Inter Governmental Agreement Declaration 2016-2026

What is the Inter Governmental Agreement Declaration

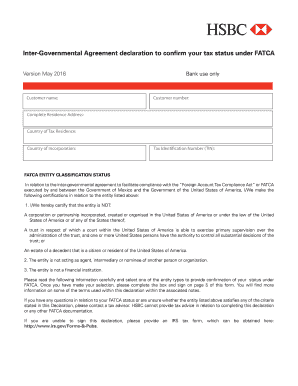

The Inter Governmental Agreement Declaration is a formal document that outlines the terms and conditions agreed upon by two or more governments. This declaration is particularly significant in the context of international tax compliance, where it serves to facilitate the exchange of information between countries. The primary objective is to prevent tax evasion and ensure that individuals and entities comply with their tax obligations. In the United States, this agreement is often associated with the Foreign Account Tax Compliance Act (FATCA), which mandates foreign financial institutions to report information about U.S. account holders to the IRS.

Steps to Complete the Inter Governmental Agreement Declaration

Completing the Inter Governmental Agreement Declaration involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including personal identification details and financial information. Next, carefully fill out the declaration form, ensuring that all sections are completed without omissions. It is essential to review the document for any errors or inconsistencies before submission. Once verified, the declaration can be submitted electronically or via mail, depending on the specific requirements outlined by the relevant authorities. Finally, keep a copy of the submitted declaration for your records.

Legal Use of the Inter Governmental Agreement Declaration

The legal use of the Inter Governmental Agreement Declaration is governed by various regulations, including the IRS guidelines and international treaties. To be considered legally binding, the declaration must meet specific criteria, such as proper signatures and adherence to the relevant legal frameworks. It is crucial for individuals and businesses to understand the implications of this declaration, as non-compliance can lead to penalties and legal repercussions. Utilizing a reliable electronic signature solution can enhance the legal standing of the document, ensuring it meets the necessary legal requirements.

Required Documents for the Inter Governmental Agreement Declaration

When preparing to submit the Inter Governmental Agreement Declaration, certain documents are typically required. These may include:

- Proof of identity, such as a government-issued ID or passport.

- Tax identification number (TIN) or Social Security number (SSN).

- Financial statements or records that support the information provided in the declaration.

- Any previous correspondence with tax authorities related to the declaration.

Having these documents ready can streamline the process and ensure compliance with all requirements.

Examples of Using the Inter Governmental Agreement Declaration

There are various scenarios in which the Inter Governmental Agreement Declaration is utilized. For instance, a U.S. citizen living abroad may need to complete this declaration to report foreign income and comply with U.S. tax laws. Similarly, foreign financial institutions may use the declaration to report information about U.S. account holders to the IRS, ensuring adherence to FATCA regulations. Each example underscores the importance of the declaration in maintaining transparency and compliance in international financial dealings.

Filing Deadlines for the Inter Governmental Agreement Declaration

Filing deadlines for the Inter Governmental Agreement Declaration can vary based on individual circumstances and the specific requirements of tax authorities. Generally, U.S. taxpayers are required to submit their declarations by the annual tax filing deadline, which is typically April 15. However, extensions may apply in certain situations, allowing additional time for submission. It is essential to stay informed about any changes in deadlines to avoid penalties and ensure timely compliance.

Quick guide on how to complete inter governmental agreement declaration

Complete Inter Governmental Agreement Declaration effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, enabling you to access the right format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly without interruptions. Manage Inter Governmental Agreement Declaration across any device using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The most efficient method to modify and eSign Inter Governmental Agreement Declaration with ease

- Find Inter Governmental Agreement Declaration and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Inter Governmental Agreement Declaration to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inter governmental agreement declaration

How to generate an eSignature for a PDF file online

How to generate an eSignature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The best way to create an eSignature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is HSBC inter governmental and how does it relate to airSlate SignNow?

HSBC inter governmental refers to the collaboration between HSBC and various government entities to streamline operations. airSlate SignNow integrates with these initiatives, allowing users to send and eSign documents efficiently in compliance with governmental standards.

-

What are the pricing plans for airSlate SignNow tailored for HSBC inter governmental users?

airSlate SignNow offers flexible pricing plans designed for both small and large organizations, including those involved in HSBC inter governmental collaborations. Prospective customers can choose from monthly or annual subscriptions, ensuring that they select a plan that fits their budget while benefiting from essential features.

-

What key features does airSlate SignNow offer for HSBC inter governmental operations?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time document tracking, making it ideal for HSBC inter governmental documents. These tools help ensure compliance and efficiency in managing agreement workflows.

-

How can airSlate SignNow benefit my business in HSBC inter governmental projects?

Using airSlate SignNow for HSBC inter governmental projects saves time and reduces paperwork, as it enables teams to focus on strategic initiatives rather than manual processes. The platform's user-friendly interface and integration capabilities enhance collaboration and ensure timely approvals.

-

Can airSlate SignNow integrate with other software commonly used in HSBC inter governmental scenarios?

Yes, airSlate SignNow offers seamless integrations with various software applications frequently used in HSBC inter governmental contexts, such as CRMs and document management systems. This integration enhances productivity and ensures a smooth workflow across different platforms.

-

Is airSlate SignNow compliant with governmental regulations for HSBC inter governmental use?

Absolutely, airSlate SignNow is developed with compliance in mind, meeting regulations that are crucial for HSBC inter governmental transactions. The platform implements strong security protocols and audit trails, ensuring that all documents adhere to legal standards.

-

What support services does airSlate SignNow provide for clients engaged in HSBC inter governmental activities?

airSlate SignNow offers robust customer support services for all users, including those involved in HSBC inter governmental operations. Support is available through multiple channels such as chat, email, and phone, ensuring that clients receive prompt assistance for any queries.

Get more for Inter Governmental Agreement Declaration

Find out other Inter Governmental Agreement Declaration

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT