Satisfaction of Mortgage Form

What is the satisfaction of mortgage form

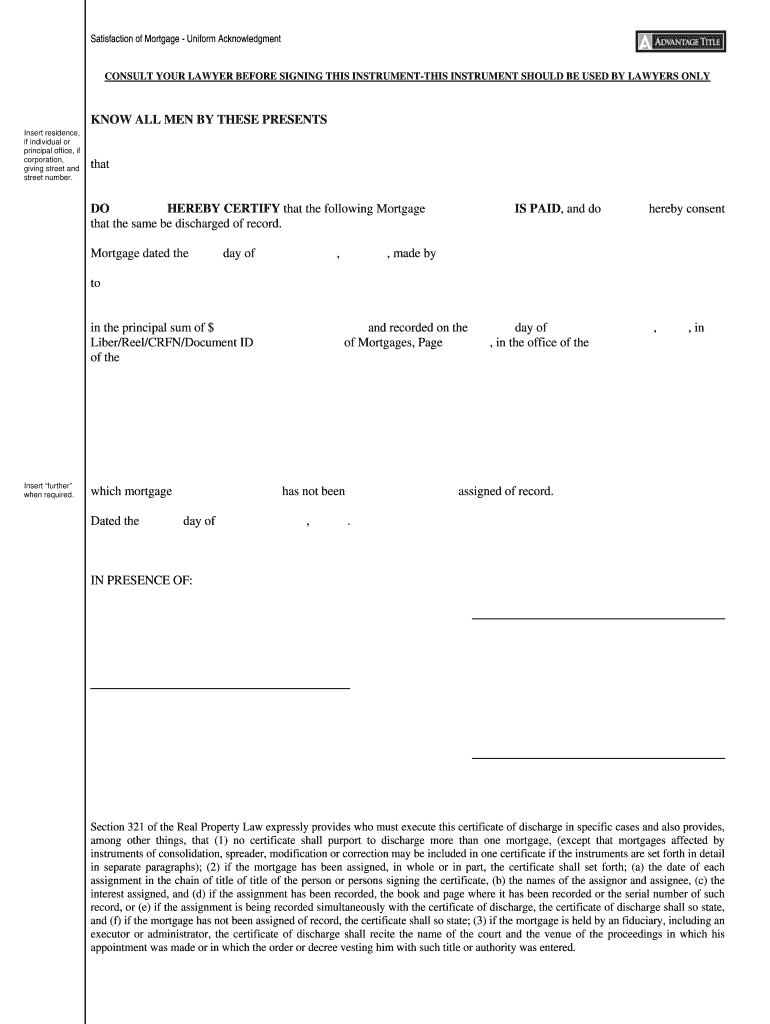

The satisfaction of mortgage form is a legal document that serves as proof that a mortgage has been fully paid off. This form is essential for homeowners who have completed their mortgage payments, as it officially releases the lender's claim on the property. By filing this document, the borrower ensures that their property title is clear, which is crucial for future transactions, such as selling the home or refinancing. In the United States, the satisfaction of mortgage form is recognized by state laws and must be executed according to specific legal requirements.

How to use the satisfaction of mortgage form

Using the satisfaction of mortgage form involves several steps to ensure it is completed correctly. First, the borrower should obtain the form from a reliable source, such as their lender or a legal document provider. Next, the borrower must fill out the necessary information, including the mortgage details and property description. Once completed, the form needs to be signed by the lender, confirming that the mortgage has been satisfied. Finally, the borrower should file the signed form with the appropriate county office to officially record the satisfaction of the mortgage.

Key elements of the satisfaction of mortgage form

The satisfaction of mortgage form contains several key elements that must be included for it to be legally valid. These elements typically include:

- The names and addresses of both the borrower and the lender.

- A description of the property associated with the mortgage.

- The date the mortgage was paid in full.

- The original mortgage document number.

- The signatures of the lender and, in some cases, the borrower.

Ensuring all these elements are present is crucial for the document's acceptance by county recording offices.

Steps to complete the satisfaction of mortgage form

Completing the satisfaction of mortgage form requires careful attention to detail. Follow these steps:

- Obtain the satisfaction of mortgage form from your lender or a legal document service.

- Fill in your name, address, and the property details accurately.

- Include the mortgage account number and the date of full payment.

- Have the lender sign the document to confirm the mortgage has been satisfied.

- Submit the completed form to the appropriate county office for recording.

By following these steps, you can ensure that your mortgage satisfaction is properly documented.

Legal use of the satisfaction of mortgage form

The legal use of the satisfaction of mortgage form is governed by state laws, which dictate how and when the form must be filed. Once the mortgage is paid off, the lender is obligated to provide this form to the borrower. It is crucial for borrowers to file the satisfaction of mortgage form promptly to avoid any potential issues with property ownership. Failure to file this document can lead to complications in future property transactions, as the mortgage may still be viewed as active until officially recorded as satisfied.

State-specific rules for the satisfaction of mortgage form

Each state in the U.S. has its own rules regarding the satisfaction of mortgage form. These rules may include specific wording, filing fees, and deadlines for submission. For instance, some states require notarization of the lender's signature, while others may have different requirements for recording the document. It is important for borrowers to familiarize themselves with their state's regulations to ensure compliance and avoid delays in the satisfaction process.

Quick guide on how to complete satisfaction of mortgage form

Effortlessly prepare Satisfaction Of Mortgage Form on any device

The management of online documents has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow offers you all the tools necessary to create, modify, and electronically sign your documents swiftly and without interruption. Handle Satisfaction Of Mortgage Form on any device using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

How to modify and electronically sign Satisfaction Of Mortgage Form with ease

- Find Satisfaction Of Mortgage Form and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require printing new document versions. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Satisfaction Of Mortgage Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the satisfaction of mortgage form

How to create an eSignature for a PDF document online

How to create an eSignature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The way to create an electronic signature straight from your smart phone

How to generate an eSignature for a PDF document on iOS

The way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is a satisfaction of mortgage?

A satisfaction of mortgage is a legal document that confirms the borrower has paid off their mortgage in full, releasing them from any further obligations. This document is important as it ensures the mortgage lender updates the public records to show that the debt has been satisfied. Using airSlate SignNow, you can easily create and manage a satisfaction of mortgage to streamline this essential process.

-

How can airSlate SignNow help with the satisfaction of mortgage process?

airSlate SignNow simplifies the satisfaction of mortgage process by providing businesses with a user-friendly electronic signature solution. You can send the satisfaction document for eSignature, track its status, and store it securely in the cloud. This enhances efficiency and ensures you have a legally binding record of the mortgage satisfaction.

-

What are the benefits of using airSlate SignNow for satisfaction of mortgage?

Using airSlate SignNow for your satisfaction of mortgage provides numerous benefits, including reduced processing time and lower costs associated with traditional paper methods. Additionally, the platform's security features ensure that your documents are protected from unauthorized access. This efficiency helps both lenders and borrowers manage their mortgage records effectively.

-

Is there a cost associated with obtaining a satisfaction of mortgage through airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective compared to traditional methods. Pricing plans are flexible and can accommodate businesses of all sizes. By utilizing airSlate SignNow, you can save money and time on the satisfaction of mortgage process.

-

Can I integrate airSlate SignNow with other software for managing mortgage documents?

Absolutely! airSlate SignNow offers robust integrations with popular platforms such as CRM systems and document management tools. This integration allows for seamless management of the satisfaction of mortgage and other related documents, enhancing workflow efficiency and data consistency across your operations.

-

How does airSlate SignNow ensure the security of the satisfaction of mortgage documents?

airSlate SignNow prioritizes security by using encryption protocols and secure storage systems to protect your satisfaction of mortgage documents. The platform complies with industry standards, ensuring that all data is safe from unauthorized access. By using airSlate SignNow, you can have peace of mind that your sensitive mortgage documents are secure.

-

What is the typical turnaround time for processing a satisfaction of mortgage using airSlate SignNow?

The turnaround time for processing a satisfaction of mortgage with airSlate SignNow can be as quick as a few minutes to a couple of days, depending on the quickness of eSignature approvals. The platform allows for real-time tracking, so you can monitor the status and follow up if necessary. This expediency is one of the key advantages of going digital.

Get more for Satisfaction Of Mortgage Form

Find out other Satisfaction Of Mortgage Form

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement