow offers comprehensive customer support for users working with the Ss4 98 Form. Our dedicated support team is available to assist you through any questions or challenges you may encounter while completing your form. This ensures you can leverage our platform efficiently and confidently.

Get more for Ss4 98 Form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair illinois form

- Letter tenant notice 497306128 form

- Landlord demand repair form

- Letter tenant repair 497306130 form

- Letter from tenant to landlord containing notice that heater is broken unsafe or inadequate and demand for immediate remedy 497306131 form

- Letter from tenant to landlord with demand that landlord repair unsafe or broken lights or wiring illinois form

- Letter landlord with 497306133 form

- Letter from tenant to landlord with demand that landlord remove garbage and vermin from premises illinois form

Find out other Ss4 98 Form

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF